According to Forbes, more than 53% of people in the US use digital wallets more than traditional payment methods. With the technology gaining popularity, new digital wallets emerge every week. Respectively, the more digital wallets to choose from, the harder the choice. Especially considering the pros and cons we discussed in the previous article.

In the previous two articles, we explored all about digital wallets and the benefits they bring. In this article, we offer some key insights aimed at helping you choose the right digital wallet. Our experts compiled a list of factors reflecting years of experience working with digital wallets. So, stay tuned.

Digital wallets, in simple terms

As mentioned in our first article, digital wallets are online payment tools that usually come as an app. These wallets store virtual debit and credit cards. With digital wallets, you don’t need to enter your card details or carry a physical card to make payments.

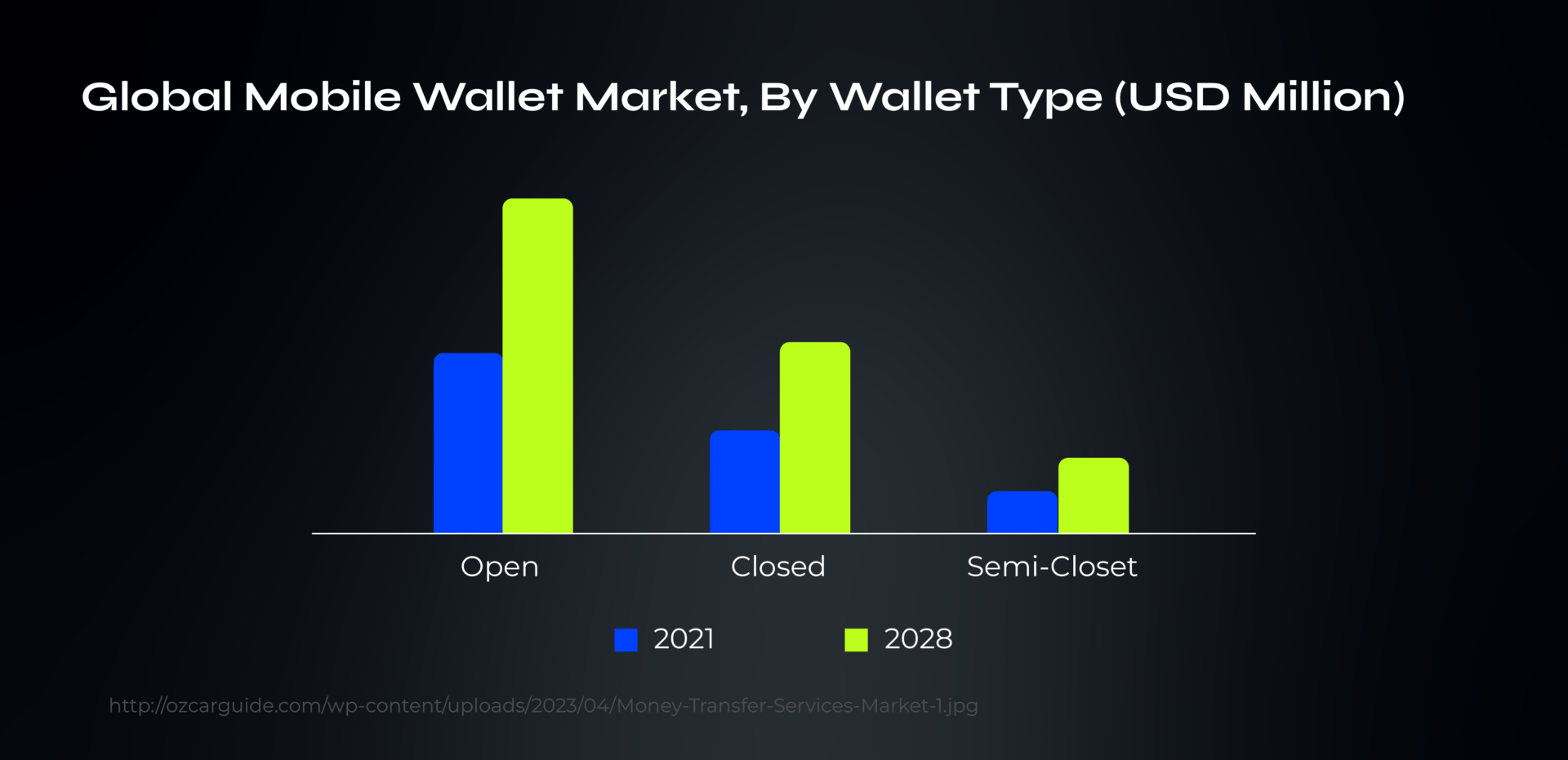

Types of digital wallets: open, semi-closed, and closed

Based on the environment they operate in, digital wallets can be open, semi-closed, and closed. Let’s explore them in more detail.

