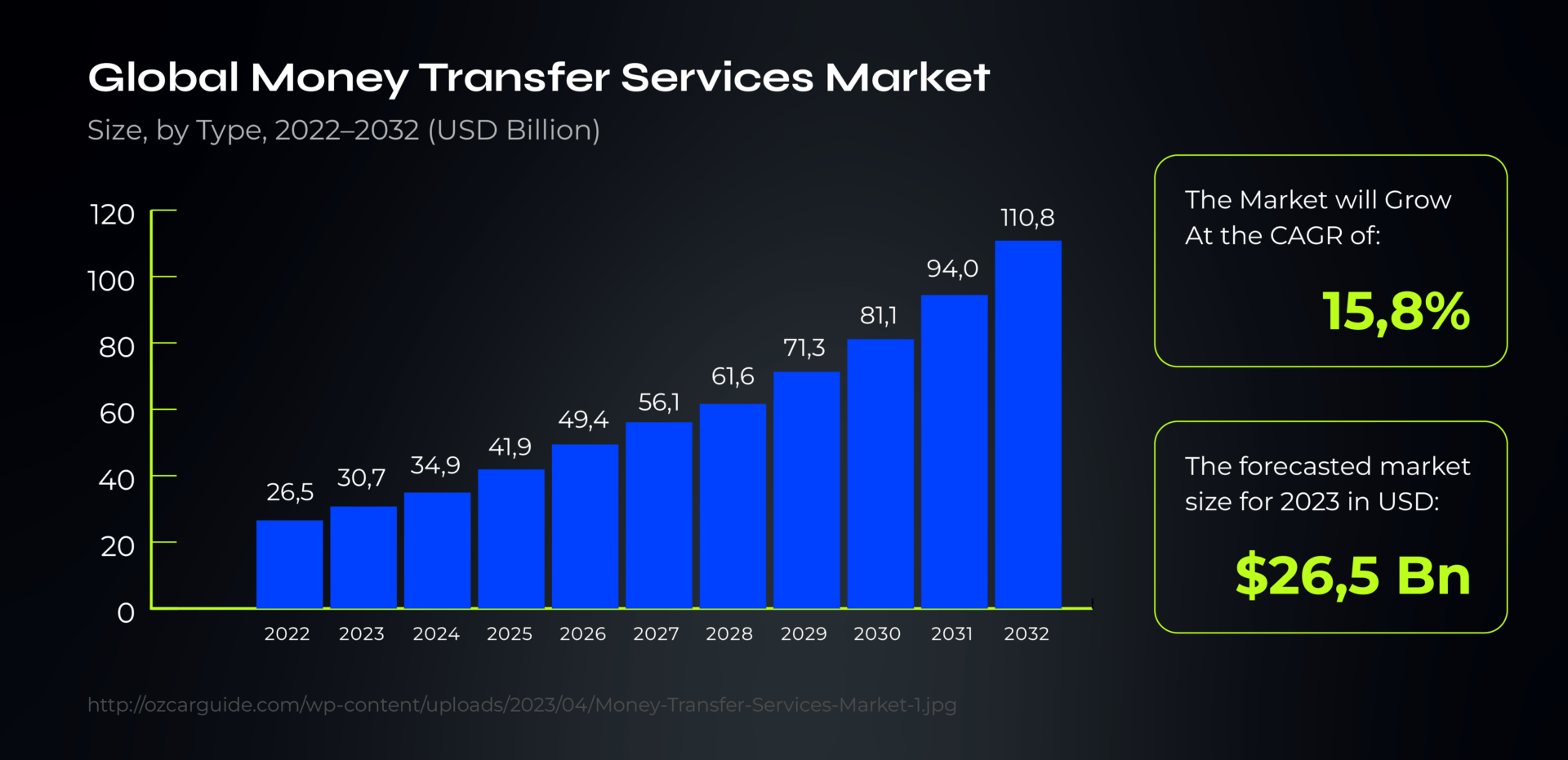

As per GlobeNewsWire, the market size for money transfer services is expected to exceed approximately US$ 110.8 billion by 2032. The growth is anticipated to follow a consistent Compound Annual Growth Rate (CAGR) of 15.8% from 2023 to 2032 (see Fig.1). As a result, more and more payment providers, methods, and schemes enter the market. This make it harder to find the cheapest way to send money where you need them to go.

Figure 1. The global money transfer services market size

In this article, we will explore some essential tips on choosing the best way to send money online as a business. We will consider several factors to help you make a final decision. This article is designed to assist you in identifying the payment services that meet your specific needs.

Watch out for hidden costs

Hidden fees are additional costs associated with a service that may not be immediately apparent or disclosed to the user. These fees can significantly impact a transaction or service’s overall cost, and they often surprise individuals.

