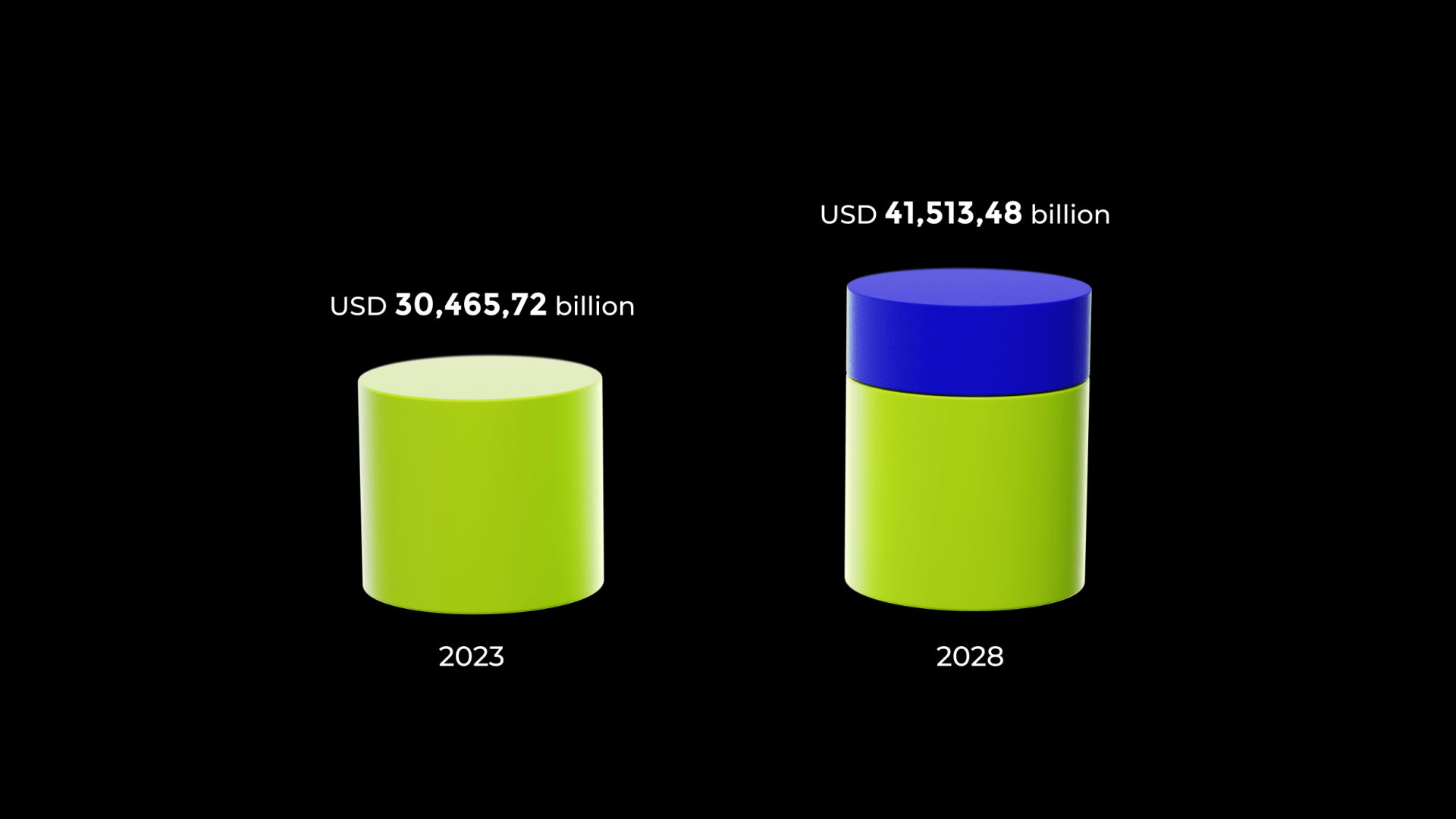

“Approximately 4.2 billion gambles at least once a year.” In other words, more than half of the planet is part of the iGaming market, which is developing really fast (see Fig. 1). So, it was only a matter of time iGaming payment technologies blossomed as flowers in the spring.

Figure 1. Global online gambling market size

The more your business knows how to use iGaming payment technologies, the higher the likelihood of your business success. It is that simple, and PayDo has seen that many times while working with multiple iGaming operators and platforms.

Five Fast-Developing iGaming Payment Technologies to Consider

- Responsible Gambling

- Better Security

- AI-Based Personalisation

- Neobanking

- Cross-Platform Accessibility

1. Responsible Gambling

Gaming is not about making the most money at the expense of gambling addiction people have. Following the social responsibility trends, respective iGaming businesses look more and more toward responsible gambling initiatives. It is estimated that approximately 70% of online gamblers are aged 18-39, a demographic particularly sensitive to responsible gambling measures.

