How Payment Tokenization Protects Your Customers

As digital payments continue to rise, so does the threat of payment fraud. In 2024, over 50% of banks surveyed by Alloy reported an increase in business fraud, and more than 65% saw a rise in consumer fraud.

Payment tokenization is one of the fintech industry’s most effective responses to ongoing hacker threats.

What is Tokenization in Payments?

Payment tokenization is the process of replacing sensitive payment data with a randomized string of characters—called a token—that holds no exploitable value outside a specific transaction or merchant system.

Example:

Imagine you’re paying for coffee with your credit card.

Without tokenization:

- Your real card number (e.g., 1234 5678 1234 5678) is sent to the payment processor.

- Hackers can potentially intercept the data.

- If stolen, your card could be used fraudulently.

With tokenization:

- You tap your card or phone at the register.

- Your bank or payment provider replaces your card number with a token, like “A1B2C3D4.”

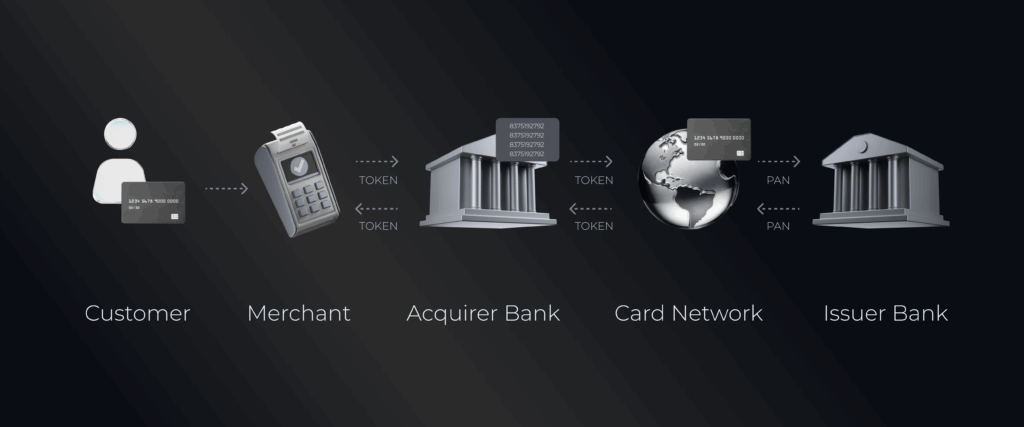

- The token is sent to the payment processor.

- Behind the scenes, the payment provider maps the token to your real card number to complete the transaction.

- If a hacker intercepts the token, it’s useless—only valid in that specific context.

Tokenization is like a coat check system. Your card number is your coat; the token is your coat check ticket. The ticket doesn’t resemble your coat, but it works within a specific environment—and once you retrieve your coat, the ticket is no longer valuable.

Single-use Tokens and Multi-Use Tokens

It may seem that all tokens are single-use, but multi-use tokens also exist.

- Single-use tokens are valid for one transaction only and offer maximum security.

- Multi-use tokens are reusable and provide greater convenience, especially for recurring payments, but come with slightly increased fraud risk since they’re easier to link back to the original card number.

Device-Based Tokenization and Online Tokenization

Tokens can be generated on a device or stored online:

- Device-based tokenization begins when you add your card to a digital wallet. The wallet contacts the payment network to tokenize your card, and your issuer may require authentication (e.g., OTP). Once approved, a token and cryptographic key are sent to your device for contactless payments.

- Online tokenization is used when you save your card on a merchant’s website. The merchant requests a token through a token service provider. Once authenticated, the token is stored and updated as needed, enabling secure recurring payments—even if your card details change (e.g., expiration date).

Benefits of Payment Tokenization for Businesses

The key benefit of tokenization is enhanced security. Randomized tokens are nearly impossible to reverse-engineer within the time frame of a transaction, reducing the risk of data breaches. This means that tokenization keeps payment data safe with fewer resources, and can save businesses money on anti-fraud measures if they are willing to splurge on integrating the procedure into their systems.

Differences Between Tokenization and Encryption

Tokenization is not the only way to secure financial data by converting it into an unreadable format. Encryption is the other option: it uses cryptographic algorithms and keys that also make the process reversible.

| Tokenization | Encryption | |

| Purpose | Protects sensitive data by replacing it with a token | Secures data by converting it into unreadable format |

| Reversibility | Not reversible | Reversible only with a secret decryption key |

| Output | Token with no meaning outside its system | Unreadable ciphertext |

| Compliance | Ideal for PCI DSS compliance and minimizing data exposure | Commonly used for protecting data in transit or at rest |

| Security Method | Substitution – stores original data in a secure vault | Mathematical transformation using cryptographic algorithms |

| Susceptibility to Attack | Tokens are useless without access to the vault | Encrypted data is unreadable, but could be brute-forced without strong keys |

Conclusion

Payment tokenization offers a powerful and creative way to protect financial data. While multi-use tokens improve convenience, single-use tokens provide the highest level of security. For businesses, tokenization is a scalable, cost-effective tool to reduce fraud risk and streamline compliance.

At PayDo, we prioritize the safety of your data. Get in touch—let’s explore how we can help protect your business from fraud today.