Businesses may often overlook charges associated with currency exchange rate conversion rates, transaction fees, and intermediary bank costs. Currency conversion fees, for a bank instance, may seem nominal at first, but they can add up substantially, particularly for frequent international transactions.

Transaction processing fees, another often overlooked aspect, can vary widely among service providers & countries. Some platforms may impose flat fees, while others charge a percentage of the transferred amount. Additionally, intermediary banks involved in the transfer process may levy their fees, there – contributing to the total cost.

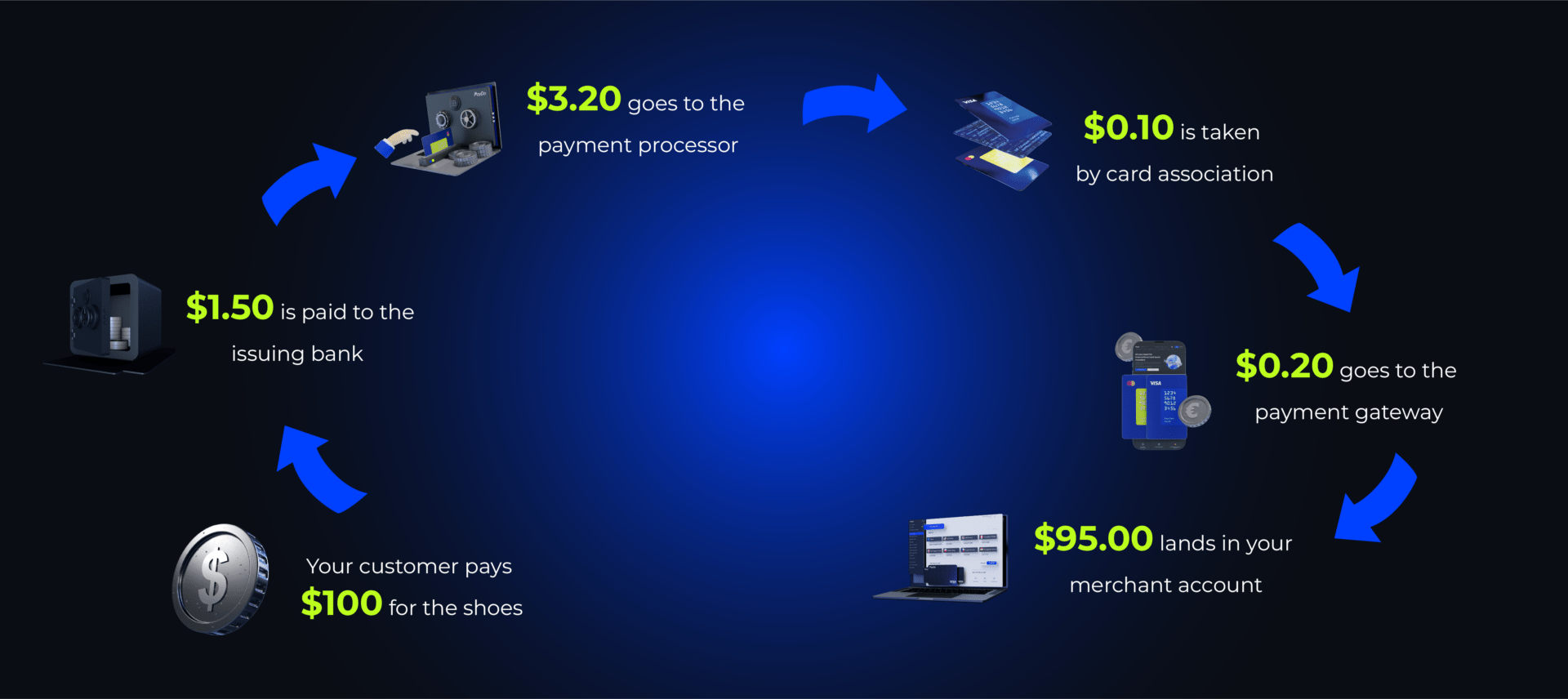

Here’s an example of how that works

Imagine you’re a merchant selling shoes online. A customer happily pays you $100 at checkout. But, behind the scenes, there’s a journey for that money before it reaches your bank account:

- First, the payment processor takes its cut, charging a percentage (let’s say 2.9%) plus a fixed fee ($0.30). So, from the $100, $3.20 goes to the payment processor.

- Next, the card association, like Visa or Mastercard, takes a tiny piece, maybe 0.1%, which amounts to $0.10.

- Then, the bank that issued the customer’s credit card wants its share, say 1.5%, taking $1.50.

