With technology’s growth, businesses can operate globally without a physical base. Though they can serve customers everywhere, opening business accounts presents challenges. Traditional banks often demand a physical presence, complicating things for non-UK/non-EU businesses. As a result, opening a business account for non-UK residents becomes a great challenge.

But there’s a silver lining. Many financial platforms allow these businesses to open accounts without in-person requirements, easing international expansion. This article offers solutions for these businesses, emphasizing easier global operations than traditional banking hurdles.

What is the solution for business for opening a business account?

Technology and innovation have significantly transformed the financial landscape in recent years. One of these transformations is the rise of Electronic Money Institutions (EMIs). EMIs offer digital platforms that can perform many of the functions of traditional banks but in a more agile, user-centric manner. For businesses, especially startups and SMEs, digital payment platforms have become a viable alternative when considering where to open a business bank account.

1. Choose a payment platform/EMI as an alternative to a traditional bank to open a business account for non-UK residents

EMIs are financial entities that offer digital-only platforms for managing and transferring money. Unlike traditional banks, they often operate exclusively online without physical branches.

Benefits of Using EMIs for Business Accounts

- Speed and Efficiency. Opening a business account with an EMI is typically faster than a traditional bank. The process is facilitated, often requiring only a digital application and verification.

- Global Operations. EMIs are inherently digital and often cater to an international clientele. They can manage multiple currencies, making them ideal for businesses operating in a global market.

- Cost-effective. Many online payment platforms offer competitive fees, especially regarding foreign exchange rates and international transfers.

- User-friendly Interfaces: Built for the digital age, such platforms prioritize user experience with intuitive interfaces and easy-to-use features.

- Flexibility and Scalability. EMIs often design their platforms with scalability in mind. As your business grows, the platform can adapt without switching to a different banking provider.

2. Open a business account for non-UK residents without physical presence

The internationalization of business and the advent of digital banking have made it increasingly easier for non-UK and non-EU residents to open business accounts without being physically present in the country where the bank operates. Such accessibility not only aids global entrepreneurs but also promotes economic integration. Before you choose the digital payment platform, you have to consider the following factors:

- Business Needs. Ensure the chosen platform supports the necessary features for your business, such as multiple currencies, global transfers, or integration with accounting software.

- Fees. Understand the fee structure, including transaction charges, maintenance fees, and foreign exchange rates.

- Customer Support. Opt for platforms known for robust customer service since you’ll be dealing with them remotely.

- Regulation & Protection. EMIs are regulated, but the degree of customer protection, like deposit guarantees, might differ from traditional banks.

PayDo business account

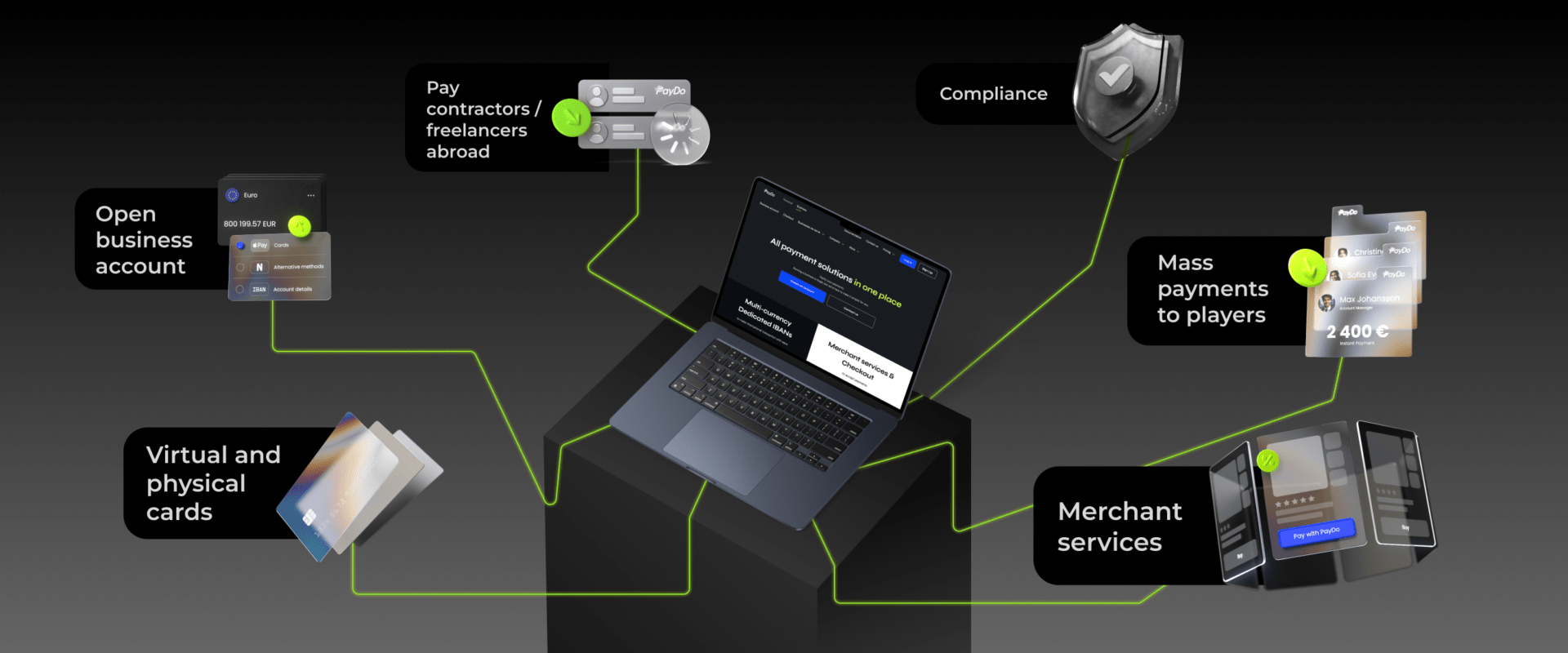

One of the reliable solutions is PayDo. Our range of products and services stands out from traditional banks and EMIs, providing a flexible solution for businesses looking to open business accounts. We tailor our requirements to the unique needs of the business sector, acknowledging the specific challenges and concerns they face. PayDo’s platform accelerates business account opening and facilitates multicurrency transfers.