Now, operators are implementing AI-driven tools to monitor player behavior, set deposit limits, and detect risky gambling patterns early. For instance, AI algorithms can identify when a player engages in potentially harmful betting behaviors and trigger automatic alerts or interventions.

2. Better Security

Security remains a top priority in iGaming. Operators adopt more robust encryption protocols, multi-factor authentication (MFA), and blockchain technology to secure transactions and user data.

Such a trend is particularly important considering cybersecurity threats in the iGaming industry have risen by 40% in the last two years.

3. AI-Based Personalisation

AI is everywhere. However, there is a difference between AI being just a buzzword and a real trend. When properly applied in iGaming, the tool can analyze player behavior, suggest personalized payment options offers, and even recommend games that players are likely to enjoy.

How might it work?

For instance, an iGaming platform might offer a player who frequently deposits via e-wallets a special bonus for using this payment method, thereby encouraging continued use. As a result, a platform gets a long-term customer while a player gets a favorable payment method. A win-win.

4. Mobile Gambling

In Europe alone, the mobile gaming market experiences an annual growth rate (CAGR) of about 6.7%. In Asia, 88% of all iGaming transactions are made with mobile devices. There is a clear shift toward mobile in the iGaming sector. Soon enough, more and more players will use mobile casino apps tied to their digital wallets to improve gambling and payment experiences.

5. Cross-Platform Accessibility

There is a growing push for cross-platform accessibility in the iGaming sector. Premium payment solutions are expected to work across desktops, tablets, and smartphones. Players must have a consistent gambling experience, regardless of their device.

Cross-platform functionality means a player can start a game on their desktop at home, continue playing on their tablet during a commute, and make a payment via their smartphone—all without interruption.

The Four iGaming Payment Technologies Likely to Have A Renewed Focus in 2025

- Buy Now, Pay Later (BNPL)

- Voice-Activated Payments

- Biometric Authentication

- Metaverse and VR Payments

1. Buy Now, Pay Later (BNPL)

BNPL is going past e-commerce and marketplaces. It is entering the list of iGaming payment technologies. The increasing number of platforms allow players to spread out their payments over time.

With BNPL, a player can deposit and repay the amount in installments. This makes high-stakes gaming more accessible without needing an immediate full payment.

2. Voice-Activated Payments

Voice-activated payments are part of iGaming payment technologies. They improve accessibility by letting players use voice commands to transact on mobile and smart devices. This innovation is particularly useful for hands-free gaming experiences.

The adoption of voice-activated payments is expected to grow by 25% annually in the iGaming sector, reaching widespread use by 2026. Players can use voice commands to deposit funds or place bets. This avoids navigating menus. And it is more convenient, especially on mobile.

3. Biometric Authentication

Integrating biometric iGaming payment technologies, such as fingerprint scanning, facial recognition, and voice recognition, is becoming more prevalent in iGaming payments. Many iGaming platforms start to implement biometric-based KYC procedures. These help prevent fraud.

For instance, players can log in and authorize payments on their gaming accounts using facial recognition. This greatly reduces the risk of unauthorized access.

4. Metaverse and VR Payments

With the rise of the metaverse and VR, iGaming platforms are exploring new payment methods for these immersive environments. This includes virtual wallets and in-game currencies linked to NFTs or other blockchain assets.

The metaverse market is projected to grow to $500 billion by 2027. Even now, players in a VR casino can use virtual wallets to make real-time purchases or place bets within the gaming environment. One can only expect such technology to get more traction.

PayDo in Pursuit of Making Premium Payments Convenient

What Is PayDo?

