Starting and running a business is undeniably tough. According to recent statistics, about 10% of new companies fail within their first year and 90% fail over the long term. This means only 1 in 10 businesses overcome all the hurdles they face. How many payment providers do you need to have contracts with to ensure your business operates smoothly?

Running a business, for instance, in the iGaming industry, means having contracts with at least five payment providers. In the following sections, we’ll explain this in more detail and suggest a way to access five payment provider services under just one contract.

Payment Providers 1. Open Banking Account

Starting an iGaming business involves several hurdles, and one of the first is opening a bank account for a business. As a business owner, you’ll need to approach various payment providers. They will ask numerous questions and require a lengthy list of documents.

If you’re fortunate, you’ll pass the verification and onboarding process after a couple of weeks, and your account will be up and running.

Note: Remember that you’ll need to share access to your account with authorized team members. Choosing a payment provider that understands and supports the industry in which you operate is also crucial. Otherwise, you may face significant challenges down the line.

Payment Providers 2. Pay Contractors in Different Currencies

You’ve set up your business account and now must pay your contractors and freelancers. In the after-COVID world, there is a high chance they live and work in different countries. It means you need to make global transfers in various currencies.

To pay them, you require Cross-border services. However, you soon discover that while many payment providers offer SEPA, finding one that provides Cross-border is challenging.

Fortunately, you will find a payment provider that offers Cross-border and supports multiple currencies. You obtain an IBAN and begin paying salaries to your contractors abroad. This means you’ve now signed two contracts.

Note: Remember that you’ll likely have B2B contracts with your contractors, meaning you’ll send money to companies. The Cross-border payment provider might ask additional questions if they operate in the digital services sector, potentially causing transfer delays. Many banks and Electronic Money Institutions (EMIs) don’t fully understand how digital businesses operate and may hesitate to engage with high-risk industries.

Payment Providers 3. Checkout for Your Website

You have dealt with the business account and paid salaries to contractors. Now, you need checkout to accept payments because you have a website. In other words, you need a merchant provider. Most EMIs out there do not offer merchant services.

After many hours of research, you finally find the merchant provider. You sign a contract and have your checkout ready.

Note: With checkout, you need to focus on the integration aspect. If it is hard to integrate, you will spend resources and time on developers doing the task. Besides, as with the bank, with a merchant provider, you need a dedicated account manager to constantly update the information, which is hard.