- Lastly, the payment gateway, ensuring secure transactions, charges a flat fee (let’s say $0.20).

When you add it all up, the total fees amount to $5.00. So, what initially seemed like $100 ends up being $95.00 that lands in your account.

These hidden fees, seemingly insignificant on an individual basis, can accumulate over a bank time, translating into a considerable amount. Understanding and addressing these hidden costs are essential steps towards making informed and cost-effective decisions in international payments and local money transfers.

Top 8 tips for finding the cheapest way to send money

In the quest for cost-effective money transfers, consider these eight essential tips that can help you maximise your financial resources.

1. Compare rates

Before initiating a money transfer, take the time to compare rates across different platforms. Various services may offer distinct $ exchange rate rates and fees, and choosing the right one can result in significant savings.

2. Understand the fees

Look into the details of fees associated with money transfers. Be aware of hidden charges, such as currency conversion fees and intermediary bank costs. This will help you make informed decisions when choosing the best payment method.

3. Use online services

Choose online money transfer services, often offering competitive exchange rates and user-friendly interfaces. Online platforms tend to have lower overhead costs than traditional methods, saving your business money.

4. Keep in mind currency conversion

Be mindful of currency conversion fees, as they can significantly impact the cost of international bank transactions. Choose services that offer favourable conversion rates or consider multi-currency accounts for better financial efficiency.

5. Track timing matters

Keep an eye on currency market trends and exchange rates. Timing your money to transfer -s strategically can result in better rates, saving your business money in the long run.

6. Use bulk transfers

If feasible, consolidate smaller transfers into larger, less frequent transactions. Many services offer better rates for bulk transfers, making it a cost-effective strategy for businesses.

For example, as a PayDo Business Account user, you can easily pay many payees in just minutes using our payment APIs. Our mass payout options include payments to other PayDo users, cards, and bank transfers. Learn more about mass payments.

7. Leverage promotions and discounts

Explore promotions, discounts, or loyalty programs offered by money transfer services. Utilising these incentives can lead to additional savings, especially for businesses engaged in frequent international money transfers.

8. Distinguish local vs. international transfers

Distinguish between local and international transfers, considering fees and rates may vary. Assess whether local options and international are more cost-effective for certain transactions, optimising your business’s financial resources.

By implementing a few of these tips, you can navigate the complex landscape of money transfers more effectively and identify the cheapest way to send money while optimising your financial resources.

Benefit from the cheapest way to send money – PayDo

At PayDo, we’ve combined the most essential financial services into one dashboard, allowing you to manage all your payments in one place. We understand that running a business can be challenging in today’s world, but we’re here to simplify it for you.

The PayDo Business account, PayDo Checkout (merchant services), and mass payments are seamlessly integrated into one application and governed by a single contract.

This comprehensive suite facilitates a swift initiation or expansion of your online business. It provides an efficient way to engage new customers by securely accepting payments worldwide.

Here is how it works. End-shoppers with a registered PayDo account can log in to the account and pay in 1 click with a linked card, PayDo wallet, or alternative payment methods.

If the client does not have an account, they can immediately create one from the checkout page, verify it in two step,s and complete the payment. Payment methods for the end shoppers are displayed according to your project settings and geolocation.

PayDo IBAN

You can sign up for a PayDo Business Account and pass verification in about 48 hours. As a result, you can request as many dedicated multicurenncy IBANs as you want. These come with:

- Cross-border, SEPA, SEPA Instant, FPS and five more payment schemes for global transfers.

- Access to 35+ currencies.

- The chance to send/receive transfers from/to 150 destinations.

- Transparent fees included.

PayDo Checkout

We ensure that our pricing plans are transparent and free of hidden fees. And you get the cheapest way to send money. PayDo’s fees take into consideration how you’re sending or receiving money, your user type (business or personal), and the location of your transactions. Pricing for Checkout transactions is tailored to payment methods and regions.

Additionally, we offer conversion rates based on current market conditions upon request. Explore our pricing plans to find the model that best suits your needs as a PayDo Business user.

Conclusion

In a globalised world where financial transactions are necessary, finding the cheapest way to send money is paramount.

Hidden fees, often overlooked, can significantly impact the overall cost of transactions. Understanding and addressing these costs are crucial in making informed decisions for international and local money transfers.

To tap into the cheapest way to send money, consider these financial tips: compare rates, understand fees, use online services, be mindful of currency conversion, track timing, use bulk transfers, leverage promotions, and distinguish local vs. international transfers.

With transparent pricing plans tailored to your needs, PayDo ensures you can send money efficiently and cost-effectively, maximising your business’s financial resources. Create your PayDo Business account to explore opportunities for secure and borderless money transfers for your business goals.