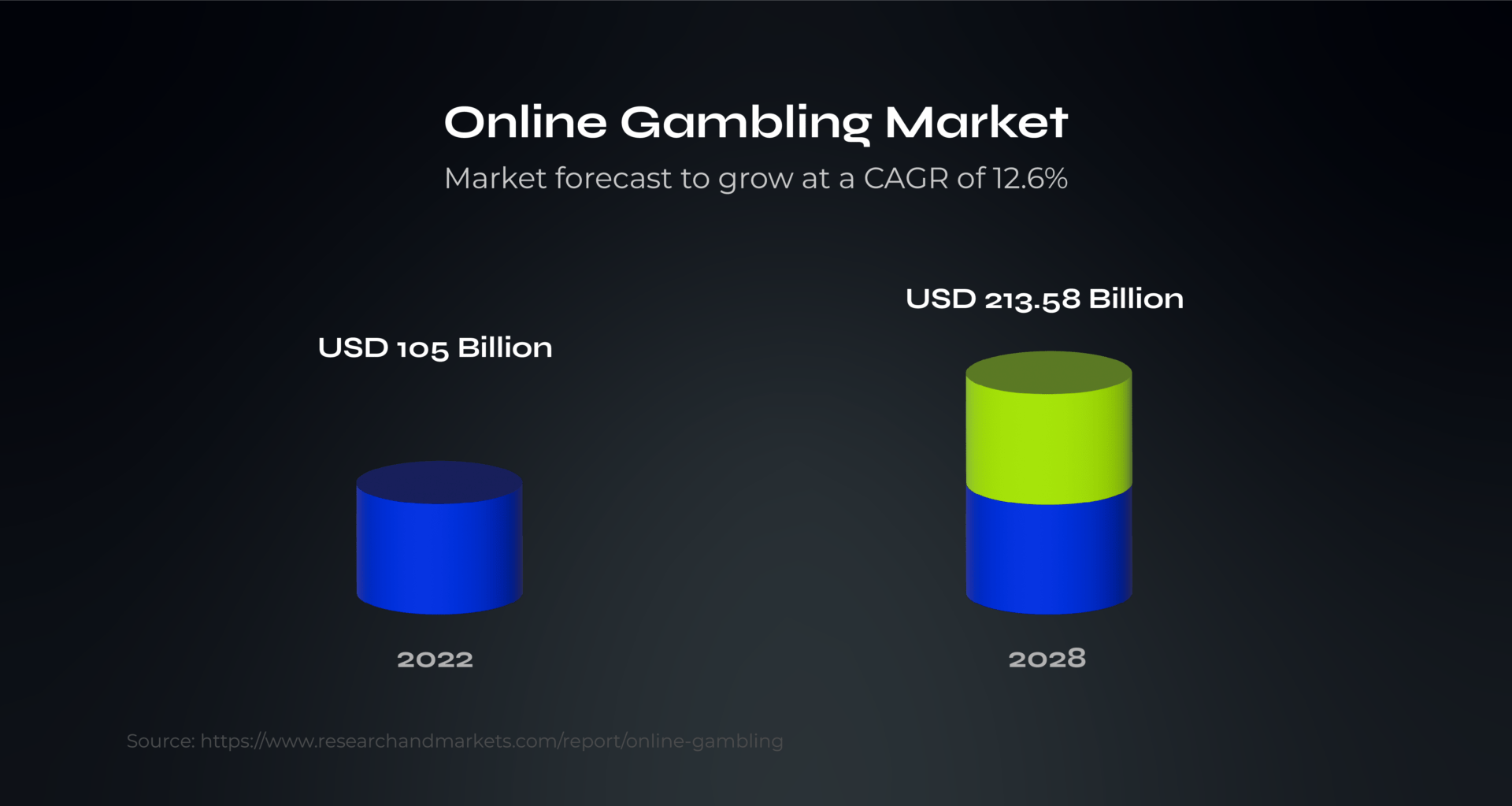

The online gambling industry is booming like never before. Research & Markets predicts that its global value will double from 2022 to 2028, hitting over $213 billion. No wonder everyone is looking for the best digital wallets for iGaming and other industries.

