Open Banking is breaking down traditional barriers between banks and financial institutions. Customers can now securely share a merchant’s banking information with trusted third parties. These include fintech service providers, tech companies, and other financial institutions. This expands access to diverse personalised products and services.

In this blog post, we’ll dive into what open banking is and how it helps banking customers. We’ll talk about the benefits and opportunities it brings to financial interactions. We’ll also discuss important challenges and things to consider.

Open banking inner working

The open banking industry is growing year on year. As evidenced by data collected by Statista, the number of Open banking users grew from $28.4 million in 2022 to $42.6 million in 2023.

According to the open banking report by Delloite, there are three main reasons behind this growth.

- Customers are changing their behaviour and want to utilise open banking features.

People are increasingly able to differentiate between a good and a bad customer experience and will not accept laborious processes when it comes to their needs.

- There is an advanced technology that enables it.

Cutting-edge technologies like AI, real-time analytics, machine learning, and blockchain help financial services providers enhance their operations, offerings, and products across the board.

- Regulations around the world foster open banking.

The regulatory landscape actively encourages innovation by explicitly prioritising ‘Open’ as a policy objective for all financial institutions. Notably, directives like PSD2 and the UK’s Open Banking Initiative serve as prominent illustrations of this approach.

As a result, the open banking movement has transformed from a perceived threat to an opportunity. It provides access to untapped profit pools and paves the way for future growth.

Some studies predict that the global value of Open Banking transactions will exceed US $330 billion by 2027 (currently around $57 billion for 2023).

The primary goal of open banking is to increase competition and innovation in the financial sector by allowing for greater transparency, collaboration, and data sharing among different financial service providers.

