What Is a Branch/Sort Code and How to Find It

Imagine each bank branch with its unique postal code — that’s what a branch code or sort code is in the financial world. It’s a set of numbers that stamps each transaction with an address. This ensures your money goes to the right place.

We are zipping through an era where banking is becoming more digital by the second. These codes are becoming critical signs in the vast network of money exchanges. Keeping that in mind, let’s get to know branch codes a bit closer.

What are branch code and sort code?

Branch codes are the navigational stars of banking, guiding funds to their rightful harbors.

Distinction between branch code, sort code and other banking codes

In the UK banking system, the branch code is commonly referred to as a ‘sort code.’ It’s different from other banking codes, such as the BIC/Cross-border code, which is used for international payments. Unlike the account number which is unique to an individual, the sort code is unique to the bank branch.

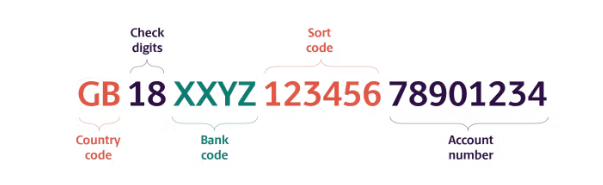

Components of a branch code and sort code

What is sort code example? A sort code in the UK is a six-digit number formatted as three pairs (e.g., 23-45-67). The first pair identifies the bank itself, the second pair may denote the area where the branch is located, and the third pair pinpoints the specific branch.

The role in identifying bank branches

Sort codes are crucial in processing payments within a banking system. They direct the money to the correct bank and branch. For instance, if someone wants to set up a direct debit or transfer money, they’ll need to provide the sort code of the recipient’s bank branch to ensure the funds are accurately deposited.

The functionality of branch codes and sort codes

What is sort code in banking? Branch codes and sort codes are like DNA for bank branches, streamlining where the money goes. They’re key to smooth and accurate banking.

Facilitate bank transactions

These codes make sure your cash lands in the right spot. For example, when paying a bill or setting up a direct debit, inputting the correct branch code ensures your funds zip straight to the recipient’s account, no detours.

Domestic and international banking

While sort codes are mainly for local use, they also nestle within international bank account numbers (IBANs) to give a global touch to your money transfers, bridging the gap between local and overseas banking.

Finding your branch code and sort code

How to find bank sort code?

Essentially, there are several ways to locate a sort code. You can use a free sort code checker also known as sort code and and account number checker here to investigate your sort code and branch code.

- Look at your bank statement; the sort code is often there, bold and clear. Remember about the six figures.

- Your IBAN can also be a map to your sort code. It’s right after the first couple of letters and numbers.

To find the branch code/sort code in your PayDo Business Account, follow these steps:

- Log in into your Business Account.

- In the left panel of your dashboard go to “Account Details”

- Take a look at the IBAN. The 9th, 10th, 11th, 12th, 13th, and 14th digits of the IBAN represent the branch code/sort code.

In some cases, depending on your card provider, you can see sort code on card. Sort code and account number on card may go hand-to-hand.

Conclusion

Navigating the world of finance without branch codes is like trying to find a street without a map. They are essential in guiding our transactions to their ports. They serve as safeguards against the tides of errors.

The banking sector is speeding towards a digital future. A solid grasp of a branch/sort code is more than helpful. It’s a necessity for anyone looking to speed up their financial journey.