While online gambling can be fun, ensuring smooth and secure transactions is crucial. That’s where e-wallets come into play. Even though many people use credit/debit cards to pay for iGaming services, e-wallets are gaining traction. They offer convenience with extra security features.

There are many digital wallets to choose from. Most of them have similar functionality, though some have specific features. In this piece, we will explore the best digital wallets for iGaming. Simply put, we will explore everything you need to know about e-wallets in iGaming.

What is a Digital Wallet?

An e-wallet, or digital wallet, is an online service that gives you an account to store money. You can use it to make online purchases. You can also send money to others. Finally, you can deposit and withdraw funds at online casinos.

The great thing about e-wallets is that you don’t have to give all your personal information to the merchant like you would with a credit card. This makes digital wallets really secure in terms of data privacy.

To illustrate, when you use e-wallets at an online casino, transactions happen almost instantly. So, you can start playing in just a minute or two. For withdrawals, many casinos offer quick payouts, allowing you to enjoy your winnings sooner without any delays. Some digital wallets even provide users with a debit card (availability varies by country) that can be used to withdraw cash from ATMs worldwide.

Comparison between digital wallets and mobile wallets

While people often use the terms ‘digital wallets’ and ‘mobile wallets’ interchangeably, there’s a slight difference. A mobile wallet is a type of digital wallet. It can either be a built-in feature on your smartphone or an app you download.

Unlike a physical wallet stuffed with cards and cash, mobile wallets, such as PayPal, Google Pay, Apple Pay, Samsung Pay, and Venmo, are super convenient. They store credit and debit cards, gift cards, and coupons, making them handy for both in-store and online purchases.

These apps also have built-in security to protect against fraud, making them safer than traditional wallets. More and more businesses now accept payments through mobile wallets, so you can go cashless wherever you are.

