The iGaming industry is an economic powerhouse. It generates impressive revenues and fosters innovations.

The European iGaming market saw a notable 23% boost in revenue, hitting $115.7 billion in Gross Gaming Revenue (GGR) in 2023. Online and brick-and-mortar establishments drive this growth. It showcases the industry’s stability and upward potential. The online segment jumped 8% from the previous year to a GGR of $40.7 billion.

What are the key tech innovations driving this industry forward?

Let’s unwrap them in this article.

5 Key Tech Innovations in iGaming to Shape 2024 and Beyond

Several technological advancements will change the iGaming industry in the next few years. These tools promise to shape the future of iGaming. They offer immersive experiences and enhanced functionalities.

1. Virtual Reality (VR) and Augmented Reality (AR)

According to a report by G2, AR and VR markets currently worth $31.12 billion. Revenue from mobile AR is forecast to rise from $12.45 billion in 2021 to $21.03 billion in 2024.

Revolutionary advancements such as VR casinos and AR racetracks are set to elevate engagement levels. They turn any setting into a dynamic and interactive gaming arena. AR/VR games engage the senses, fueling players’ imagination and enticing them to return for a fresh and distinctive experience.

In the iGaming industry, Virtual Reality (VR) technology provides bettors with an immersive and interactive journey, enabling them to craft their own customised 3D virtual avatars. These avatars, tailored to individual preferences and personalities, inject a personal touch into the iGaming experience.

With the growing influence of the metaverse trend, coupled with advancing technology and increased adoption, the gambling industry stands to gain significantly. The Metaverse, in particular, has the potential to create a unique and unforgettable user experience by transporting players into virtual realms of diverse worlds and games.

2. Artificial Intelligence (AI) and Machine Learning (ML) in iGaming

The integration of social gaming elements has transformed the iGaming industry. AI and ML have played a significant role in this transformation.

Recognised for its tech-savvy approach, the iGaming sector has been quick to realise Al’s potential. This has led to its rapid integration in diverse areas such as marketing, design, and tailoring player experiences. Such a rapid adoption encapsulates how Al is not only a game-changer in enhancing operational efficiencies but also in driving a more personalised and secure user experience.

The data from the SOFTSWISS survey paints a stark picture – Al is on the verge of becoming a cornerstone technology.

Let’s see how iGaming operators can incorporate AI and ML into their businesses.

1. Personalised gaming experience

Al can tailor gaming experiences to individual preferences, making games more engaging and retaining players for longer.

For example, platforms recommending games and bets based on players’ past behaviours.

2. Chatbots and virtual assistants

These technologies enhance customer service by providing instant responses to queries, assisting in troubleshooting, and guiding users through the gaming platform.

Chatbots provide round-the-clock support, handling common queries and escalating complex issues to human agents. Virtual assistants help players understand game rules, provide tips, and ensure a smooth gambling experience.

3. Responsible gambling measures

Al can assist in promoting responsible gambling by identifying and alerting potentially problematic gambling behaviour and enforcing self-exclusion policies. For instance, monitoring player behaviour to identify signs of problem gambling and suggesting self-exclusion or other help. Ensuring players adhere to self-exclusion agreements by monitoring and blocking access when necessary.

These are just some of the examples of how AI and ML and level up iGaming experiences in terms of personalisation, support, and responsible gambling. As technology evolves, more companies will leverage these features.

3. Use of blockchain and crypto in iGaming

According to a report by Crypto Reporter, crypto gamblers spent ~ $30 million in crypto on bets in Q1 2021, which rose to $63 million in Q1 2022. That indicates an increase of over 116%. With increasing crypto and blockchain adoption, the value of the iGaming market was projected to reach $95.05 billion in 2023.

One of the major advantages of accepting cryptocurrency bets is lower transaction costs. Cryptocurrency transactions are cost-effective. This enables casinos to save money and enhance their services for players.

