Experts regard the Danish market for its innovative payment processing schemes, which creates a unique opportunity for businesses to expand. Danes use Dankort all over the world. And mobile payment platforms like MobilePay is insanely popular in Denmark. Understanding these options is crucial for a successful entry into the market. The guide will help you navigate Denmark’s digital payment landscape and select the right payment processing schemes for your business.

Overview of payment processing schemes and methods in Denmark

Denmark is a payments frontrunner. In 2015, there was the launch of one of the first instant payment systems. Danes make more real-time payments per capita than elsewhere in Europe, with adoption rising fast.

Cash is responsible for only 1% of payments in the country, making contactless payments very popular. People in Denmark prefer a mix of global and local payment methods for their transactions.

Along with global payment methods like Cross-border, TARGET2, and SEPA, there are other popular contactless payment processing schemes. Let’s explore them in more detail.

Dankort

The most popular payment method in Denmark is Dankort.

Introduced in 1983, Dankort gave Danish consumers an alternative to cash, cheques, and foreign cards. In 2015, Dankort introduced contactless payments, enhancing the speed and security of transactions.

Denmark quickly embraced contactless payments, surpassing global adoption rates. Currently, more than 5.6 million consumers own this card.

Both businesses and consumers like to use Dankort. Payment processers accept everywhere in Europe and the globe. People trust Dankort for its security. It also works well with different platforms. Businesses looking to expand into the Danish market can rely on this payment method.

MobilePay

Another widely used payment method in Denmark is MobilePay.

Launched in 2013, MobilePay is a digital wallet widely used in Denmark and Finland. With over 4 million users in Denmark alone, out of a population of 5.8 million, the app facilitated transactions exceeding €23 billion in 2021.

MobilePay is a preferred choice for online payments. This payment method offers enhanced security by linking each account to the user’s CPR number for easy tracking in case of scams.