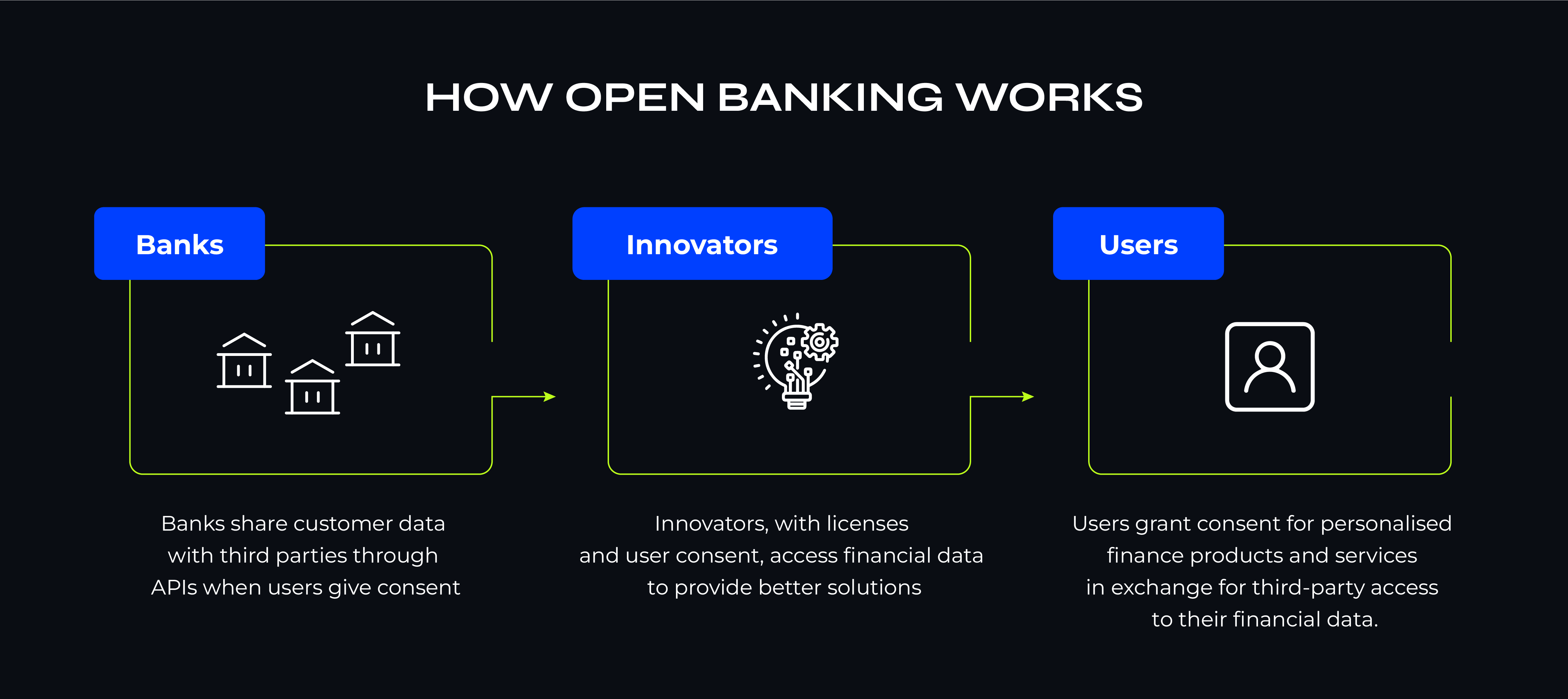

Here’s how it works:

- Access and control

Banks grant third-party service providers access and control over their customers’ financial and personal data under open banking. These providers are often tech startups and online financial service vendors. Customers typically need to give consent for this access, payment methods such as checking a box on a terms-of-service screen in an app.

- Data sharing

Through third-party APIs, third-party providers can access customer data. Including information about their financial transactions and counterparties. This data sharing enables various functionalities:

- Comparison

Customers’ accounts and transaction histories can be compared to financial service options provided by providers.

- Aggregation

Data can be aggregated across participating financial institutions and customers to create marketing profiles.

- Transactions

Third parties can make new transactions and account changes on the customer’s behalf.

How is open banking regulated in different countries?

Regulatory frameworks governing open banking vary across regions. Many are designed to ensure security, consumer protection, and fair competition. Let’s delve into the regulatory landscape of open banking across various regions, highlighting key examples.

PSD2 in Europe

PSD2 (Revised Payment Services Directive) is a set of laws in the European Union (EU) aimed at enhancing payment services for consumers. It achieves this by:

- Setting security standards.

- Encouraging competition and innovation in the banking market.

With PSD2, banks in the EU must let their customers safely share data with other companies. PSD2 started on November 25, 2015, and EU countries had until January 13, 2018, to make it a part of their own laws.

Unlike the UK’s mandatory Open Banking standards, there isn’t a specific technical standard for European banks. However, several standards have emerged to simplify API-based open banking. For instance, German banks often use XS2A standards, while French banks prefer STET.

United Kingdom regulations

Open banking in the UK has evolved through various initiatives:

These regulations established the legal and regulatory framework for open banking in 2017, incorporating PSD2 into UK law.

Created by the Competition and Markets Authority (CMA) in 2018, this entity developed an open banking standard for account access.

The standard is adopted by the nine largest UK banks (known as the CMA9) and other banks to comply with the Payment Services Regulations.

Regulations in the United Arab Emirates (UAE)

The UAE has also embraced open banking. The Central Bank of Bahrain launched its open banking framework in 2018. Open banking regulatory principles emphasise contextual relevance and market-driven approaches. Key points include:

1. Contextual frameworks

Open banking regulations should align with local needs and market demand. Early fintech ecosystems and use cases inform regulatory decisions.

2. PISP/AISP licensing

The PISP/AISP model allows licensing without mandating full platform opening by financial institutions (FIs). Bilateral agreements facilitate non-standardized access solutions.

3. Timelines and innovation

Regulators should enforce timelines for FIs to work with PISP/AISPs. Delayed access could hinder innovation in open banking.

Open Banking in the United States

While it’s not mandated by regulations as in the countries we’ve explored above, US banks are gradually embracing open banking principles. Here are some key points about the current status:

Technology adoption

US banks are leveraging APIs to offer users an easy way to access their financial information. By adopting technology, they facilitate data sharing and enhance customer experiences.

A2A Payments

In certain markets, payment-initiation-service-provider (PISP) open banking enables third parties to move money from consumers’ accounts to merchants’ accounts. These account-to-account (A2A) payments are commonly used for bill payments and e-commerce transactions.

While the US open banking landscape is still evolving, there is growing interest and adoption. Banks are exploring ways to enhance services, improve efficiency, and empower consumers through data sharing and innovation.

Open banking in Australia

Australia’s open banking regime, based on the Consumer Data Right (CDR) legislation, was officially launched in July 2019. Through this framework, individuals can access a wider range of financial services and make more informed decisions about their money.