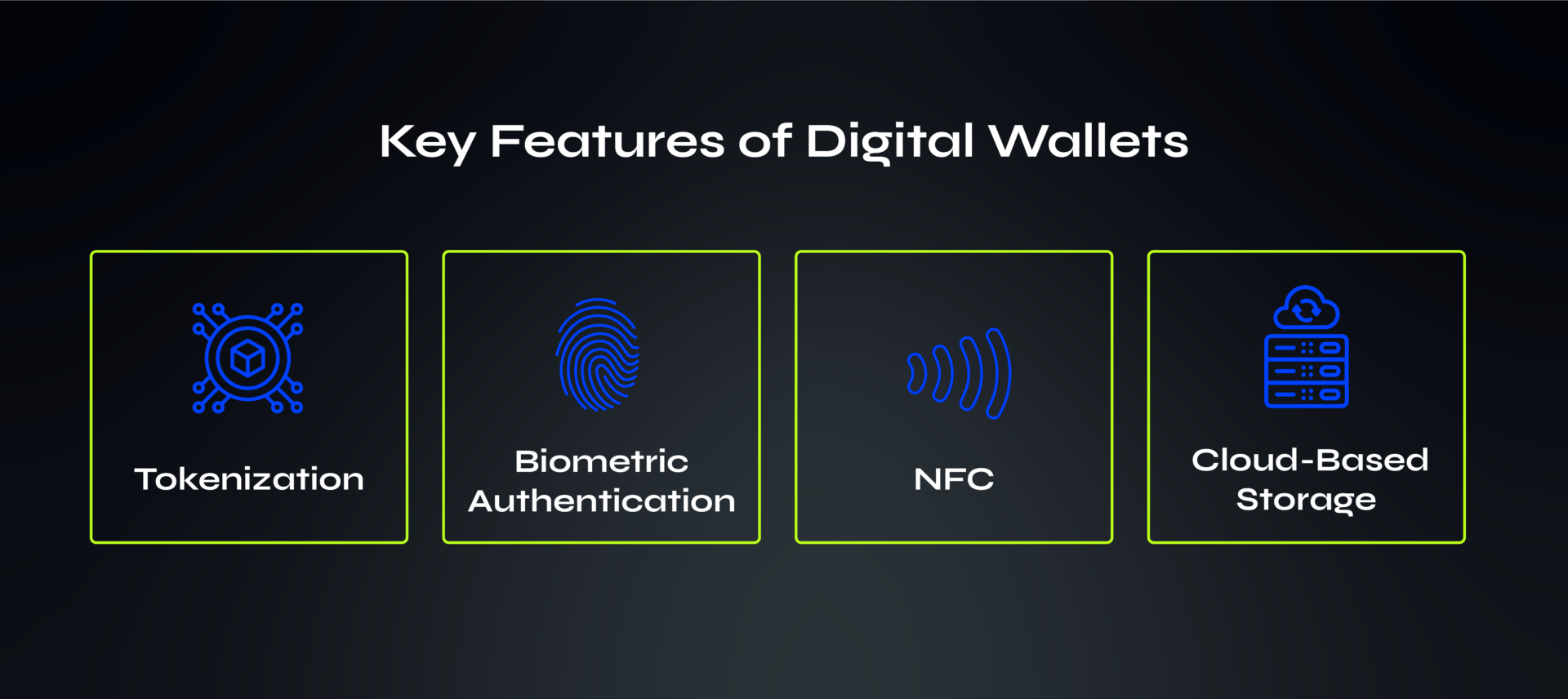

Key features of best digital wallet for iGaming

Let’s explore some of the key features of the best digital wallets for iGaming. We’ll mostly focus on tokenisation, NFC technology, and MFA.

Tokenisation

Tokenisation is a security feature where sensitive information, like credit card numbers, is replaced with a unique token. This token is meaningless on its own and reduces the risk of exposure in case of a security breach. Every time you purchase, the digital wallet gives it a different identity (token). So, when you make an online purchase using your digital wallet, it doesn’t reveal the real credit card number. Instead, it sends this special identity (token) to complete the transaction. Even if a crafty hacker tries to intercept it, they won’t get the actual credit card information.

This way, your real credit card details stay safe, allowing you to confidently shop online or in stores. Your special identity (token) works undercover, ensuring your money stays secure even in the digital world.

NFC technology

The other essential feature of digital wallets is NFC technology. NFC enables contactless communication between devices within close proximity (usually a few centimeters).

The best digital wallets for iGaming often use NFC to facilitate contactless payments, allowing users to transact by tapping their mobile devices or cards near compatible payment terminals. The first smartphone with NFC technology appeared in 2010, and now people worldwide can’t imagine their daily lives without using this technology to pay with their mobile phones.

Biometric authentication

Even though the number of digital wallet users is growing fast, with projections to reach 5.2 billion users in 2026, there are still major security concerns connected with mobile wallets. To address this concern, biometric authentication technology has become a possible solution.

Many best digital wallets for iGaming utilise biometric authentication, such as fingerprint scanning or facial recognition. Biometric verification adds an extra layer of authentication without causing unnecessary friction. As a result, enhance security and streamline the user authentication process.

Cloud-based storage

The best digital wallets for iGaming may leverage cloud-based storage to securely synchronise payment information across multiple devices. Cloud-based storage in digital wallets is like having a virtual vault for your payment information. Instead of storing sensitive details, like credit card numbers, directly on your device, they are securely kept in the cloud.

This means you can access and use your payment methods from various devices, and even if you lose your device, your payment info remains safe in the virtual vault. It adds convenience and security, making it easier to manage digital wallet information across different platforms.

These features collectively contribute to digital wallets’ security, convenience, and versatility, making them a preferred choice for users in various financial transactions.

The growing importance of finding the best digital wallets for iGaming

The COVID-19 pandemic has reshaped consumer behaviour. It emphasises the rising need for contactless transactions to minimise physical interactions. In this context, the best digital wallets for iGaming provide a seamless and touch-free payment experience, aligning with health and safety concerns.

The iGaming industry has recognised the importance of adapting to post-pandemic consumer preferences. Incorporating e-wallets as payment methods helped businesses cater to the demand for contactless transactions in both depositing funds and withdrawing winnings.

Traditional payment methods, such as credit cards and bank transfers, may involve delays in processing transactions. Digital wallets, on the other hand, enable faster deposits and withdrawals. They enhance the overall user experience in the iGaming sector.