The growing crypto audience, with over 420 million users worldwide, is another reason why companies should consider accepting Bitcoin payments. This allows businesses to tap into an extensive global client base, expanding accessibility and reaching customers in diverse regions. It eliminates traditional payment hurdles, such as the need to search for local providers.

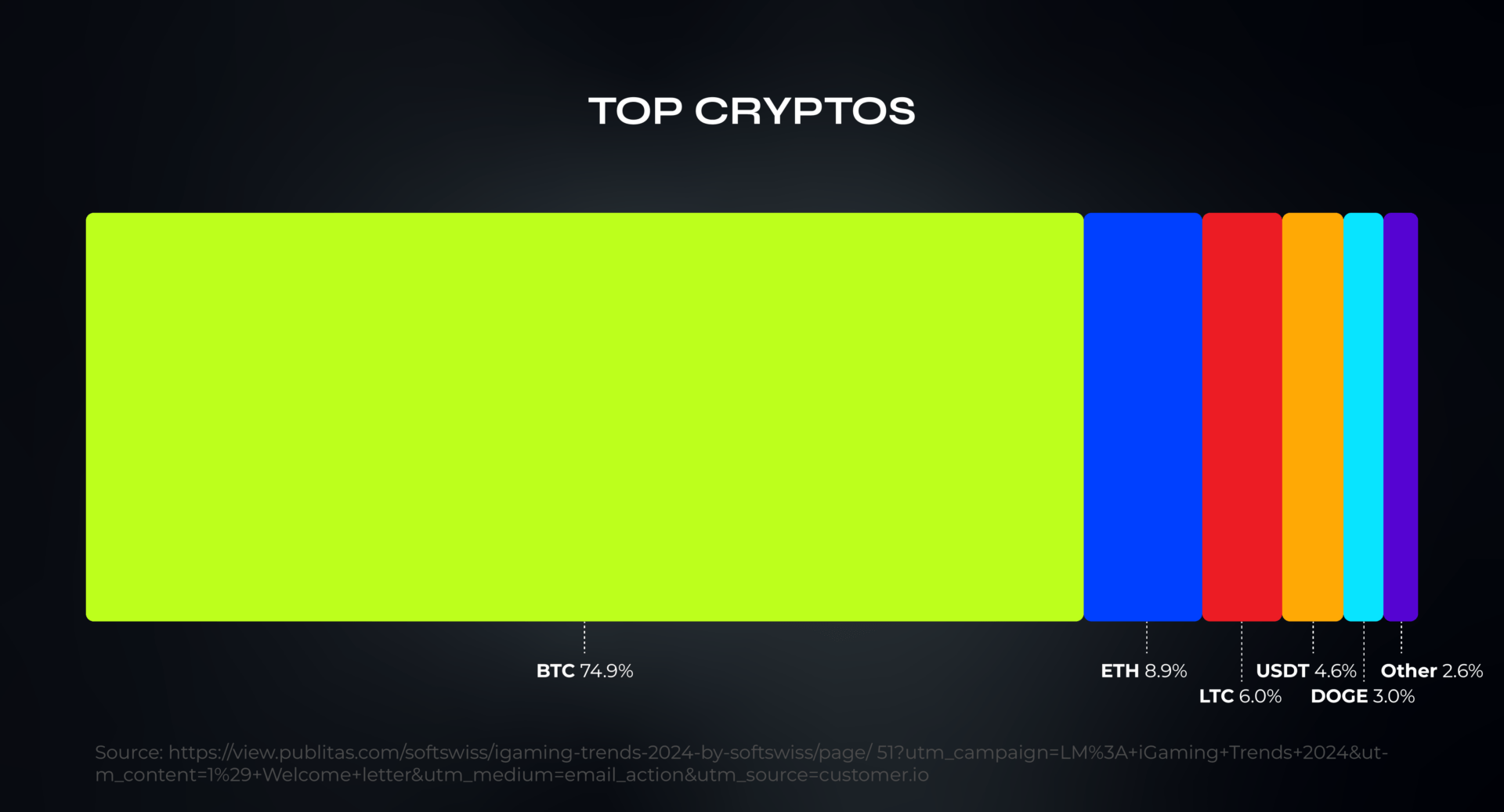

Cryptocurrency bets accounted for 30% of all bets in the first quarter of 2023, according to data. iGaming’s most popular cryptocurrencies reveal a consistent hierarchy. Bitcoin is leading with 74.9%, followed by Ethereum at 8.9%, Litecoin at 6.0%, Tether at 4.6%, and Dogecoin at 3.0% (see Fig.1).

