The Future of Online Payments. Technologies to Watch in 2025 and Beyond

The year 2024 has been a real test for many sectors of the economy. However, online payments have only become more popular. Nevertheless, in the near future, online payments will undergo serious changes.

This will not happen in 10 or 30 years but 2025. We offer you a short online payments industry news digest. You’ll find out what trends await us next year and how the economy affects the online payment industry.

Artificial Intelligence (AI)

You may argue that artificial intelligence has been used for years, even decades. The first AI program was written in 1951. Yet, technology has only found its niche in recent years.

Now, many companies are using AI to automate processes and fight fraud. Yet, still, businesses underestimate the reactive capabilities of AI.

AI’s special tools can analyze many customers’ spending habits. They can detail customers’ transaction histories. They can even predict, with high accuracy, what goods and services customers will buy.

Thanks to AI, it is possible to optimise the costs of individual buyers and entire companies by selecting lower-cost products.

Imagine you own an online marketplace. With AI, you can predict what products each customer will likely buy next based on browsing and purchase history. This allows you to stock the right items at the right time, optimize your inventory, and offer personalized deals that increase customer satisfaction and boost sales.

Cloud Online Payments

Alt: A graphic showing a transition from paper-based billing to digital payments via cloud technology.

Late payments put your business at significant financial risk. However, you can solve this problem with the help of cloud technology. The cloud computing market is expected to go beyond $2.2 trillion by 2032 from its current value of $670 billion.

Hoppin on the cloud payment train, you will not have to keep all your customers’ payment data on a local server. Cloud technology is fast, flexible, and reliable. Access financial info anytime, anywhere, securely. It saves you time and effort.

Think back to when you had to track all your accounts manually. A cloud-based payment system will automate manual processes. It will make things easier and save you a lot of trouble. Manual billing will be a thing of the past.

Authentication Update for Online Payments

Alt: A layered 3D model with icons representing fingerprint, facial recognition, and secure authentication technologies.

Market conditions are changing fast. Companies must adapt to these changes. Protect every customer’s financial info at all times. By 2024, all companies with online payment options must follow PSD2. Also, an alternative must be offered soon – DORA. It should enhance security and add authentication. It is a question of being able to make regular payments without re-authentication.

Biometric ID will be the fastest, most secure way to confirm payments. It is estimated that by 2026 around 4.4 billion identity apps will be downloaded. New ways of authentication are still to come and make life for ordinary consumers way easier.

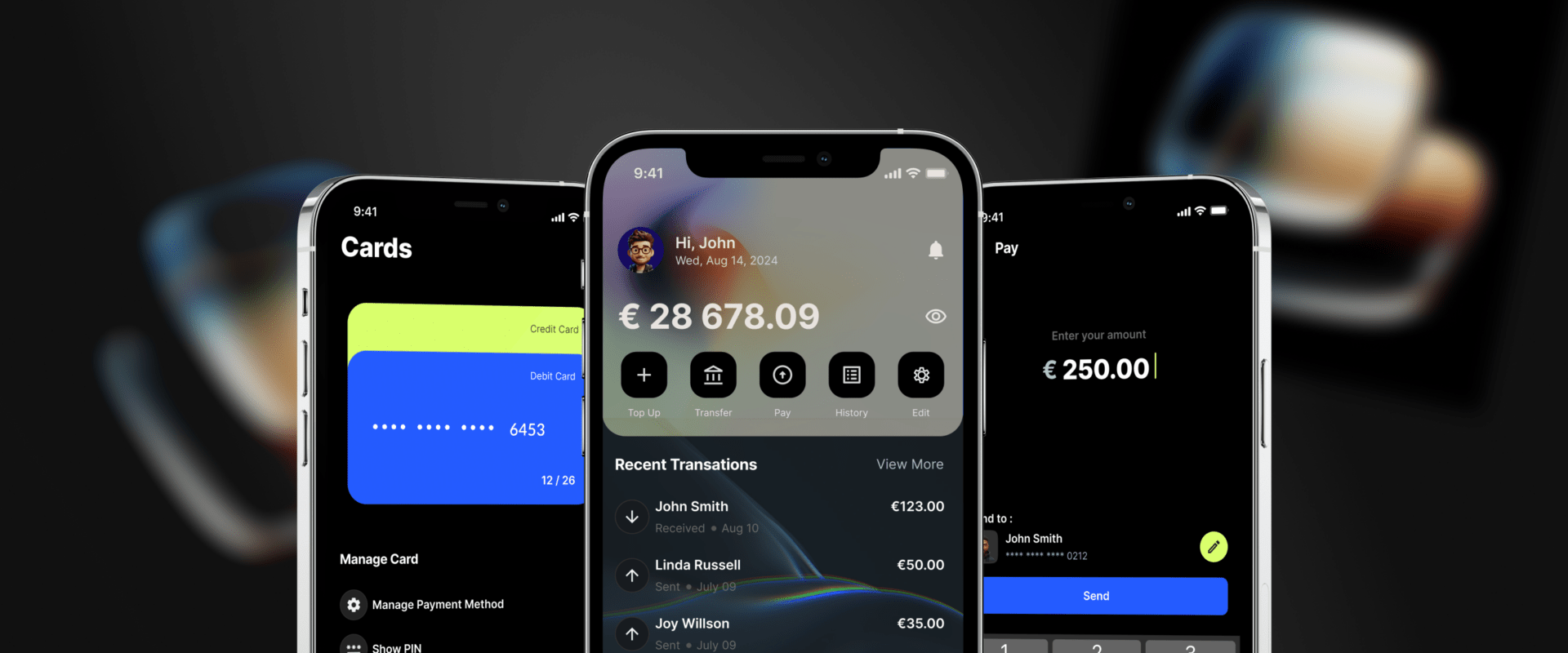

Neobanking

Today, the competition for clients is fierce. Even a few lost minutes can cost their loyalty and sales to competitors. Companies develop mobile apps to avoid this. They cut intermediaries and make payments simple and convenient.

Besides, thanks to such applications, clients can communicate directly with the company and receive additional bonuses through discount coupons, accumulate points for further service exchange, etc. The volume of mobile payments is $3.8 trillion and is expected to reach $27 trillion by 2032.

Conclusion

The nearest future of online payments lies in four key words:

- AI

- Cloud

- Authentication

- Mobile

These are the areas in which companies should and will invest. If you are looking for a business or payment provider working within the aforementioned segments, you are in look. PayDo is a payment ecosystem offering services for high-risk and low-risk clients working with digital services.

Contact us and become a part of the future right now.