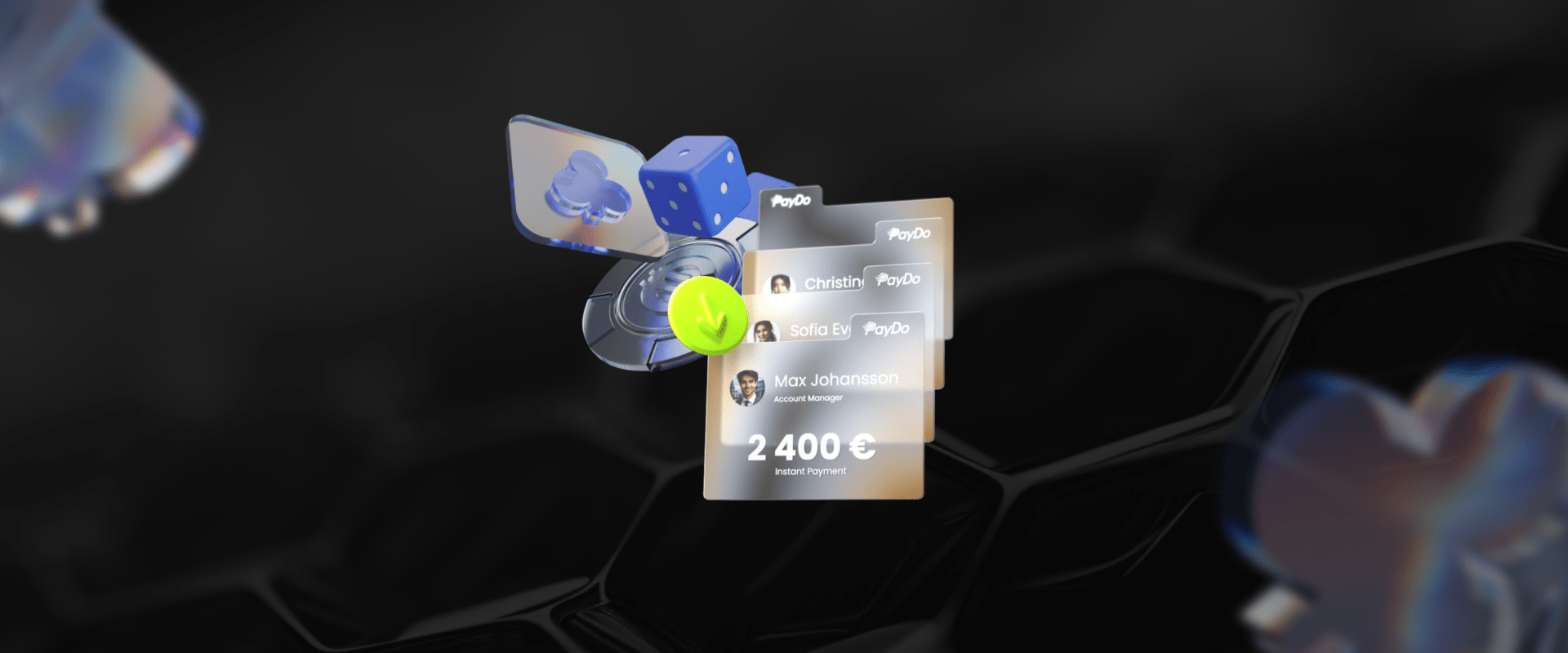

Payment Providers 4. Mass Payments to Players

After signing the third contract, you encounter another challenge: you need mass payout capabilities to ensure that players receive their winnings promptly. Many B2C payment providers don’t offer mass payment features.

Additionally, you require mass payouts via API integration. This is further complicated because different payment providers often cater separately to high-risk and low-risk businesses. Despite these hurdles, you find a payment provider offering mass payout services and sign your fourth contract.

Note: Always remember that with each payment provider, you need to build relationships, secure dedicated support, and keep your information updated. Having someone reliable on your side is crucial.

Payment Providers 5. Virtual and Physical Cards

Now you need a corporate card.

- First, you require virtual cards for Google Ads.

- Second, you need a corporate card for expense management.

- Third, to build your brand, you want physical cards that can be personalized for your employees.

Immediately, you discover the hard truth: most payment providers offer physical or virtual cards, but rarely both.

You manage to find that rare provider offering both plastic and virtual cards. You sign your fifth contract.

Note: Remember that each provider will have its own onboarding process, which can last months. The more providers you have, the more time you’ll spend on onboarding, documentation, support, etc.

The Matter of Compliance

Now that you have contracts with five payment providers, you might think you can breathe a sigh of relief. Unfortunately, that’s not the case.

Enter compliance.

As you navigate this path, you’ll frequently encounter regulations, jurisdictions, licenses, and other compliance issues that can be challenging for business owners.

With each payment provider on board, it’s crucial to ensure they hold the appropriate iGaming licenses. Moreover, they must be authorized to operate in the jurisdictions relevant to your business. You can’t afford to engage with dubious payment providers—not only because of regulatory requirements but also due to the ethical standards your company upholds.

Ignoring these compliance aspects can lead to swift and serious repercussions.

