The International Bank Account Number (IBAN) has become a cornerstone for international transfers. According to Bankrate, digital banking is a growing trend. 76% of Americans using digital banking channels at least once a week. Across the pond, Statista reports that 93% of Norwegians engage in online banking, the highest in Europe. Naturally, virtual IBAN appears as the next evolutionary step.

But what’s truly revolutionizing the financial landscape is the advent of Virtual IBANs. These digital marvels offer businesses unparalleled flexibility, cost-effectiveness, and security in managing international transfers. With 69 countries adopting the IBAN system, according to SatoshiFire, isn’t it time your business to leverage the power of Virtual IBANs?

What is an IBAN and a virtual IBAN?

What is an IBAN?

An IBAN is a standardized identifier facilitating international transfers between banks across different countries. When making an international payment, the sender must provide the recipient’s IBAN and other essential details like name and address, enabling the sender’s bank to route the funds accurately.

Upon receiving the payment, the recipient’s bank verifies the provided IBAN for authenticity. A correct IBAN ensures the funds come to the recipient’s account. However, if the IBAN is incorrect or doesn’t match any existing accounts, the transfer may face delays, rejection, or even reversal back to the sender.

What is a virtual IBAN?

A virtual IBAN, often called vIBAN, serves the same fundamental purpose as a traditional IBAN: it acts as a unique identifier for fund transfers. However, vIBANs offer businesses extra flexibility and convenience, particularly for international transfers.

Unlike traditional IBANs, the ones tied to physical bank accounts, a vIBAN is a digital representation of a physical bank account. This allows companies to create multiple vIBANs linked to a single ‘master account,’ enhancing their ability to manage financial operations.

These vIBANs designate for specific clients, projects, or departments, enabling more efficient fund management and transfer monitoring. Payments channeled from traditional bank accounts through a vIBAN are usually directed to the underlying physical account, consolidating funds in several different banking relationships in one place.

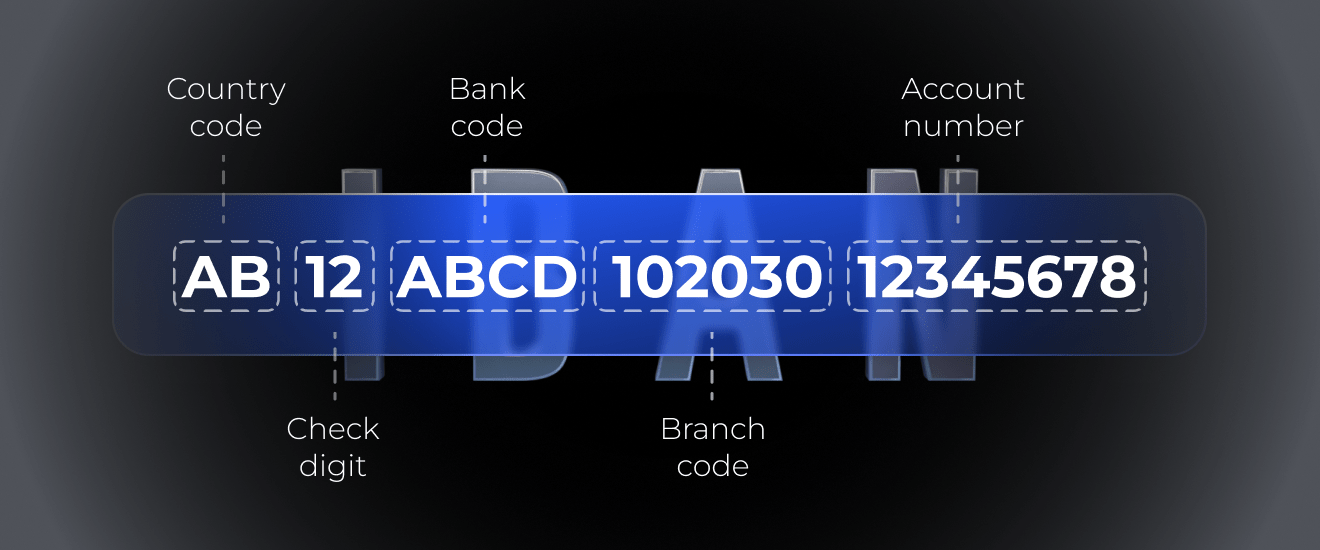

What does a virtual IBAN look like?

A virtual IBAN follows the same structure as a traditional IBAN:

- A two-letter country code

- Check digits

- A series of alphanumeric characters representing the bank and account details

The country code helps identify the country where transfer money from the bank account is held, while the check digits ensure the accuracy of the vIBAN by validating its integrity.