Figure 1. Use of cryptocurrencies in iGaming

Blockchain technology can help to boost transactions at minimal fees, provide privacy and anonymity, and offer better odds and return to players. By leveraging blockchain to drive new experiences across platforms, the industry is set to advance even further.

4. The rise of 5G mobile gaming and progressive web apps

Casino games are one of the leading mobile gaming genres in popularity with an 18.9% revenue share. 5G technology is significantly impacting mobile gaming by enabling faster speeds, reduced latency, and more immersive experiences. According to a report by Ericsson, 5G technology is revolutionising the gaming industry by enabling immersive virtual reality gaming experiences that were not previously possible.

Additionally, 5G technology facilitates real-time interaction and collaboration in virtual environments without delays. This enhances the gaming experience. Live casino games, sporting events, and live auctions can now be hosted on powerful servers in data centres. Video and audio are streamed to devices in real time, contingent on a stable 5G connection.

Progressive Web Apps

Progressive Web Apps (PWAs) are becoming increasingly popular in the mobile gaming industry. The PWA combines the best features of native mobile apps and mobile web to provide an enhanced user experience (UX).

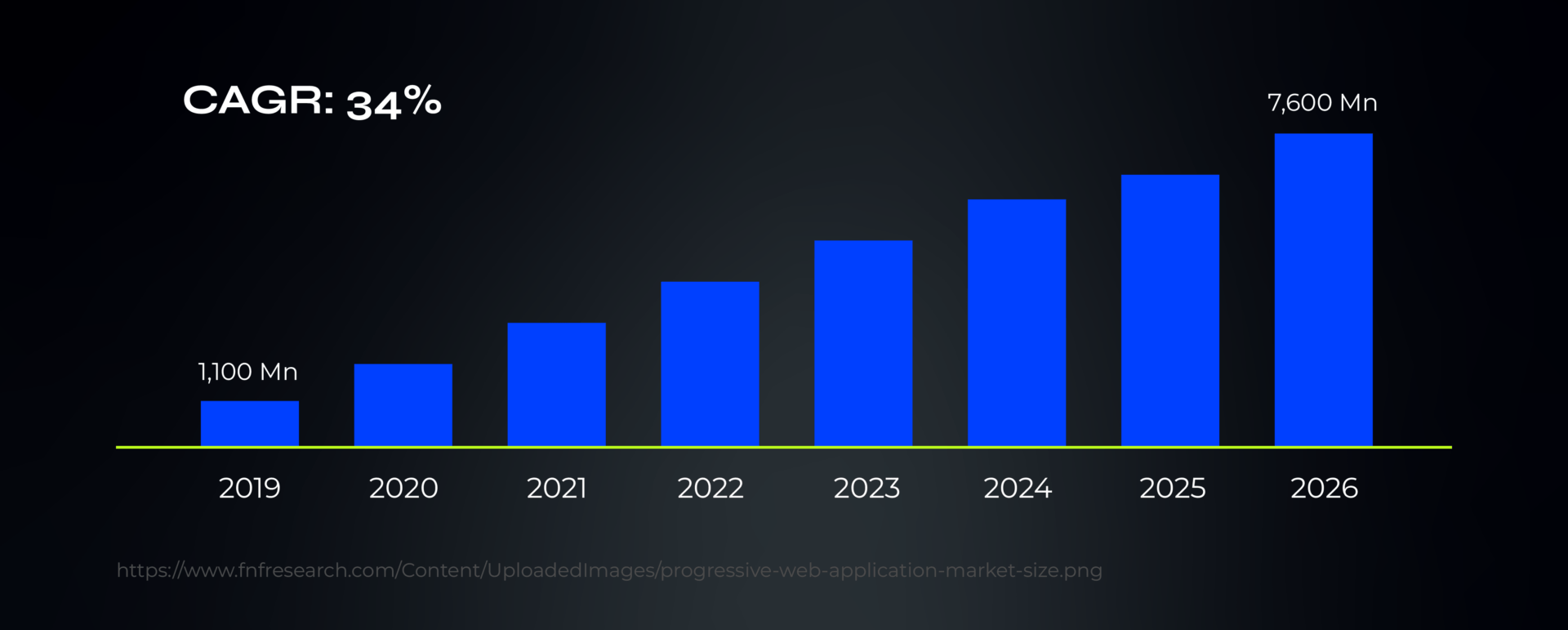

As per a report by Facts & Factors, the global market size of Progressive Web Applications was valued at approximately USD 1100 million in 2019. The report predicts the market will grow to around USD 7,600 million by 2026, with a compound annual growth rate (CAGR) of roughly 34% between 2020 and 2026 (see Fig.2).

Figure 2. Progressive Web Application market size

It is obvious that PWAs are set to redefine the online gambling experience. They offer a brighter and more accessible future for players and operators alike. PWAs are discoverable through search engines, enhancing your iGaming brand’s visibility and SEO ranking.

Several iGaming giants have adopted PWAs, such as Bet365 and William Hill, showcasing their effectiveness in providing a top-notch user experience. Implementing PWA in the iGaming Industry can help boost transactions at minimal fees, provide privacy and anonymity, and offer better odds and returns to players.

The integration of 5G technology and the adoption of Progressive Web Apps are shaping a more dynamic and accessible landscape for mobile gaming within the iGaming industry. These advancements contribute to enhanced user experiences, improved connectivity, and the exploration of innovative gaming possibilities.