Here’s how it works:

- Customers can choose to share their financial data (such as transaction history, account balances, and payment details) with accredited third parties, including fintech companies and other banks.

- Before any data is shared, explicit customer consent is required. Users must authorise the release of their information to specific third-party providers.

- Financial institutions create Application Programming Interfaces (APIs) that allow authorised third parties to access customer data securely. These APIs ensure data privacy and compliance with regulations.

Open banking promises benefits for users and encourages innovation and competition between banks and nonbanks. However, it also signals a significant shift in the financial services landscape.

As banks adapt to this new ecosystem, regulatory and privacy concerns come to the forefront. Global markets have approached open banking governance differently, resulting in varying levels of progress. Regardless of location, the momentum toward open banking models is evident, compelling banks and fintechs to strategically position themselves for success and anticipate customer impacts in this evolving environment.

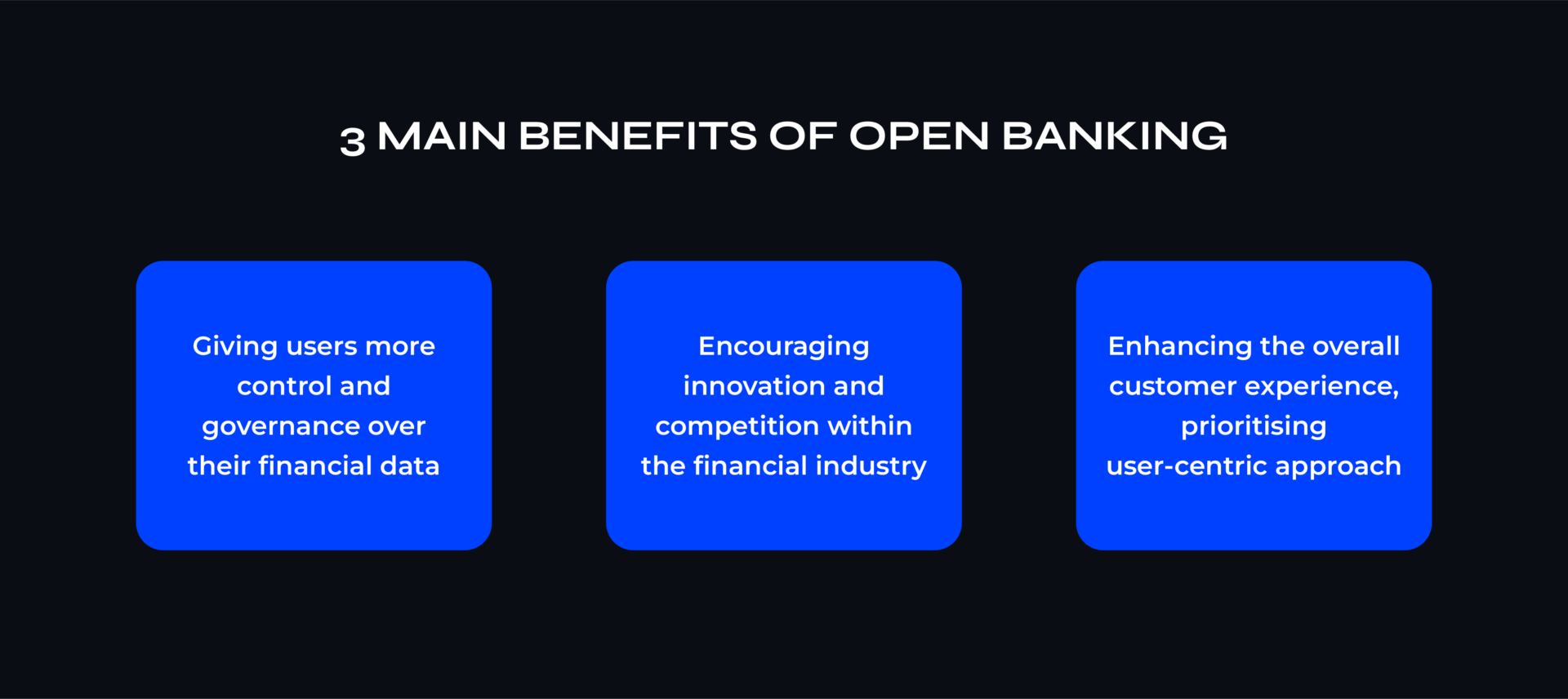

Open banking benefits

The Regulating Open Banking 2023 report provides insights into open banking initiatives worldwide, examining their progress. The report also explains the benefits and goals of open banking.

