In 2022, the online gambling market was valued at $81.08 billion. It’s projected to increase to $88.65 billion by the end of 2023, with an annual growth rate of 9.3%. The market is anticipated to hit a staggering $125.6 billion in the next four years. Growing at a rate of 9.1%. By the end of 2030, it’s predicted to expand even further, reaching $583.69 billion, as per Grand View Research. To match such a rapid growth and cater to many players worldwide, iGaming businesses should offer the ultimate user experience. Including standalone iGaming payment methods.

In this article, we explore the payment landscape in the iGaming industry. As well as some of the top payment methods every iGaming business should incorporate to reach a wider audience.

The payment landscape for bringing top payment methods to the table

As of 2023, there are 4,792 casinos and online gambling businesses worldwide. This is 4.3% more than last year. Online casinos make up some 2,000 of that count. And according to the forecasts, this number will only grow.

To make sure your iGaming business provides a frictionless and secure user experience, you need to implement multiple payment methods. This is where iGaming payment providers come into play.

Companies like these help casino players move money between them and casinos and create and manage special systems for doing so. They act as intermediaries to ensure the right amount of money goes to the right place on time.

These payment companies also take care of keeping their customers’ information safe. This is crucial because the data needed for transactions in a casino often includes sensitive personal details like passport or social security numbers, addresses, and more.

For online casinos, it’s important to pick a payment company that takes data security seriously. Having a good history of keeping customer data safe makes new players more confident, especially those who might be worried about strict identity checks.

Payment companies that handle currency conversion also make it simpler for casinos to manage their users’ money in just one currency, making the casino’s operations much smoother.

Top iGaming payment methods

Choosing the right payment methods for your iGaming business can be tricky with so many options available. We simplify things for you by providing all the information you need to find the perfect match.

Explore the online gambling payment platforms below to find the ideal payment option that aligns with your business goals.

Debit and Credit Cards

Debit and credit cards, traditional and widely accepted, allow seamless fund transfers tied to users’ bank accounts or credit lines.

They offer immediate transactions but may incur fees and compromise privacy. Including card payments on your iGaming platform might be the smartest choice. Cards are the most popular way people pay online in many countries. Especially in the top 10 nations with the most online gambling activity. These countries, like Brazil, the USA, India, Mexico, the UK, Canada, Japan, and Turkey, all prefer using cards for online payments.

That’s why cards are the best option for your iGaming platform. These countries make up more than 70% of the world’s online gambling traffic.

Digital Wallets

E-wallets are widely favoured in online gambling for their quickness and security.

In 2022, a report revealed that 49% of all online transactions worldwide were made through digital wallets. This number is anticipated to grow, reaching 54% by 2026. Widely used, PayPal is a digital wallet facilitating secure online transactions. It provides robust security and buyer protection but may have transaction fees and limited acceptance in some regions.

The appeal of digital wallets in the iGaming sector lies in their ability to offer streamlined, secure transactions while enhancing user privacy, positioning them as a key payment method option. Digital wallets allow players to fund their accounts without directly exposing sensitive customer’s bank account details, providing an additional layer of financial security. This feature is particularly beneficial for merchant accounts in the iGaming industry, as it offers a secure alternative to traditional debit card payments and credit card transactions.

Direct Debit

Direct debit is a way for players to pay for iGaming services by allowing the gaming platform to withdraw money from their bank accounts automatically. It’s like giving permission for the gaming company to take the payment directly without players having to do it every time.

This method is handy for regular payments, like monthly subscriptions or ongoing services in gaming. This helps gaming companies get money regularly and on time.

Direct debit is considered low-risk for fraud, and it can be a good choice for iGaming platforms that want a reliable and predictable way to get paid. However, companies need to follow the rules and make sure they communicate clearly with players about how the direct debit process works.

Bank Transfers

Bank transfers offer a safe way to transfer money. Although they might take a bit longer than some faster options. People often use them for bigger transactions. For online gaming platforms, considering their strong security and the industry’s risk of online fraud, including bank transfers, could be a smart move.