- Open wallets allow users to make transactions with any merchant accepting digital payments. They are not limited to a specific network or set of merchants. PayPal is an example of an open digital wallet.

- Semi-closed wallets are restricted to a specific group of merchants or services. Companies often issue them for use within their ecosystem or affiliated partners. The Starbucks app, which allows payments within Starbucks stores, is an example of a semi-closed wallet.

- Closed wallets are limited to a single merchant or service. Users can only use these wallets for transactions within the specific provider’s ecosystem. Store-specific gift cards or loyalty programs, as well as digital wallets like Amazon Pay, are closed types of wallets.

According to the data from Verified Market Research, semi-closed wallets are and will be the most commonly used among the above-mentioned types.

Choosing digital wallets: five key factors to consider

According to a report by FIS Global, e-wallets are getting popular due to their speed and simplicity. Here are some other factors to consider when choosing a digital wallet for your everyday payments:

1. Security features and encryption protocols

When choosing a digital wallet, prioritize security. Providers use two-factor authentication, one-time PINs, and encryption to protect user information. Digital wallets can be password protected, and your card number is tokenized, so merchants only receive limited information.

Pro Tip: take extra precautions like using strong passwords and monitoring your accounts.

2. Compatibility with your device and regional availability

Some digital wallets may not be compatible with all devices or unavailable in all regions. Google Wallet, for instance, is available in many countries and regions, but some features are only available on certain devices and in certain countries.

Pro Tip: always check if the digital wallet you’re interested in is compatible with your device and available in your region before deciding.

3. Fees and service agreement requirements

When choosing an e-wallet, it’s important to consider the fees and service agreement requirements. E-wallets may charge fees for every process step, including deposits, withdrawals, and conversion rates.

In most cases, withdrawal fees can vary from 0% to 8%, depending on the withdrawal method and the agreements between the e-wallet and the payment provider.

Pro Tip: pay attention to additional fees on e-wallet platforms before getting one.

4. Integration capabilities with other apps and services

Considering which e-wallet to use, it is important to consider its integration capabilities with other apps and services. This is because integration can give a smooth experience for the user. It lets them access many services from one platform.

For instance, if you use a digital wallet that connects to your bank account, you can easily move funds between accounts. You won’t have to switch between apps. Similarly, if your e-wallet links with your favourite shopping app, you can buy from the app. You won’t have to enter your payment info every time.

Pro Tip: Look for digital wallets with available third-party apps and services.

5. Customer support options

When choosing a digital wallet provider, consider their customer support services. Look for support channels like live chat, email, or phone and read user feedback to assess the provider’s commitment to customer satisfaction.

Pro Tip: live chat is a popular option as it provides real-time support and can handle multiple customers simultaneously.

The aforementioned factors add up. They affect the usability, security, and convenience of a digital wallet. By fully assessing each part, you can make an informed choice. It will fit your preferences and improve your digital payment experience.

PayDo is at the forefront of working with digital wallets

PayDo is a versatile solution. The platform undergoes constant evolution and has been proven to increase its outreach in major strides. Currently, PayDo is synonymous with global accessibility, a versatile toolkit, and quick onboarding.

Global accessibility

PayDo’s reach extends globally. It works with businesses in diverse locations, like Europe, North America, and Asia.

Dedicated IBAN for multicurrency business accounts

Opening a multicurrency business account with PayDo goes beyond traditional offerings. It provides multiple dedicated IBANs, which are vital for international transfers and global payments.

The platform supports 35 major currencies. You can use them to pay employees, receive payments, and manage cash flows. Besides, the IBAN comes with 150 destinations and a number of payment schemes, including

- SEPA

- SEPA Instant

- Cross-border

- Fedwire

- Target2

- FasterPayments

- Chaps

- Bacs

- Kronos2.

Quick and efficient onboarding

PayDo recognizes the value of time in the fast-paced digital payment industry. So, it speeds up the onboarding process. Clients can have a business account in as little as five business days with a standard set of documents.

Bottom line

Choosing the best digital wallet requires careful thought. You must consider security, compatibility, fees, integration, and support.

By evaluating these factors, one can get the right digital wallet. It will improve their payments and fit their needs. This brings both convenience and security in the digital age.

Create your Personal or Business Account and explore the benefits of managing finances in one place. Also, after creating an account, you can apply for our VISA EUR physical and virtual cards. These can be easily added to a digital wallet of your choice.