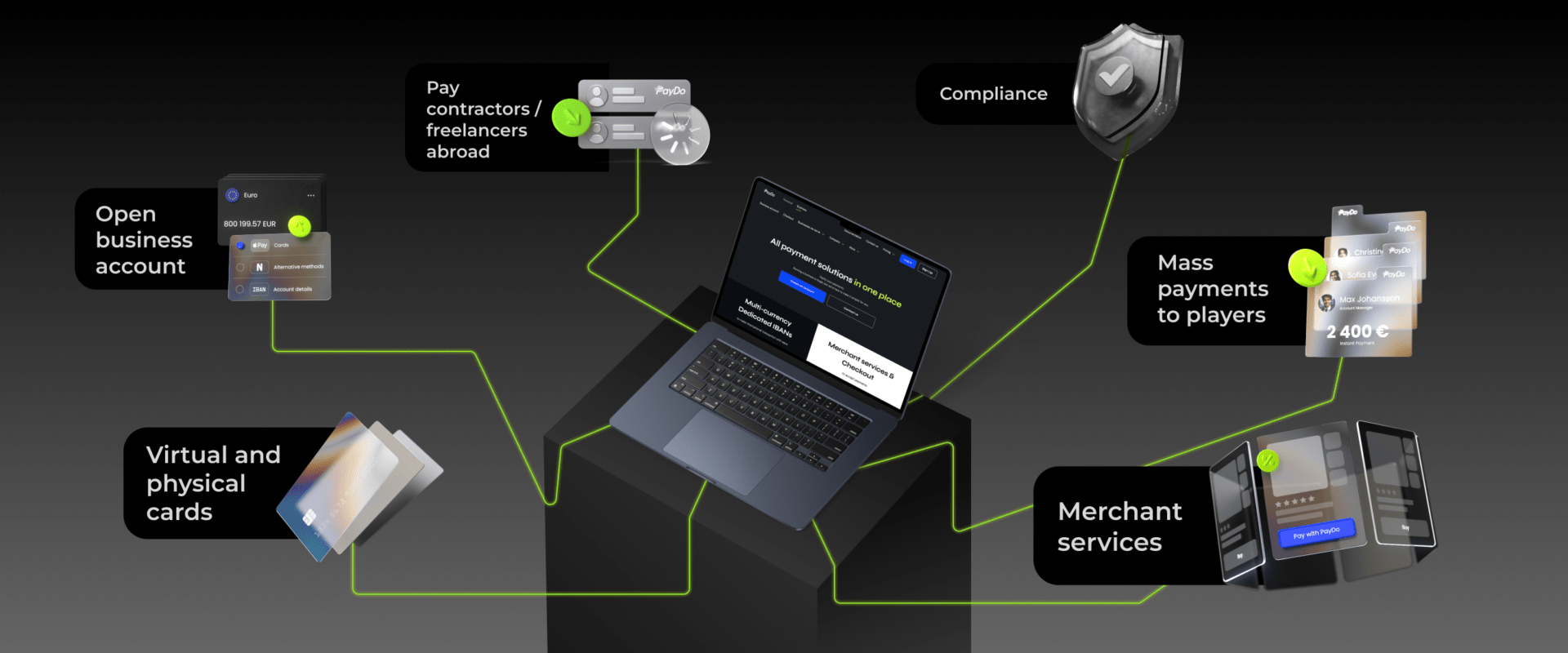

All Payment Solutions in One Place

PayDo is a payment ecosystem with a mission to provide all payment solutions in one place. With the platform, you get the services of five payment providers under one contract.

More specifically, PayDo offers:

I. Business Account with a Dedicated Multicurrency IBAN

- Reome opening in 48 hours

- Quick onboarding

- Standard pack of documents

- 35+ currencies

- 150+ countries

- Cross-border, SEPA, and seven more payment schemes

II. Merchant Services Payment Providers

- No chargebacks

- No holds

- No rolling reserve

- Easy API integration

- 350+ payment methods

- Localization

- Instant settlements

- Conversion rate > 98%

- Unlimited websites

III. Mass Payouts

- Automatic payouts without any manual inputs

- Customers receive their funds without fees

IV. Virtual and Physical Cards

- Offer employees personalized cards.

- Improve corporate expense management.

- No limit on issuance.

And most importantly, PayDo is high-risk friendly and designed for iGaming business:

- No volume restrictions.

- No hidden fees

- No minimal commitments

- No minimal balances

- No nonsense requirements

- All iGaming licenses (Curacao included).

- In-depth understanding of high-risk industries.

- Curacao and other licenses supported

- A dedicated account manager with extensive experience in iGaming

- Momentary payouts

- Scheduled payments

- 140+ destinations

PayDo is fully licensed and regulated by the FCA, FINTRACK, and UAB. The payment ecosystem also has built-in anti-fraud, AML protocols, automated KYC, encryption, PCI-DSS level 1 compliance, and safeguarding measures.

Conclusion

There is little more to say. Having an iGaming business is tough. However, with PayDo on your side, you can save many resources and time. Have five payment-provider services in one place and under one contract.

PayDo is designed with high-risk industries like iGaming in mind. With no volume restrictions, hidden fees, minimal commitments, and full support for all iGaming licenses—including Curaçao—you can operate confidently, knowing that compliance and regulatory requirements are thoroughly managed. A dedicated account manager with extensive experience in the iGaming sector ensures personalized support tailored to your business needs.

In an industry where time is money and compliance is non-negotiable, having a reliable, all-in-one payment solution is not just advantageous—it’s essential. PayDo empowers you to focus on what truly matters: growing your business and providing exceptional customer experiences.

Why complicate your operations with multiple providers when you can have all your payment solutions in one place under one contract? By choosing PayDo, you’re simplifying your payment processes and gaining a strategic partner committed to your success.

Don’t let complex payment logistics hold your business back. Open an account right now and take the first step toward a more streamlined, efficient, and compliant financial future. We’re ready when you are!