When seeking an online casino merchant account, opt for providers with a good track record in online bank transfers. This signals their commitment to a robust online security system

In the realm of online gaming platforms, bank transfers not only ensure transaction security but also offer a level of trust and credibility vital in financial interactions. This payment method, integral to a comprehensive payment system, caters especially to those who prefer traditional banking methods over digital wallets or card payments.

It is essential to ensure these payment options align with the acquiring bank’s authorization process and adhere to the industry’s fraud prevention standards, safeguarding both the merchant and customer’s interests.

Buy Now, Pay Later (BNPL)

BNPL services enable users to make purchases and pay in instalments, offering payment flexibility with minimal upfront costs. While budget-friendly, they may incur interest rates and risk overspending.

With Buy Now, Pay Later, customers can purchase things and pay over time instead of all at once. This is especially useful in the gaming world, where people spend a lot on in-game stuff. Offering this option helps gaming companies attract and keep customers who might not have the money to pay everything upfront.

Incorporating BNPL services into an iGaming platform’s payment system offers a competitive edge by aligning with modern consumer spending habits. This payment method, functioning as an alternative to traditional credit and debit card payments, is particularly appealing for online transactions where customers seek flexibility.

By offering BNPL, iGaming businesses can cater to a broader audience, including those who prefer not to use their bank accounts or merchant accounts for large gaming expenditures. This approach not only enhances customer satisfaction but also potentially increases the frequency and volume of transactions, benefiting the business model.

It’s crucial for gaming platforms to partner with BNPL providers who ensure a transparent and responsible borrowing process, minimizing the risk of hidden fees and aligning with financial institutions’ standards for secure and ethical lending.

Mobile Payments

Pay-by-mobile options like Apple Pay and Google Pay also offer great convenience for iGaming. Players simply link their bank account or card details within the mobile wallet app. At online casinos and sportsbooks, they can then make fast one-touch payments using biometrics like fingerprints or facial recognition on compatible devices.

Top benefits include:

- Super quick and easy deposits in just seconds

- Added security with biometrics and dynamic codes

- Avoids manually entering card details at each site

- Charges show up like any other card transaction

As e-wallets and integration improve, mobile payments have enormous growth potential in iGaming. Expect increasing adoption.

However, its limited device compatibility and acceptance are drawbacks.

Crypto Payments

Blockchain technology and cryptocurrencies are changing the iGaming industry. In Q1 2022, the total value locked in blockchain games hit $2.3 billion, showing a huge 639% increase from Q1 2021, as reported by DappRadar. This shift is likely to keep growing in 2023, with more iGaming platforms embracing blockchain and allowing the use of cryptocurrencies.

How to choose the top iGaming payment methods

Choosing the right payment method for iGaming involves considering various factors to meet the needs of both the gaming platform and its players. Here are some tips to guide you:

1. Understand your audience

Know your players and their preferences. Some may prefer traditional methods like credit cards, while others may lean towards newer options like digital wallets or cryptocurrencies.

2. Consider global accessibility

If your gaming platform caters to an international audience, choose iGaming payment methods that are widely accepted globally. This ensures accessibility for players from different regions.

3. Evaluate transaction costs

Understand the fees associated with each payment method. Some methods may have higher transaction costs, which can impact both the gaming platform and the players.

4. Prioritise security

Security is paramount in iGaming. Choose iGaming payment methods with robust security features to protect both player information and transaction integrity.

5. Offer diverse options

Provide a variety of payment options to cater to different player preferences. This includes traditional methods, e-wallets, bank transfers, and even emerging options like BNPL or cryptocurrencies.

6. Consider processing speed

Evaluate the speed of transactions. Some players prefer instant deposits and withdrawals, while others may be willing to wait a bit longer for transactions to process.

7. Stay compliant with regulations

Understand and comply with regional and international regulations related to online gaming and payments. This ensures legal and smooth operations.