Instant withdrawals appeal to players who value quick access to their winnings. The best digital wallets for iGaming provide a more efficient and streamlined process than traditional banking methods, contributing to player satisfaction and loyalty.

User-friendly and convenient

Additionally, the best digital wallets for iGaming offer a user-friendly and convenient payment experience. Players can store their payment details securely in the wallet, reducing the need to enter sensitive information for each transaction. The simplicity of using the best digital wallets for iGaming aligns with the modern, fast-paced lifestyle. They are an attractive choice for players seeking efficiency and ease of use.

Many of the best digital wallets for iGaming support multiple currencies, allowing iGaming operators to cater to a global audience. Players from different regions can transact in their preferred currency without the need for currency conversions, promoting inclusivity and accessibility.

The ability to seamlessly handle transactions in various currencies contributes to the international expansion of iGaming platforms.

Overall, the growing importance of the best digital wallets for iGaming sector is driven by the industry’s adaptation to post-pandemic trends, the need for faster and more secure transactions, and the emphasis on providing a convenient and user-friendly payment experience. As the iGaming landscape continues to evolve, digital wallets are likely to remain a crucial component of the industry’s payment ecosystem.

Statistics on mobile iGaming sales and market share

As a general trend, mobile iGaming has been on the rise. An increasing number of users engage in gaming through their smartphones and tablets. The convenience of mobile devices has significantly contributed to the growth of the iGaming market, with a substantial portion of the industry’s revenue coming from mobile platforms.

According to Statista, the share of mobile gaming revenue worldwide in total digital gaming revenue was 74.4% in 2022. It is projected to increase to 77.5% by 2027.

The market share of mobile iGaming varies by region and platform. The global iGaming market reached $86.6 billion in 2023, growing at 10.5%. By 2028, it could hit $104.5 billion, showing significant growth from the $20.7 billion in 2017.

Even more stats…

The number of global iGaming players is also set to rise to 593 million by 2024, up from 454 million in 2017. The rise in player numbers will likely lead to increased revenues and better customer satisfaction rates.

In addition, the market is expected to see an increase in female players and mobile gaming revenue. In the coming 4 years, the online gambling market is expected to reach $213.58 billion at a CAGR of 12.6%. This is further expected to expand up to $583.69 billion by the end of 2030, according to Grand View Research (see Fig. 1).