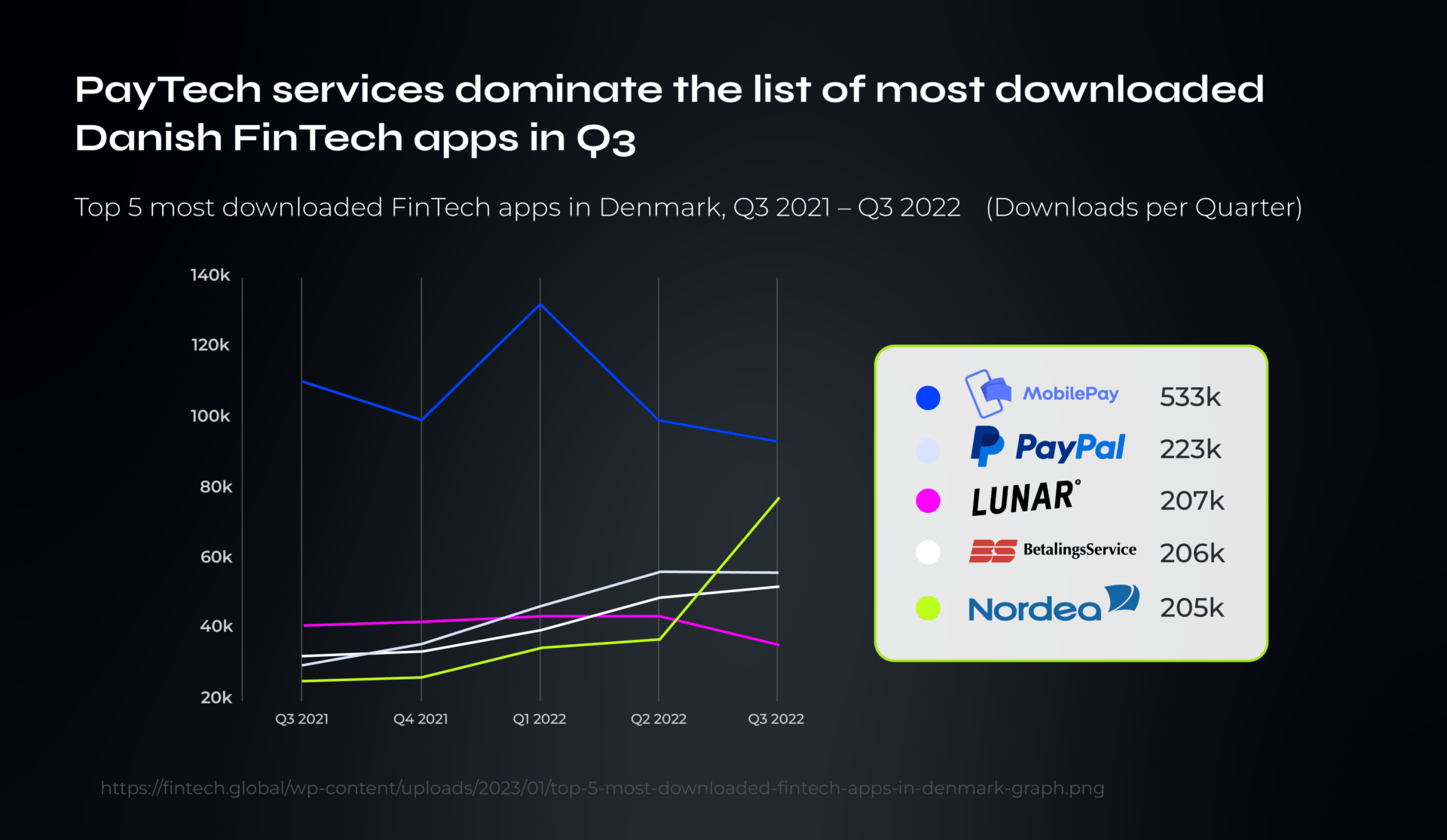

According to FinTech Global Research, MobilPay is the most downloaded fintech app in Denmark. During the third quarter of 2022, the app was downloaded 533 thousand times.

Notably, Danes consider MobilePay more essential than popular social media apps like Facebook and Instagram. This highlights its crucial role in the Danish online payment ecosystem.

PayPal

PayPal is one of the most popular online payment methods in the world. It is also widely used in Denmark.

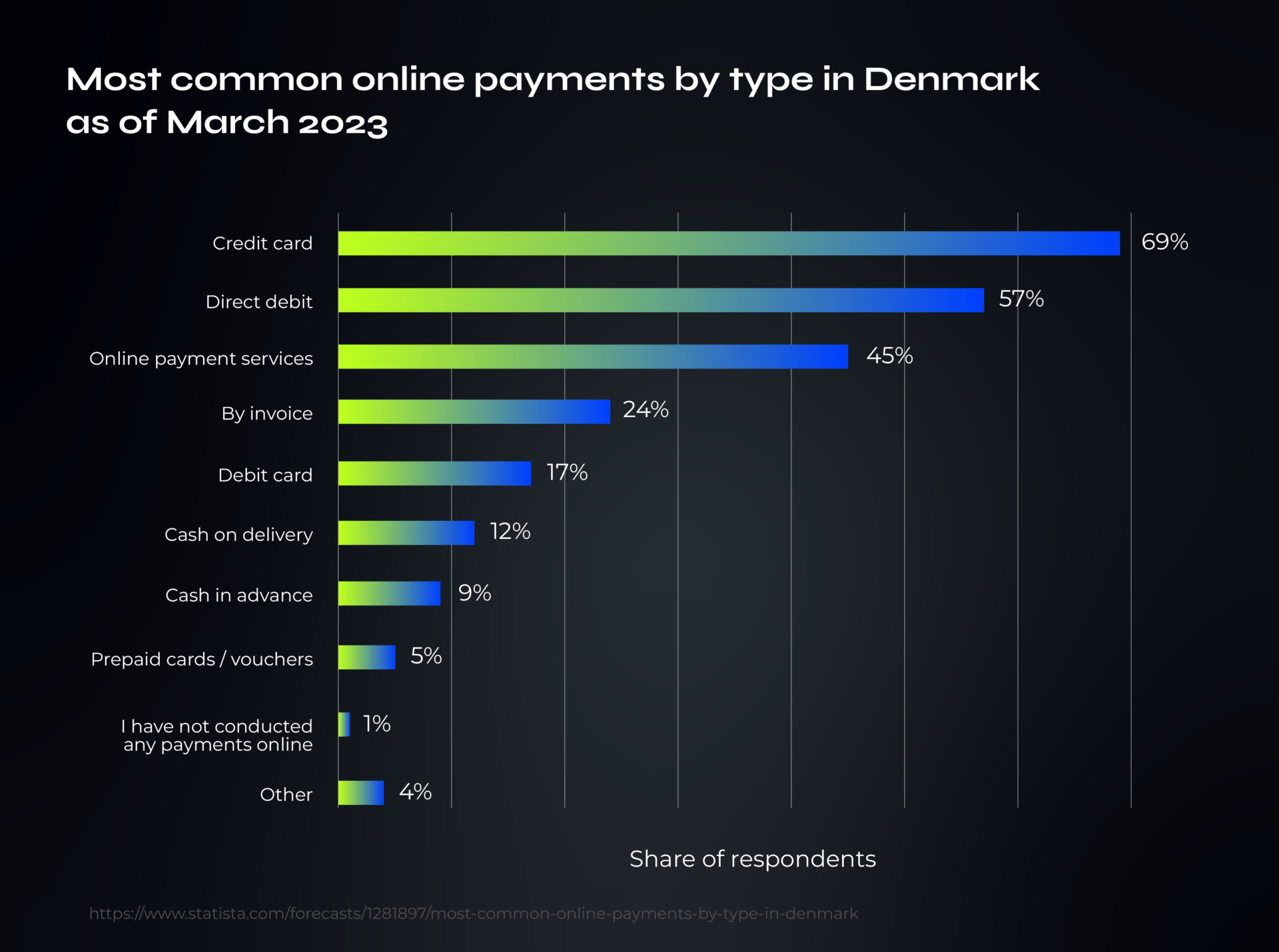

According to Statista data, PayPal is one of the most common online payments by type in Denmark as of March 2023. 45% of surveyed people use this service (along with Amazon Pay) to pay online.