5. WebRTC real-time streaming and industry standards

Web Real-Time Communication (WebRTC) is a technology that enables real-time audio and video communication between web browsers. It is used in various applications, including iGaming and gambling.

The iGaming industry has been revolutionised by WebRTC technology, allowing small to mid-sized gaming companies to add voice and video to existing gaming platforms. WebRTC technology also enables peer-to-peer multiplayer games by passing data back and forth between players and servers in real time.

For bettors who continuously adjust their strategies until the last moment, high-quality streaming and real-time interaction are crucial, demanding instant and precise data.

What about multiview cameras?

Multiview camera angles have become a standard feature in various aspects of iGaming.

They provide 3 to 5 distinct perspectives in live streams, from casino dealers to auctioned items. In live betting sports apps, fans can easily switch between camera angles or watch multiple games simultaneously on one screen.

WebRTC can improve the live online casino experience by allowing casino operators to stream video content almost in real time. This benefits both online casinos and users by maintaining quality and security.

Top iGaming Trends for 2024

In this section, we will cover some key trends shaping the iGaming industry in 2024 and beyond. We will focus on: enhancing a user-centric approach, data-driven innovations, and secure payment systems integration.

The player-centric approach in iGaming

Players are the cornerstone of the iGaming industry. The success of any gaming platform is correlated with their satisfaction and engagement. Without an exceptional player experience, iGaming companies risk losing their audience to competitors.

Neglecting the player experience can have dire consequences for iGaming businesses. High latency, disruptive gameplay, and negative mobile experience can lead to frustrated players, high churn rates, and a damaged reputation. Attracting and retaining players becomes a monumental challenge without a seamless and secure environment.

How to level up your game in iGaming? No pun intended

Businesses, including iGaming, can level up their user experience using multiple ways. Some of them include:

- Designing and building a high-performance server and network stack tailored to specific workloads ensures uninterrupted gameplay. This reduces latency, creating a more enjoyable experience for players.