You can send or receive cross-border, high-volume transfers using SEPA, Cross-border or Fedwire by opening a multicurrency account in 150 countries with 6 currencies (EUR, USD, GBP, AUD, CAD, and DKK) on PayDo.

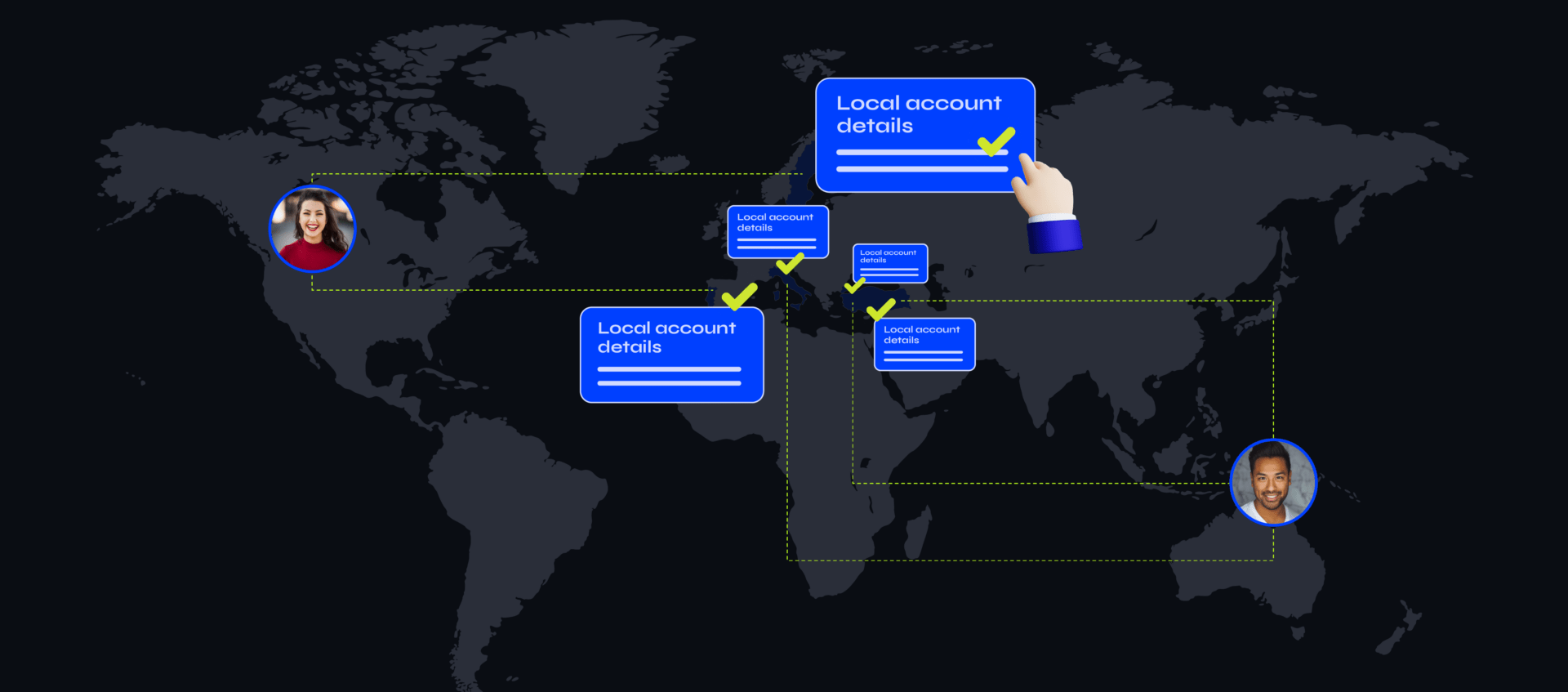

The multicurrency business account with a dedicated IBAN allows our clients to use SEPA, SEPA Instant, Cross-border, Fedwire, and Target2. In addition, PayDo also provides local account details, granting access to FasterPayments, Chaps, and Backs for the UK and Kronos2 for Denmark.

With just a standard set of documents, you can have your account up and verified within 5 business days. Moreover, we cater to businesses from various regions, including the UK and EEA, without needing them to be physically present in these locations. By ultimately comprehending the needs of businesses, PayDo unveils broader opportunities for them.

3. Sign a contract, verify & use a business account

Get started with a PayDo Business Account in 3 easy steps!

- Fill in pre-verification form

- Sign the single contract

- Complete an easy verification

Setting up a PayDo Business account is a straightforward process. With just three simple steps, you’ll be ready to take advantage of this account’s features. Don’t miss out on this smooth and intuitive onboarding experience.

Final recap

Opening a business account for non-UK residents should not be as hard as it is right now. These requirements, such as needing a company’s physical presence in a location, can hinder growth. This particularly challenges non-UK/non-EU businesses, leading them to explore alternative solutions like EMIs.

With that in mind, PayDo a business account for non-UK residents can be set up an account in 48 hours using a standard set of documents. We serve businesses from diverse regions, including the non-UK and non-EEA, without requiring physical presence. PayDo’s deep understanding of business needs enables them to offer expanded opportunities.

Get started with PayDo now!