PayPal is valued for its global presence. It’s everywhere in the world, making it easy for transactions across borders and connecting businesses globally.

Kronos2

Kronos2 is the payment system used by Danmarks National Bank to settle payments in Danish kroner. This scheme plays a crucial role in Denmark’s payment infrastructure.

It is a real-time gross settlement system, meaning each payment is settled individually and immediately. It is used for large-value and time-critical payments. For example, interbank transfers, securities transactions, and foreign exchange settlements.

However, Kronos2 will be replaced by a new system called TARGET DKK in 2025 as part of migrating to the pan-European platform for payments and securities trading, TARGET Services. This will ensure a single platform for the settlement of payments in Danish kroner, as well as enhanced IT security and operational efficiency.

Key features of good payment processing schemes

A good payment processing scheme should handle transactions, build trust, and adapt to different business needs. Here are some key features:

Security

Strong payment processing schemes use advanced encryption to protect sensitive information during transactions. This includes credit card details and ensures they remain confidential and protected from unauthorised access.

Implementing measures to detect and prevent fraud adds an extra layer of security. This involves real-time monitoring for suspicious activities, verifying transactions, and the ability to flag or block potentially fraudulent transactions.

Integration

An effective payment processing scheme smoothly works with existing business systems. Like accounting software and inventory management. This makes the overall process more streamlined. It also reduces the need for manual data entry and minimises errors.

A versatile system accommodates various payment methods such as credit cards, debit cards, digital wallets, and emerging forms of payment. This flexibility caters to a wider customer base, enhancing the overall user experience.

Transaction fees

Transparent communication about transaction fees is crucial for building trust. Clearly outlining fees for services like processing payments, chargebacks, and currency conversion (if applicable) helps businesses understand the cost implications.

A good payment system offers competitive rates compared to industry standards. This helps businesses manage costs and ensures that customers find the payment process reasonable. Potentially encouraging more transactions.

Addressing these key features helps you create a secure, efficient, and cost-effective financial environment for your payers. For instance, PayDo provides encryption and fraud prevention, integrating seamlessly with various business tools. We also transparently communicate transaction fees, offering competitive rates to both small and large businesses.

Consideration for cross-border merchants

Choosing a payment gateway for your business site or app can be challenging. Opt for a high-risk payment processor that ensures consistent payments for your app/site. An ideal payment processor, with an payment gateway and casino merchant account, should have the following features:

- Strict security measures

The casino merchant account must adhere to the strictest PCI-DSS guidelines and incorporate security features such as fraud scoring, tokenisation, and 3D secure authentication to protect merchants from fraud.

- Advanced solutions to prevent chargebacks

At PayDo, users pay for goods and services from their PayDo account. As a result, chargebacks are reduced to a minimum.

- Support for foreign currencies

The payment processor should support all major foreign currencies to cater to a diverse customer base. PayDo offers 18 of the most popular currencies to meet your needs for global payments.

- Transparent fee disclosure

The payment processor must disclose all charges to ensure transparency in financial transactions.

- 24/7 Customer and technical support

An ipayment processing business should provide continuous customer and technical support to address any concerns or issues that may arise.

- Regulatory compliance

Cross-border transactions require compliance with various laws, tax regulations, and financial standards. Merchants must stay informed and adhere to these guidelines for smooth cross-border operations.

When choosing a payment provider for your business, focus on the above mention key features. When finding a simpler approach, you can always look for an EMI with experience accommodating international transactions and cross-border merchants.

PayDo provides Kronos2 and other payment processing schemes to help Danish customers enjoy hassle-free transactions

By opening a PayDo Business Account, you can access dedicated and pooled multicurrency IBANs.

With PayDo, you can send and collect payments globally through various schemes, such as SEPA, SEPA Instant, and Cross-border. We also provide competitive pricing for business accounts. The pricing is calculated depending on the country of incorporation and industry of the business.

PayDo Business account offers payment options your customers know and trust. For your clients in Denmark, you can provide Kronos2 for fast and secure settlement of payments in DKK.

All our products (Business Account, Merchant Services, Mass Payments) are available by default, without additional fees, in one dashboard.

Create a PayDo Business account today and explore the possibilities of multiple local and global payment processing schemes for your business.

Conclusion

Denmark’s online gambling industry experienced substantial growth over the past few years. The country’s liberal regulatory environment and high internet penetration have played pivotal roles in this success.

Understanding the local payment landscape is crucial for those venturing into the Danish market. In this article, we’ve explored some of Denmark’s most popular payment options. These are Dankot, MobilePay, Kronos2, PayPal, Skrill, and Google, Apple & Samsung Pay.

With a PayDo Business account, you can provide your Danish users with reliable and fast payment methods they know and love.

Contact us to learn more about the benefits of a PayDo account for your business.