- With the surging popularity of mobile iGaming, it’s imperative to have IT infrastructure optimised for mobile devices. It will help you guarantee a seamless and responsive mobile gaming experience, meeting the preferences and habits of modern players.

- It is crucial to facilitate collecting and analysing real-time data on player behaviour, preferences, and gaming patterns. This invaluable information allows for personalised offers, promotions, and gaming experiences tailored to individual player tastes and habits.

By implementing these practices, iGaming businesses meet and exceed player expectations with a seamless and secure player experience. In the end, the success of any iGaming platform hinges on the player experience it provides.

Data-driven decisions and mobile gaming surge

As a game operator, your goal is to cater to your clients, the players. To better serve them, you need to meet their preferences. And a significant 70% of players prefer a good mobile gaming experience.

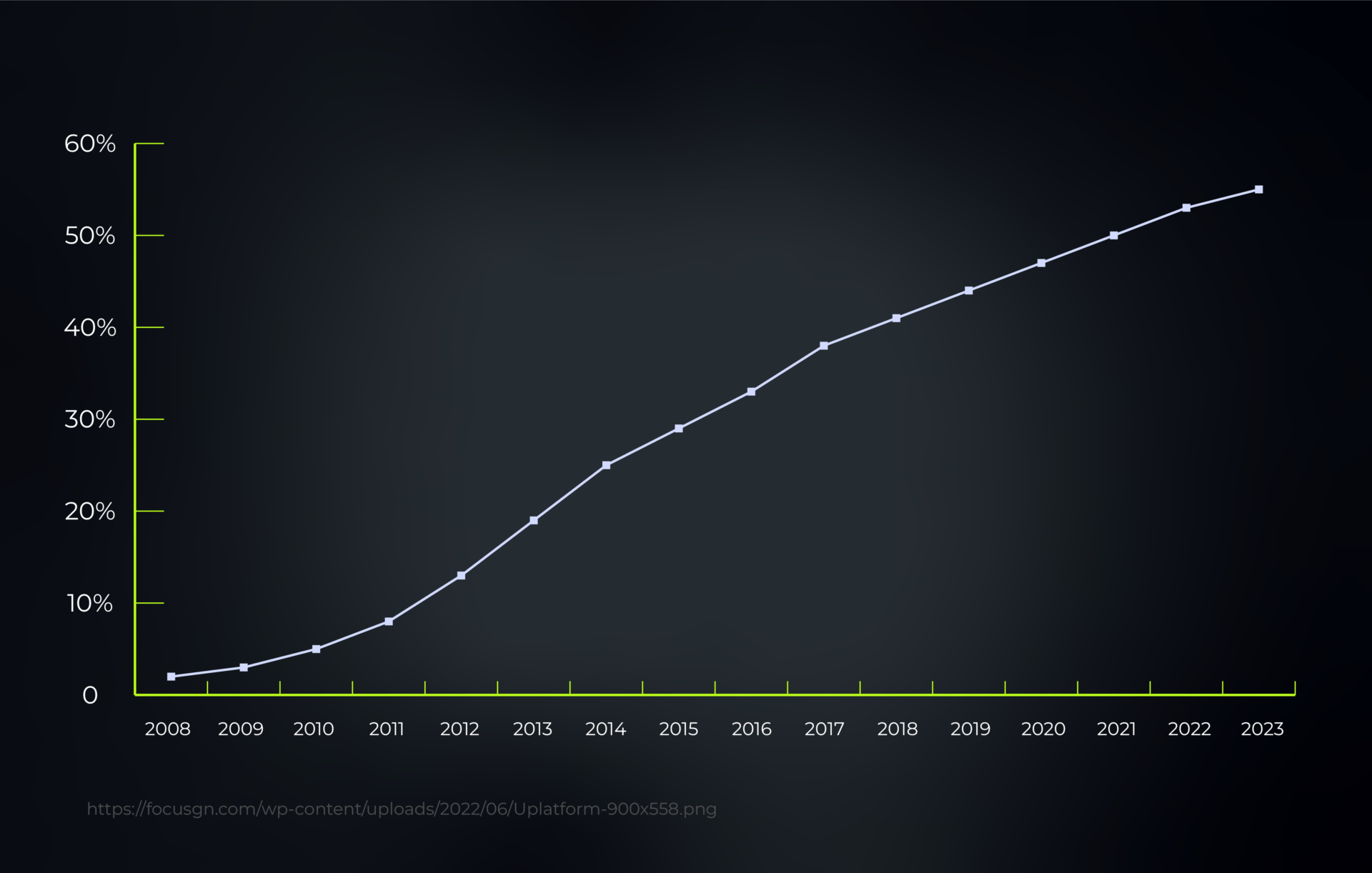

According to data from Gartner and Forrester, nearly 70% of all iGaming turnover in 2019 came from mobile devices. In 2020, this number has already surpassed 74%, showing a clear shift from desktop to mobile gaming (see Fig.3).

Figure 3. Share of online gross gaming revenue (CGR resulting from mobile betting)

Understanding the mobile landscape is crucial for success in the iGaming industry. Players want immersive experiences on their handheld devices, and the debate over portrait or landscape gaming modes is ongoing. Mobile gaming UX is still in its early stages in iGaming.

Leading operators set high standards for exciting mobile experiences. Mobile gaming is vital for future plans because it allows the creation of immersive and personalised experiences, making it a driving force in the iGaming industry.

Immersive social interaction features in iGaming

Social interaction features have the potential to make the gaming experience even more entertaining. Players can interact with others, creating a sense of community.

Chatting, competing, and collaborating with fellow players adds excitement, making the gaming experience more enjoyable. This not only enhances the fun of the games but also gives players a reason to come back – the chance to connect with others.

Features like chat systems, friend lists, leaderboards, and interactive live streams can transform the solitary gaming experience into a social realm. This integration can foster a deeper sense of community, encouraging players to return to the platforms not just for gaming but for the social interactions they offer.