According to the research, open banking can increase competition, innovation, customer experience, and security in the financial sector.

Open Banking can also enable more fluid and tailored financial services, such as loans for SMEs based on their transaction history. Let’s explore some other benefits of open banking for customers, financial institutions, and third-party providers.

Benefits for consumers

- Access to a consolidated view of all financial accounts.

- Real-time updates on account balances and transactions.

- Enhanced visibility into spending patterns.

- Tailored financial products and services based on individual data.

- Customised recommendations for budgeting and savings.

- Access to a wider selection of financial options from different providers.

- Integration with third-party apps for budgeting, expense tracking, and financial planning.

- Automated categorisation of expenses for better insights.

- Efficient management of multiple accounts through a single interface.

Benefits for financial institutions:

- Opportunities to develop and offer new and innovative financial products.

- Collaboration with fintechs to bring cutting-edge services to market.

- Differentiation through technological advancements.

- The monetisation of APIs by charging fees for data access.

- Creation of value-added services that attract additional customers.

- Expansion into new markets and customer segments.

- Enhanced customer engagement through personalised offerings.

- Quick and efficient customer query resolution.

- Ability to address evolving customer needs with agility.

Benefits for fintech and third-party providers

- Access to customer data from multiple institutions via APIs.

- Ability to create niche and specialised financial services.

- Lower barriers to entry, fostering a more competitive landscape.

- Building upon existing banking infrastructure to create innovative solutions.

- Offering specialised services such as robo-advisors, peer-to-peer lending, and payment apps.

- Collaborating with financial institutions to enhance product offerings.

- Access to a broader customer base through partnerships with traditional banks.

- Opportunities to attract customers with personalised and value-added services.

- Ability to create seamless, user-friendly experiences that resonate with consumers.

Statista says the number of open banking users worldwide is going to rise at an average annual rate of nearly 50% between 2020 and 2024. The growth will happen in two main ways:

- Recommendations. Open banking users will share their positive experiences, building trust in the technology through word of mouth.

- Banks’ support. When banks endorse the new technology, it gains credibility. Trust takes time, but active promotion by banks helps more people adopt it.

Now when we have explored the benefits and opportunities of open banking, let’s take a look at what is holding its growth back.

5 Key challenges and concerns with open banking

Switching to open banking comes with a set of challenges, mainly falling into technical, organisational, and cultural categories.

1. Integration with legacy systems

Developers face a big challenge: they have to connect with different third-party tools and systems in the fintech world. Sadly, there isn’t a standard way to manage identities and rules for open banking. So, each developer has to spend a lot of time testing all the third-party tools their product uses, making it a tough and time-consuming task for every new product.