Figure 1. Global online gambling market size

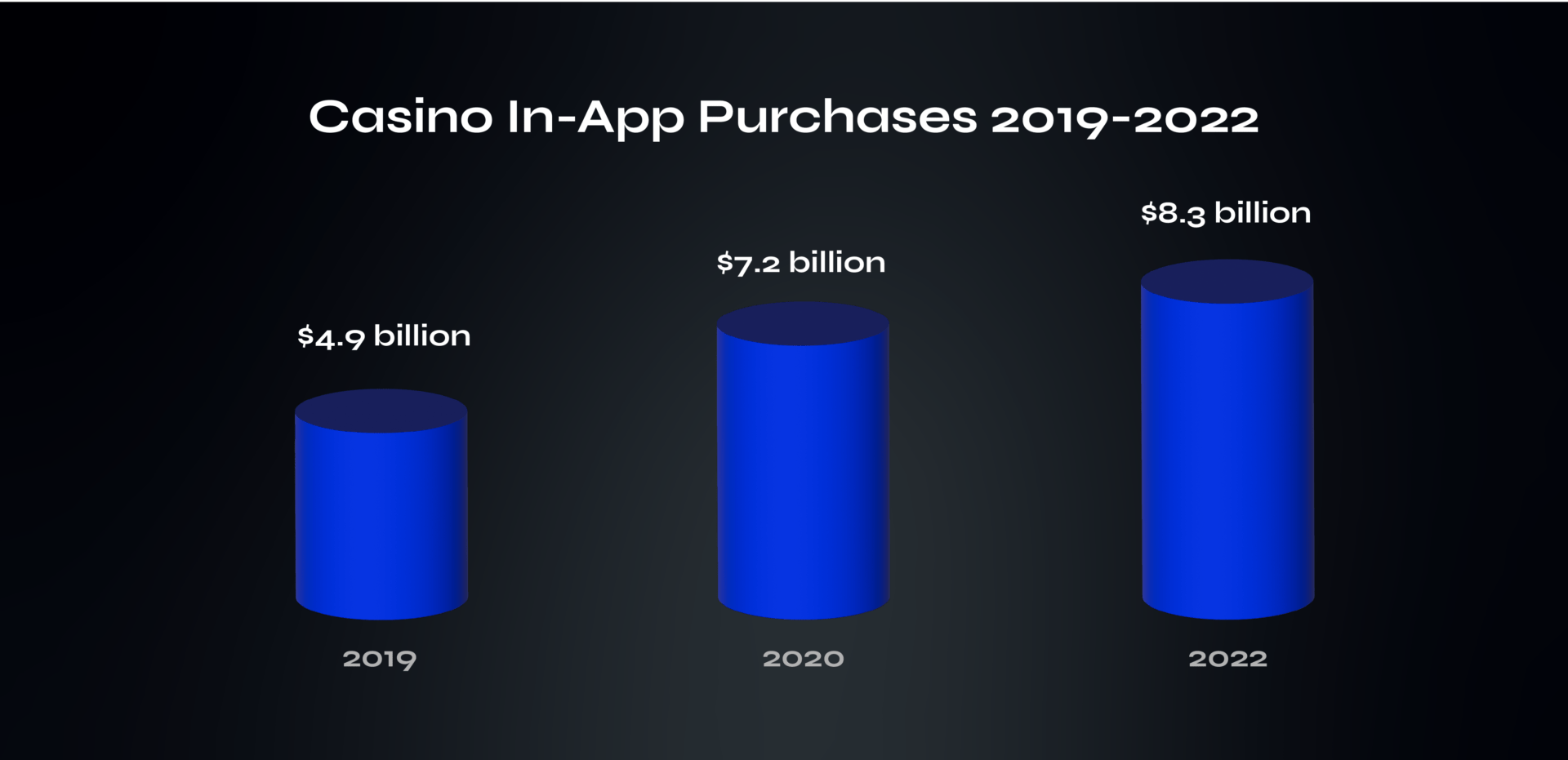

A report from Data.ai says that mobile consumer game spending hit $110 billion in 2022. Casino games are one of the top performers in this list. Casino games revenue for 2022 was $8.3 billion, compared to $7.2 billion in 2020 and $4.9 billion in 2019 (see Fig. 2).

Figure 2. Global casino in-app purchases volume

In the iGaming industry, where fast transactions and high security are crucial, providing the best digital wallets for iGaming strikes a balance between an excellent customer experience and robust security.

Merchants can offer a streamlined payment process while ensuring that sensitive information is well-protected. The best digital wallets for iGaming can simplify payments, allowing users to make quick purchases without repeatedly entering their payment details.

The 7 key advantages of the best digital wallets for iGaming

The best digital wallets for iGaming contribute significantly to streamlined checkout processes in the iGaming industry, resulting in higher conversion rates. Let’s explore the key factors here.

1. Improved checkout

Digital wallets easily integrate with gaming platforms, making the payment process smooth. This integration reduces waiting times and makes the overall gaming experience more satisfying.

2. Saved payment information

Users can securely save their payment information within the digital wallet, eliminating the need to manually enter details for each transaction. This convenience not only accelerates the checkout process but also encourages users to finalise their transactions, contributing to increased conversion rates.

3. One-click payments

In the fast-paced environment of iGaming, this streamlined process reduces friction during the checkout, leading to quicker and more efficient payments.

4. Faster deposits and withdrawals

iGaming platforms utilising digital wallets benefit from faster deposit and withdrawal processes. The instant nature of digital wallet transactions provides players with swift access to funds, enhancing the overall gaming experience and encouraging continued engagement.

5. Enhanced security

Digital wallets employ tokenisation, where sensitive information like credit card details is replaced with unique tokens. In the event of a security breach, tokens are meaningless, adding an extra layer of protection for users’ financial data.

The transmission of payment information from the digital wallet to the iGaming platform is often secured through end-to-end encryption. This encryption ensures that even if intercepted, the data remains unreadable, maintaining the confidentiality of users’ sensitive information.