6 key benefits of a virtual IBAN for your business

1. Segregated and Safeguarded Funds

As a UK Electronic Money Institution (EMI) authorized by the Financial Conduct Authority (FCA), PayDo is committed to the highest financial security standards. Utilizing a rigorous process known as “safeguarding,” PayDo segregates 100% of your funds from its operational assets. This ensures that your money is secure and readily accessible whenever you need it.

2. Unlimited IBAN Accounts

Having the ability to create many virtual IBANs gives businesses much flexibility in managing different financial tasks. Unlike regular IBANs, each vIBAN is unique and helps businesses easily track and allocate funds to specific clients, projects, or departments.

Using multiple vIBANs makes it easier for businesses to balance their accounts, cut down on extra costs, and reduce mistakes. This is especially useful for companies that work in different countries and deal with multiple currencies, as it removes the need for several bank accounts in different places.

3. Cost-Effectiveness

One of the most compelling advantages of using virtual IBANs is their substantial cost savings. These savings are not limited to reduced account maintenance fees but extend to various other aspects of financial management.

For instance, virtual IBANs allow for efficient reconciliation processes between financial institutions, which in turn minimizes the time and resources spent on financial tracking. This is particularly beneficial for businesses that deal with multiple clients, projects, or departments, as it eliminates the need for separate accounts for each, thereby reducing administrative overhead.

Moreover, the ability of underlying clients to transact in multiple currencies without incurring high foreign exchange fees adds another layer of cost-effectiveness. Virtual IBANs offer a multifaceted approach to financial efficiency, making them an invaluable asset for modern businesses.

4. Tracking Transfers

Virtual IBANs empower businesses with advanced tracking capabilities for their financial and international money transfers. These unique identifiers facilitate the segregation of funds and enable real-time transfer monitoring. This granularity gives businesses unparalleled transparency, allowing them to maintain tighter control over their financial operations.

5.Easy Identification of Incoming Payments

Leveraging multiple virtual IBANs offers a transformative approach to managing incoming payments, particularly for e-commerce businesses and online marketplaces. Companies can effortlessly pinpoint the origin of each incoming payment amount by assigning a unique virtual IBAN to receive payments from each sales platform or customer. This expedites the reconciliation process and enriches financial reporting, empowering businesses to make informed, data-driven decisions.

6.Improved Reconciliation Processes

Virtual IBANs revolutionize the reconciliation process by offering a tailored approach to fund management. Businesses can effortlessly segregate and track incoming and outgoing transfers by allocating unique virtual IBANs to specific clients, projects, or departments. This targeted approach saves time and enhances the precision of financial reporting.

Furthermore, issuing individual virtual account numbers or IBANs to each user provides an even more refined method for payment reconciliation. Every incoming or outgoing transfer is linked to a virtual account reference number and the specific user through their unique virtual IBAN. This level of granularity ensures that each payment is easily traceable, further elevating the accuracy and efficiency of financial oversight.

How to get business a virtual IBAN with PayDo?

Navigating the world of international finance has always been challenging, thanks to PayDo virtual IBANs. This step-by-step guide will walk you through the simple process of setting up your virtual IBAN business with PayDo, empowering businesses to manage their global transfers without hiccups.

Step-by-Step Guide to Instant Payment Operations

- Create an Account. The first step is to register and activate your account. You’ll also need to set up two-factor authentication (2FA) for added security.

- Verify Your Account. Choose the ‘Business Account’ option and complete the necessary fields with the required information and documents.

- Obtain Your Unique IBAN. Once your account is verified, you’ll receive a unique IBAN under your company’s name, which can be used to send and receive payments.

Quick and Easy Account Setup

Open a PayDo Business Account and pass verification in just 48 hours. Create a virtual IBAN online in just minutes. Manage your vIBAN remotely in the UK, the EU, or any other foreign country. Fill out a single application form to get started. With PayDo IBAN you get:

- Access to Cross-border, SEPA, FPS and six more payment schemes

- A multicurrency IBAN with 35+ currencies

- The chance to send/receive transfers to/from 150+ destinations

Wrapping up

Virtual IBANs offer a range of benefits that can significantly enhance the efficiency and security of your business operations, especially in international transfers. With features like fund segregation, unlimited virtual account number creation, and the cost-effectiveness of additional banking fees, Virtual IBANs are increasingly becoming a go-to solution for modern businesses.

Contact us right away to get started with any number of virtual IBANs you need.