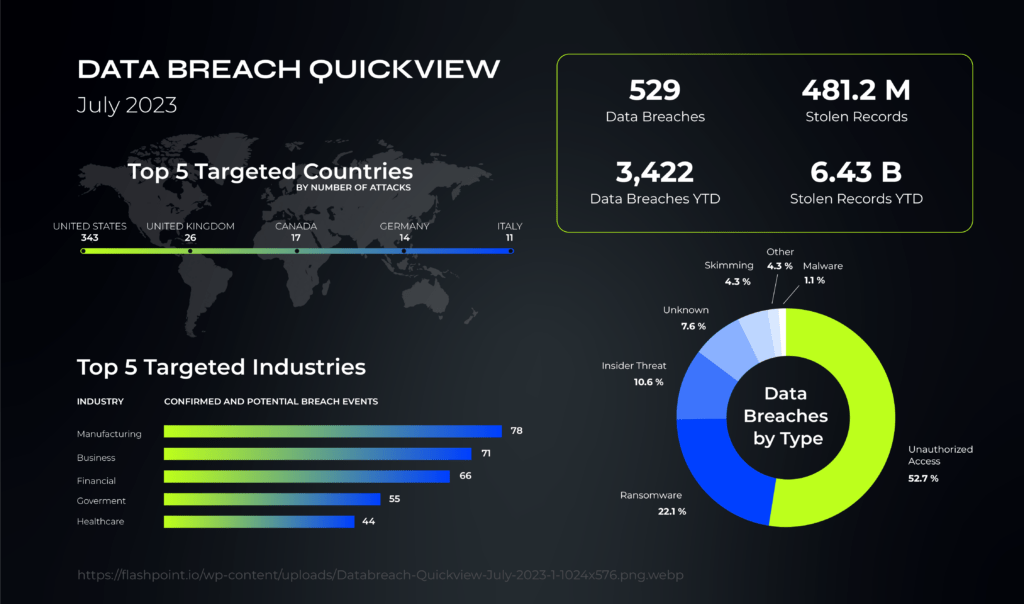

2. Security and privacy

Implementing open banking APIs introduces a critical challenge: ensuring the security and privacy of customer data and transactions. These APIs involve sharing sensitive information – account details, balances, transactions, preferences, and identity – with multiple third-party providers. Consequently, data becomes more exposed and vulnerable to breaches, fraud, or misuse.

Providers must take robust security measures, including encryption, authentication, authorisation, and vigilant monitoring, to safeguard this data. Additionally, respecting customers’ rights and preferences regarding data collection, storage, usage, and sharing is essential. Obtaining explicit and informed consent from customers is a fundamental step in maintaining trust and compliance.

According to the 2023 cost of a data breach report by IBM the average cost of data breach has reached has reached a record high of $4.45 million. This is 2% more than in 2022 ($4.35 million).

The financial industry has one of the highest data breach costs. In 2022, the finance market is paying an average of $ 5 million for a data breach.

Since open banking involves sharing sensitive financial data, ensuring robust security measures is critical to prevent data breaches, fraud, and unauthorised access.

3. Compliance and regulatory hurdles

Implementing open banking APIs presents a significant challenge: compliance with diverse regulations and standards across markets and jurisdictions.

For instance, within the European Union (EU), the Payment Services Directive 2 (PSD2) and the General Data Protection Regulation (GDPR) establish critical guidelines for open banking. These rules cover aspects like data protection, consent, security, and liability.

Providers must meticulously ensure that their APIs align with these regulations, as well as any other local or regional laws that may apply. However, this process can be intricate and resource-intensive, particularly for smaller or newer players lacking extensive expertise and resources.

4. Technical implementation

Developing and maintaining APIs that securely expose financial data is a technical challenge. Ensuring scalability, reliability, and real-time data synchronisation requires robust engineering practices.

Interoperability between different APIs and systems is crucial for a seamless user experience.

Open banking APIs are like bridges that let different groups, like banks, fintechs, and customers, share data and services. For this to work well, the APIs need to be compatible and follow certain rules. Providers must create APIs based on standards like the Open Banking Standard or Berlin Group Framework. They also need to check and fix any problems with their APIs regularly to make sure everything runs smoothly.

5. Consumer trust and acceptance

Open banking APIs let customers use different services from different providers, but they also need customers to share their data. This may make some customers unsure or worried about how good, safe, or useful these services are. Customers may not know or understand the good and bad things about open banking or how to use the APIs well.

Providers must teach and tell the customers about the good and bad things of open banking, as well as what they can and must do. They also can show and give the value and ease of their services, as well as their trust and name, to get and keep the customers.

Educating users about open banking’s benefits and risks is an ongoing endeavor.

Successfully overcoming these challenges is essential for the widespread adoption and expansion of open banking globally.

Open banking in practice

Let’s delve into some real-life case studies that showcase the practical applications of open banking. These examples highlight how this financial innovation is making a difference in day-to-day scenarios:

Circit

An audit platform, Circit leverages open banking to streamline administrative tasks for law firms, fund managers, and accountants a payment. By speeding up key processes, they enhance efficiency and accuracy in financial administration.

This platform expands access to loans for HEY Credit Union customers. By utilising open banking, they assess and fund member loans more swiftly, benefiting credit card union members.

These links embedded in invoices facilitate faster payments for businesses to pay. By integrating open banking, companies can receive payments more efficiently.

Deutsche Bank’s innovative retail deposit marketplace

Deutsche Bank has partnered with Deposit Solutions to create an exclusive retail deposit marketplace – a pioneering move among major global banks. Through its white-label solution called “ZinsMarkt,” Deutsche Bank now offers deposit products from other banks to its own customers.