Immersive social interaction features are an important tool for video game developers looking to create engaging and long-lasting games. These features can help increase player engagement and retention. By providing players with a sense of community and social interaction, they lead to more successful games in the long run.

Evolving iGaming regulations

The iGaming industry is subject to various regulations that differ from country to country.

The European Union (EU) has a unique way of governing online gaming regulations across its member states. Unlike having a single law for gambling services, each EU country has the freedom to organise its gambling services, ensuring they comply with the fundamental freedoms outlined in the Treaty on the Functioning of the European Union (TFEU).

- The types of online games allowed can vary among EU countries. Some permit all games. Others limit it to specific types like betting, poker, or casino games. Some countries have a monopoly system, where either a state-controlled public operator or a private operator holds exclusive rights to provide online gambling services.

- Adhering to iGaming regulations is crucial for businesses and players alike, as regulations help protect players’ interests and ensure fair play and the integrity of the iGaming industry. A survey conducted by SOFTSWISS reveals a strong consensus that regulatory demands are the leading force in the push for responsible gambling. In fact, 80% of responders acknowledge this.

Responsible gambling

The gambling industry is also making efforts towards ethical marketing. For example, the UK’s Betting and Gaming Council (BGC) is working with social media to protect vulnerable groups from gambling ads. France and Colombia are also tightening regulations on gambling advertising.

More people are becoming aware of gambling addiction, and 16% of survey responders look at responsible gambling as a competitive advantage. Platforms committed to responsible gambling may stand out in the market, showing it’s not just a regulatory requirement but something that can boost player loyalty and brand strength for operators.

Pondering on responsible gaming, the Maltese regulator updated its Player Protection Directive on January 12, 2023.

What is the goal here?

These amendments aim to enhance and clarify the existing player protection framework in the gaming sector. The goal is to ensure safe, sustainable, and responsible gaming practices. The modifications address licensees’ responsibilities regarding responsible gaming policies, introduce markers of harm for identifying problem gambling, and cover provisions related to real-money reinforcement and staff training.