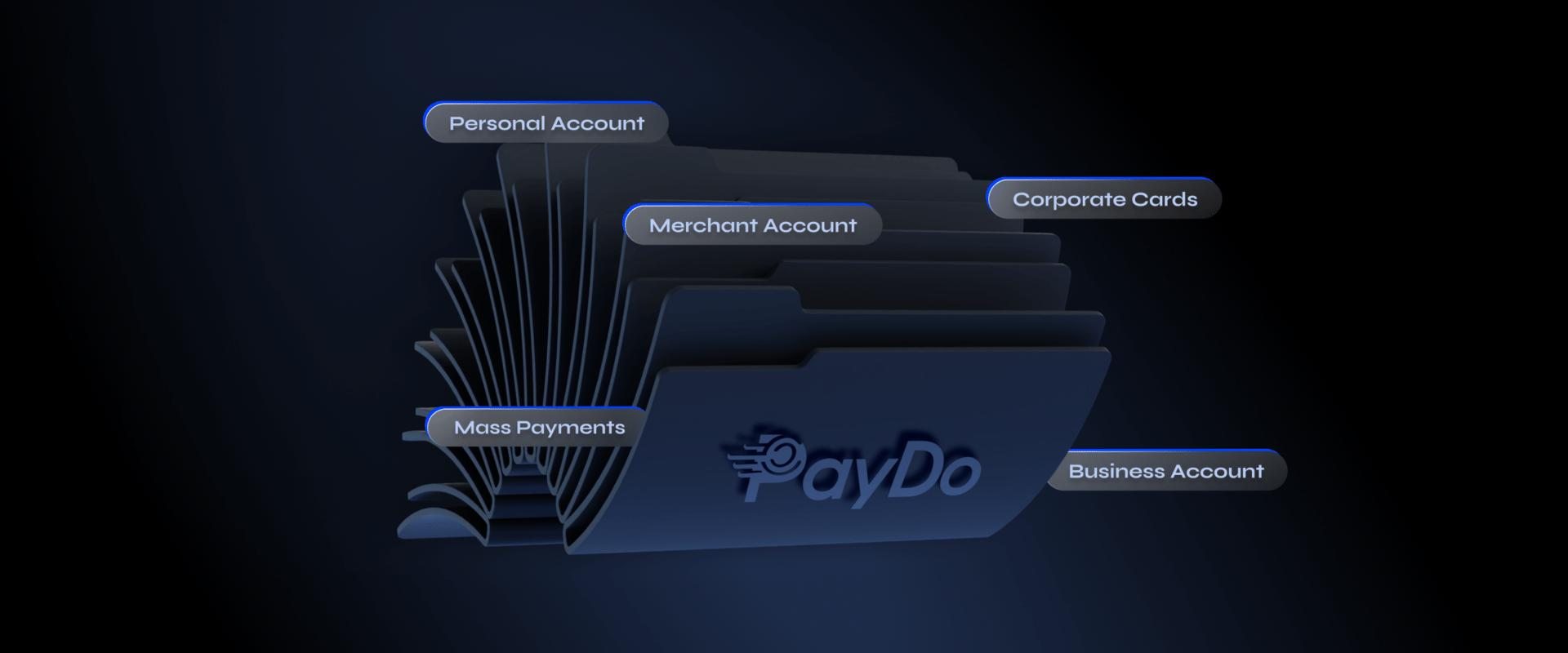

PayDo is a top-tier Electronic Money Institution (EMI) and a payment ecosystem fully authorised by both the FCA and FINTRAC. Operating globally across 150 countries and more than 28 industries, Paydo offers solutions to both businesses and individuals.

PayDo follows the mission of providing premium and convenient payment services. Its clients get all of that within one dashboard, one account, and under one contract.

Why PayDo Stands Out?

As a payment ecosystem, PayDo have developed these standalone products for iGaming clients:

PayDo IBAN

- Quick onboarding.

- Dedicated IBAN with 35 currencies.

- 9 payment schemes: Cross-border, SEPA, Fedwire and more.

- Support for high-risk and high-value transactions with no limits.

- No hidden fees.

- Crossborder and 3rd party payments to/from 140+ countries.

- Transparent FX and instant conversions in the dashboard.

- Corporate virtual and physical cards.

Merchant Services (Checkout)

- No chargebacks, no holds, no rolling reserve.

- Best in industry anti-fraud measures.

- 350+ payment methods (pay-in options): cards, direct debits, bank transfers, and many local methods.

- Customer localisation.

- All payment methods are available by default via a single API.

- One-click payments, transactional history, and reports for every user.

- Mass payments and merchant services available in one platform.

Unique to the iGaming sector, PayDo offers wallet checkout with no restrictions, dedicated to iGaming licenses, including Curacao. In a nutshell, PayDo offers all the services that 9 or 10 payment providers usually offer. You don’t need to spend time running from one provider to another. You can have it all with PayDo.

PayDo Nominated as a Payment Innovation of 2024

PayDo has been nominated for the “Payment Innovation of the Year” award at the SBC Awards 2024. This nomination shows that PayDo is recognized for its smart payment solutions.

PayDo’s focus on making payments secure, fast, and easy has helped many businesses in the iGaming industry. This award nomination highlights PayDo’s leadership role in creating better ways to handle online payments.

You can read more about the nomination here.

Conclusion

Understanding and following the latest payment trends and technologies is key to staying competitive. These advancements are shaping the industry’s future, from responsible gambling tools and enhanced security measures to AI-based personalization and innovative payment methods.

PayDo is at the forefront of these innovations, providing payment solutions to meet the unique needs of iGaming operators. As the sector continues to evolve, platforms like PayDo evolve as well.

Contact experts from PayDo and start using iGaming trends and technologies right away.