This marketplace seamlessly integrates with Deutsche Bank’s online banking and is also accessible through client advisors at the bank’s branches. With the potential to reach seven million German retail customers, Deutsche Bank strengthens its position as a central digital platform for all its financial service requirements.

These case studies and global perspectives highlight the dynamic nature of open banking, with successes driven by collaboration, innovation, and thoughtful regulatory frameworks.

The future of open banking

The future of open banking is an exciting landscape where technology and finance intersect. For example, 71% of SMEs in the UK plan to adopt Open Banking services, and 64% of adults anticipate using them by that year.

Gartner suggests that by 2030, many major banks will shrink, and FinTech firms will dominate the market through open banking. This shift will lead to increased collaboration between FinTech companies and banks. It will result in higher-quality financial services, lower consumer fees, and improved finance access for people.

Let’s explore what the future holds for open banking. Some major changes will happen due to technological evolution, regulatory changes, and consumer behavior.

Expanded services and ecosystems

We believe that banks will continue to partner with fintechs, tech giants, and other players to create comprehensive financial ecosystems. These partnerships will lead to innovative services beyond traditional & card banking.

Open banking will enable hyper-personalised experiences. Imagine financial advice tailored to your unique circumstances, goals, and spending patterns. It will be a life-changing encounter.

Data-driven insights

Shortly, banks will leverage data to predict customer needs, detect fraud, and optimise financial decisions. Understanding consumer behavior will drive product design and marketing strategies.

Global standardisation

As open banking spreads globally, standardisation of APIs and data formats will be crucial. Thus, harmonising regulations and technical specifications will facilitate cross-border services.

Security and trust

Security and trust are paramount in the financial industry. Further development of biometrics, blockchain, and secure APIs will fortify data protection. Trust in open banking will grow as consumers feel confident about their data privacy.

Open banking can bridge gaps by providing financial services to underserved populations. It will empower the unbanked and underbanked.

Regulatory evolution

Beyond banking, regulations will extend to insurance, investments, and pensions. Open finance will emerge as a broader concept.

Regulations will focus on data portability, ensuring consumers can switch providers seamlessly. Consumers, in their turn, will have control over their data, deciding who accesses it and for what purpose.

In this open banking saga, the protagonist is the empowered consumer, wielding data as a mighty sword. The plot thickens, and the chapters unfold—each one promising a twist, a revelation, and a new era of financial possibilities.

PayDo is at the forefront of innovation

At PayDo, we always keep up with the latest trends and innovations within the financial landscape.

Whether you’re a startup, a growing enterprise, or an established business, our business account caters to your needs without requiring residence restrictions.

Here’s why PayDo stands out:

Unified platform

With PayDo, you can manage all your & card payments – in one place. From accepting online payments via PayDo Checkout to handling unlimited virtual and plastic cards for you and your team, we’ve got you covered. You can also get dedicated multicurrency IBANs connected to Cross-border, SEPA, FPS, and six more payment schemes. Not something payment providers can brag about.

Global reach

Our business account opens up a world of possibilities. Access global payment rails through SEPA, SEPA Instant, Cross-border, Local UK, DK, and Germany. Choose from over 150 countries and 35 currencies to streamline your overseas cash flow.

Comprehensive features

- Get started hassle-free with our fully remote onboarding.

- Benefit from live foreign exchange rates.

- Efficiently pay and receive funds globally.

- Ensuring security with PCI DSS Level 1 Compliance.

PayDo is authorised by the FCA in the UK and FINTRAC in Canada to provide payment processor services. As a SEPA Direct Participant, Mastercard Principal Member, and Cross-border Direct Participant, PayDo adheres to strict financial standards to ensure payment processing comes with bank-grade security.

Whether navigating cross-border transfers, safeguarding against fraud, or seeking payment solutions for your business, PayDo is your trusted partner.

For more details on how PayDo can enhance your financial experiences and integrate open banking payments into your business, feel free to reach out to our team.

Conclusion

Open banking is becoming a permanent part of the financial landscape, with regulators adapting to technology advancements.

Open APIs facilitate collaboration between fintech firms and banks to enhance customer experience and boost revenue. Despite the benefits, challenges include ensuring data security, compliance with evolving regulations, integrating with existing IT systems, and addressing cultural and political obstacles.