The changes are informed by expert reviews, feedback from consultations, and the authority’s research and experience, with plans for future detailed player protection guidelines for licensees.

In 2024 and beyond, the iGaming industry is expected to experience a shift in global regulatory landscapes. The shift will focus on ethical practices and player safety. This will have implications for iGaming operators and investors.

iGaming Market Forecasts

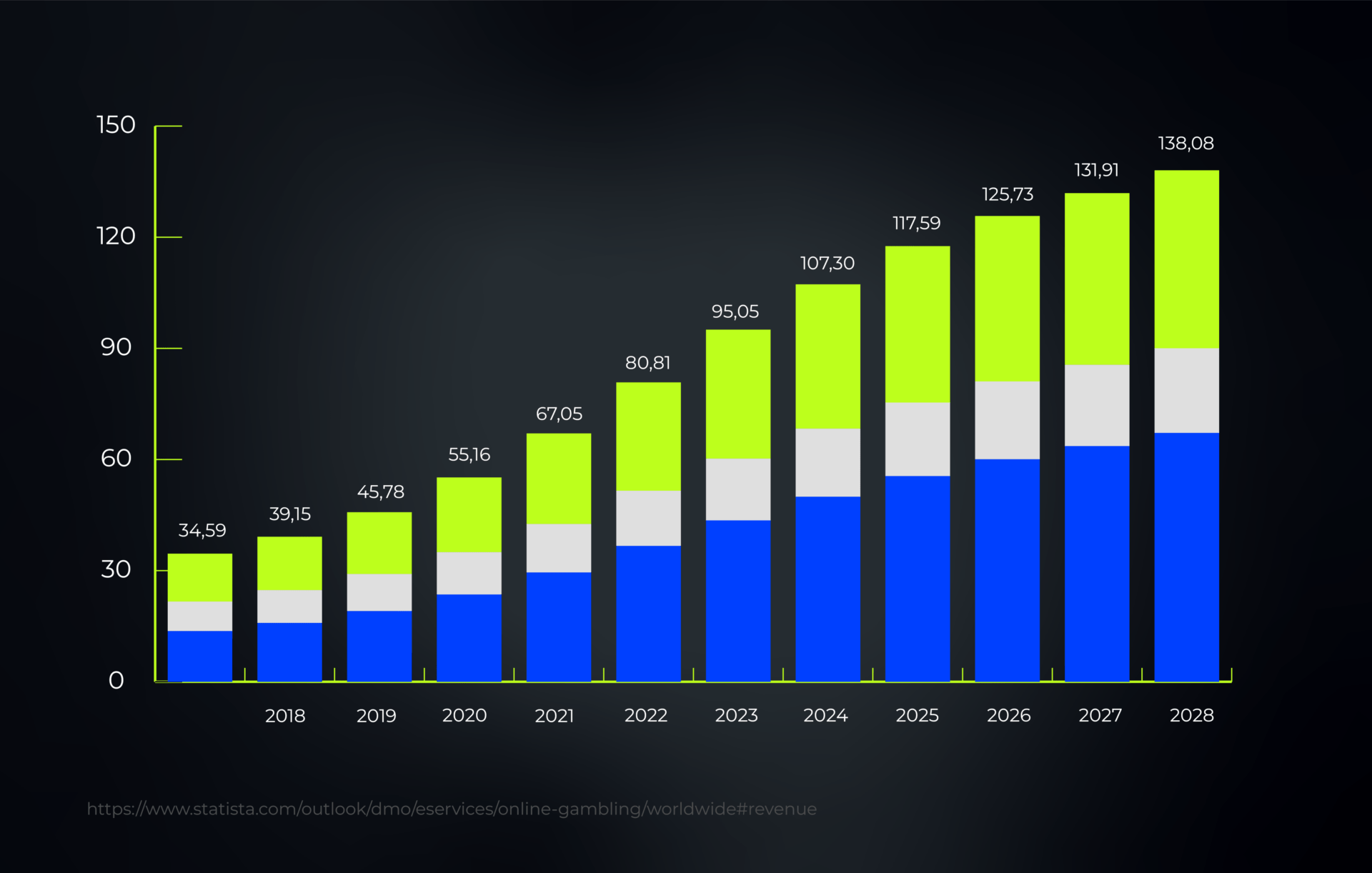

According to Statista, the Online Gambling market worldwide is projected to reach a revenue of US$107.30 billion by the end of 2024. This is expected to result in a market volume of US$138.10 billion by 2028, with an annual growth rate (CAGR 2024-2028) of 6.51%.