6. Cross-device accessibility

Users can access their digital wallets across multiple devices, providing a seamless and consistent experience. This flexibility allows players to switch between devices without any disruption to their payment methods or preferences.

7. Intuitive interface

Digital wallets typically feature intuitive interfaces, making it easy for users to navigate and manage their payment information. This simplicity enhances the overall user experience, contributing to higher satisfaction levels among iGaming enthusiasts.

Digital wallets often support various payment methods, including credit/debit cards, bank transfers, and alternative payment options. By offering a range of choices, iGaming platforms can cater to the diverse payment preferences of their user base.

The advantages of digital wallets for iGaming encompass streamlined checkout processes, enhanced security measures, improved customer experiences, and the ability to reach a broader market with diverse payment preferences. As the iGaming industry continues to evolve, digital wallets will likely remain a pivotal component in shaping the payment landscape.

Exploring the best digital wallets for iGaming in 2024/2025

When choosing the best digital wallet for iGaming payments, there are multiple options. We have selected 5 options that can cater to the tastes of global iGaming users.

Our choice is based on the following criteria:

Security

- use of robust encryption techniques to safeguard sensitive information during transactions;

- authentication mechanisms, including passwords, PINs, biometrics, or two-factor authentication, to prevent unauthorised access;

- tokenisation.

User experience

- how straightforward the digital wallet is for users, from the initial setup to making transactions;

- seamless operation across various devices and platforms;

- interface simplicity and intuitiveness. Including features like one-click payments and easy navigation.

Market reach

- wallet’s acceptance on a global scale. Its availability in multiple countries and its compatibility with various currencies;

- the number of merchants that accept payments through the digital wallet;

- partnerships with banks, financial institutions, and collaborations with other services.

Taking all these factors into consideration, we have selected digital wallets that will enhance iGaming payments.

PayPal

PayPal has transformed from a simple online payment platform into a full-fledged digital wallet. In 2024, it will offer a wide array of financial services, including lending, investment, and budgeting tools, all within the same app. PayPal recorded 435 million accounts as of 2023.

Key features of PayPal:

- Supports in-store purchases

- Implements two-factor authentication

- Facilitates easy fund transfers

- Utilizes secure encryption technology

- Provides 24/7 transaction monitoring

- Allows buying and selling of cryptocurrency

Pros:

- User-friendly interface

- Quick registration process

- Collaboration with renowned trading platforms

- High level of protection

- No cost for basic usage

Cons:

- Transaction speed is relatively low

Apple Pay

According to Apple Pay statistics, the number of Apple Pay users hit 55.8 million in 2023. Apple Pay ensures secure and private transactions, earning the top spot on our list of the best digital wallet apps for iOS in the US.

Key features of Apple Pay:

- Available in 21+ countries

- In-store and in-app payments through iOS devices

- Authentication via Touch ID and Face ID

- Widely accepted on millions of websites and apps

- Built-in privacy and security features

Pros:

- Simplifies payments

- High level of security

- Enhances data privacy

- Offers an improved overall experience

- No additional costs for merchants

Cons:

- Compatible only with Apple devices

Zelle

Zelle is all about speed and security. It enables seamless bank transfers within minutes, making splitting bills or sending money to friends hassle-free. With its widespread bank partnerships, Zelle has become a trusted choice for swift and secure transactions. In 2023, the number of Zelle users reached approximately 67 million, showing a growth of 10.1% compared to the previous year’s 61.6 million.

Key features:

- Instant transfers

- Seamless integration with a variety of banks

- A user-friendly mobile app for convenient money management.

Pros:

- Speedy transactions, with funds often available in the recipient’s account within minutes.

- Broad accessibility for users.

- Most transactions through Zelle are typically fee-free.

Cons:

- Limited international support.

- Users need a bank account associated with Zelle for transactions.

Skrill

A well-liked digital wallet and online payment service for the gambling industry. Skrill provides a safe and user-friendly platform for online transactions. Over 120,000 merchants and 40 million regular users transfer with Skrill worldwide.

Key features:

- Secure and quick international transactions.

- Offers a prepaid Mastercard for easy access to funds.

Pros:

- Widely accepted globally, making it suitable for various transactions.

- Robust security features, including two-factor authentication and encryption.

- Supports multiple currencies and various online merchants.

Cons:

- Some transactions may incur fees, impacting cost-effectiveness.

- Initial verification may take time, affecting immediate usability.

Venmo

The Venmo mobile payment app makes it possible to send and receive money between friends and family members. It’s widely used for splitting bills, sharing expenses, and making quick, peer-to-peer transactions. Users can also link their bank accounts or credit/debit cards to facilitate seamless money transfers.

By the end of 2023, the company grew its active users by approximately 85 million.

Key features of Venmo:

- Quick Payment Process

- Shop using a Venmo card

- Utilize Instant Transfer

- Make in-person or online wallet purchases

- Secure and seamless transactions through QR codes

Pros:

- Free and user-friendly

- Interactive social features

- Rarely charges commissions

- Offers both debit and credit card options

Cons:

- Fees for commercial transactions

- Lacks a feature to cancel payments

These were some of the most popular e-wallet options for iGaming payments. They offer a secure and user-friendly experience, widely accessible to a global audience. Integrating them into iGaming platforms not only enhances the gaming experience but also streamlines transactions for players worldwide.

Future outlook and predictions for digital wallets in iGaming

In a report about the future of payments, PwC, a consulting firm, highlighted digital wallets as a big trend. They predict that more people will choose digital wallets over traditional cards and banks because they’re more convenient. The report also mentions that digital wallets might play a big role in business-to-business transactions and make supply chains more digital.

With iGaming on the rise, it’s an exciting time to be part of the industry. There are lots of opportunities for revenue, growth and success with the right ideas and technologies in place. There are several improvements that we believe are going to shape the future of iGaming payments.