The number of users in the online gambling market is expected to reach 243.2 million by 2028 (see Fig.4).

Figure 4. Online gambling market user growth

Emerging iGaming markets to watch for

The iGaming industry has been flourishing in many new markets as more governments seek to regulate gambling. This allows operators to launch localised casino and esports products in previously uncharted territories.

The growth of the iGaming industry is also good news for job seekers, as iGaming brands launch in new markets, this opens up opportunities for candidates to the better life, work, and experiences.

- Brazil has been identified as the largest untapped market in the Latin America region. Regulation has continued to develop faster than expected in Brazil, especially since the pandemic outbreak. Furthermore, authorities in the region, including the Brazilian minister of economy, have demonstrated positive positions towards sportsbook betting as a means to help Brazil recover from the crisis and generate more jobs.

- India is also emerging as a force to be reckoned with in the online gambling market. The Indian iGaming market was valued at around €750 million in 2019. Experts predict that number to quadruple within the next 10 years. The young Indian population is very much into mobile gaming, and in 2019 alone, over 5.6 billion downloads of mobile gaming apps were recorded, the highest in the world.

- Bulgaria is one of the few countries that still attract interest among gambling brands looking for new opportunities to expand in Europe. The country is experiencing an annual industry growth of 20% regarding sports betting and a further 30% for online casinos. By the end of 2024, the Bulgarian iGaming market is estimated to be worth around €134.60 million. As more operators launch in the market, the country is on course to break past €165.40 million in the next few years.

The emerging iGaming markets, particularly in Brazil, India, and Bulgaria, are showing remarkable growth and potential. As these regions embrace regulation and open up to iGaming, they present lucrative opportunities for operators. They also promise significant employment prospects. This expansion signals a vibrant future for the iGaming industry, as it continues to tap into new territories and audiences.

PayDo. The Top iGaming Payment Provider on the Market

Our long-standing experience in the iGaming industry has given us a deep understanding of iGaming inner workings. We know what our customers need.

Our team of experts is dedicated to providing the most advanced and feature-rich payment platform that can help your business thrive.

Here are some unique benefits of PayDo:

- 150+ countries coverage for incoming and outgoing transfers

- 170 countries for checkout and mass payments.

- The most popular payment schemes for incoming transfers and withdrawals such as Cross-border, SEPA & SEPA Instant, and Faster Payments.

- Our “NOs”: no excessive requirements, no hidden fees, no chargebacks, no rolling reserve, no minimum balance, no minimal commitments.

- Fastest settlements and payouts. All processed funds are available immediately in your account.

- Our product supports all iGaming licenses and jurisdictions.

- External payment orchestration platform support: Devcode and Praxis integration.

PayDo Checkout

Our Merchant Solution offers different checkout options to attract your target audience with no confusing redirections. Payers can create an e-wallet on your checkout page, which has the highest retention rate in the industry. With PayDo Checkout, you have access to over 350 payment methods through a single API integration.

At PayDo, we get that businesses shouldn’t deal with old-fashioned payment providers, juggle multiple accounts for managing the funds flow, and handle extra hassles that waste time and energy. We keep things simple for you.

PayDo IBAN

You can open a Multicurrency Business Account online with just one obligation-free digital contract. You can also enjoy merchant and mass payment solutions and manage all your payments within one platform with one trusted partner. This way, you can focus on growing your business without worrying about payment processing

Contact us to explore what our product has to offer for your business.