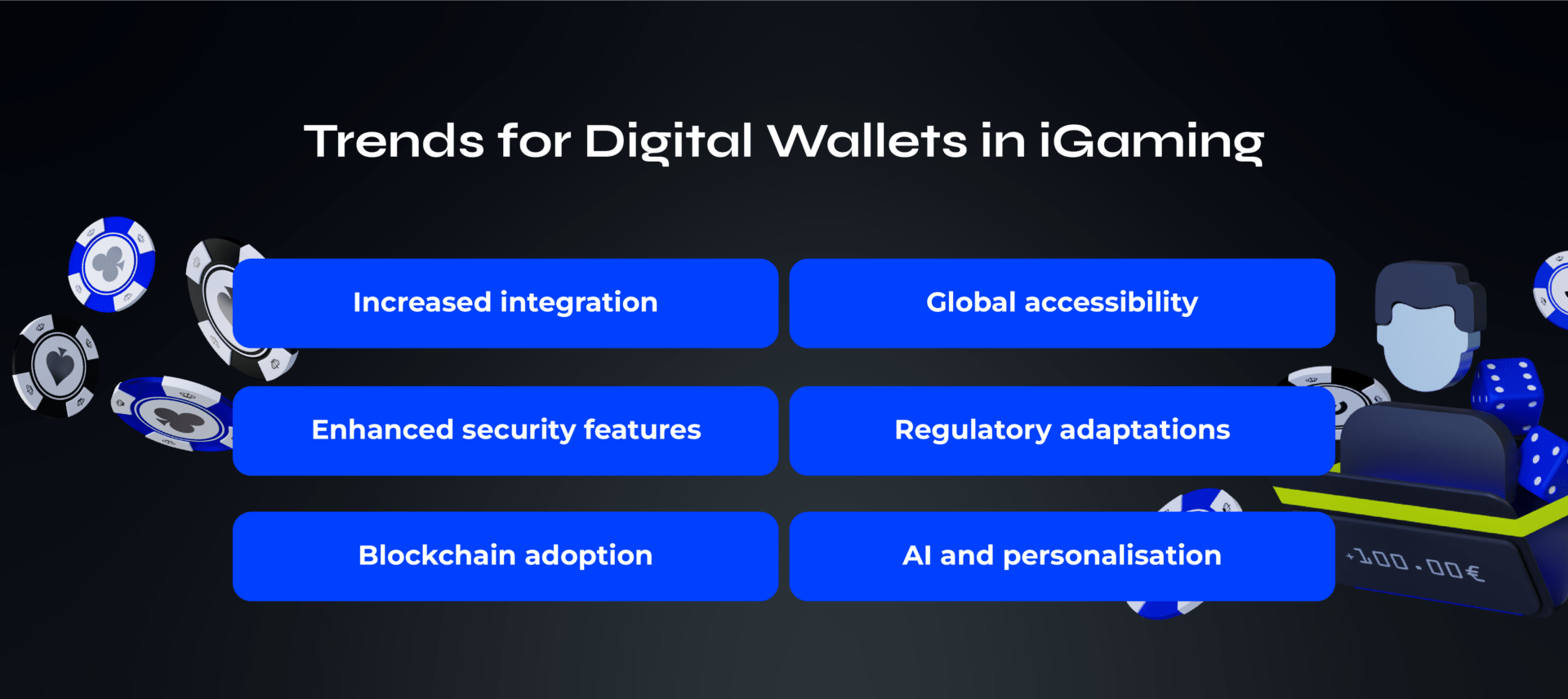

These are:

- Increased integration

Digital wallets are likely to become even more integrated into iGaming platforms, offering seamless and efficient payment experiences for players.

- Enhanced security features

With a continuous focus on cybersecurity, future digital wallets in iGaming may introduce advanced security features. They can ensure safe transactions and protect users’ financial information.

- Blockchain adoption

The adoption of blockchain technology in digital wallets could bring increased transparency and trust to iGaming transactions, providing players with verifiable and secure payment methods.

- Global accessibility

Digital wallets may expand their global reach, catering to an even broader audience and accommodating various currencies and payment preferences.

- Regulatory adaptations

Adapting to evolving regulatory environments, digital wallets in iGaming may implement features to comply with emerging standards and ensure a secure and compliant gaming experience.

- AI and personalisation

Integration of artificial intelligence (AI) could enhance personalisation within digital wallets, offering tailored recommendations and promotions based on individual gaming behaviours.

Banks, card companies, fintechs, and others must understand these trends to map a new path forward.

The top 1% of the best digital wallets for iGaming – PayDo

We have extensive experience in the iGaming industry, which has given us a deep understanding of its inner workings. Our team of experts is dedicated to providing the most advanced and feature-rich payment platform to help your business thrive.

Discover the distinctive advantages of PayDo:

- Global reach. Access over 150 countries for both incoming and outgoing transfers, with checkout and mass payments available in over 170 countries.

- Widely accepted schemes. Support for popular payment schemes like Cross-border, SEPA & SEPA Instant, and Faster Payments for incoming transfers and withdrawals.

- Transparent Policies. No hidden fees, rolling reserve, minimum balance, or minimal commitments.

- Swift settlements. Enjoy the fastest settlements and payouts, ensuring that all processed funds are immediately available in your account.

- iGaming compatibility. Our product supports all iGaming licenses and jurisdictions.

- Integration capabilities. Easily integrate with external payment orchestration platforms through Devcode and Praxis support.

- Physical and virtual corporate cards you can add to ApplePay and GooglePay (coming soon).

Whether you’re a new iGaming business or a well-known platform, the PayDo solution makes your payment process better and is dedicated to your success.

Contact us to explore what our product has to offer for your business.

Conclusion

Digital wallets are changing how users pay online. They safely store important payment details and passwords, enabling quick and secure transactions. And probably the best part for oGaming users – digital wallets often support multiple currencies!

Innovation in iGaming is ongoing, especially when it comes to payment methods. In the last year, there has been a notable rise in the use of e-wallets, driven by the availability of various options like Apple Pay, Google Pay, and PayPal, alongside regional payment methods.

Online gambling sites need to process payments 24/7. For this, they use a special account called a high-risk merchant account, necessary for handling transactions through a payment gateway. This type of account is specifically designed for businesses in the risky gambling industry. Getting one from a bank can be tough, and online gambling businesses must have the right certificates and licenses in place before applying.

This is when PayDo comes into play. We offer a secure, compliant, and reliable payment solution that utilises security measures to protect customer data. Our solution also complies with the latest regulations, and its platform is designed for high performance.

Create a merchant account for your iGaming business. Benefit from a variety of iGaming payment options.