8. Test user experience

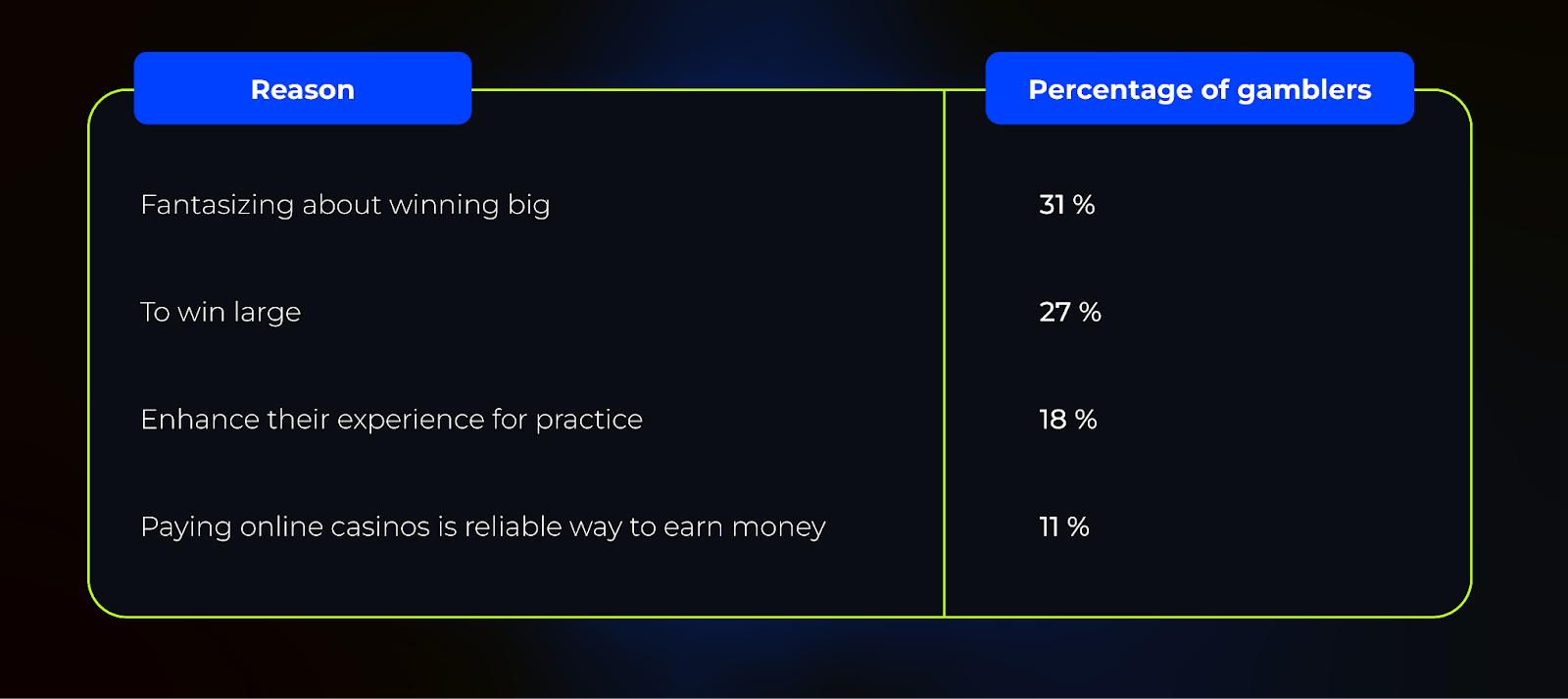

According to a worldwide statistic, 41% of gamblers play online for enjoyment (see Fig.1).

Figure 1. Leading motivations for gambling online worldwide

Hence, user experience is paramount to keep your players when they are playing and paying. Test the chosen iGaming payment methods from a player’s perspective to ensure a seamless and user-friendly process.

9. Provide customer support

Offer reliable customer support for payment-related queries. Clear communication and assistance can enhance trust and satisfaction among players.

10. Adopt a fraud prevention strategy

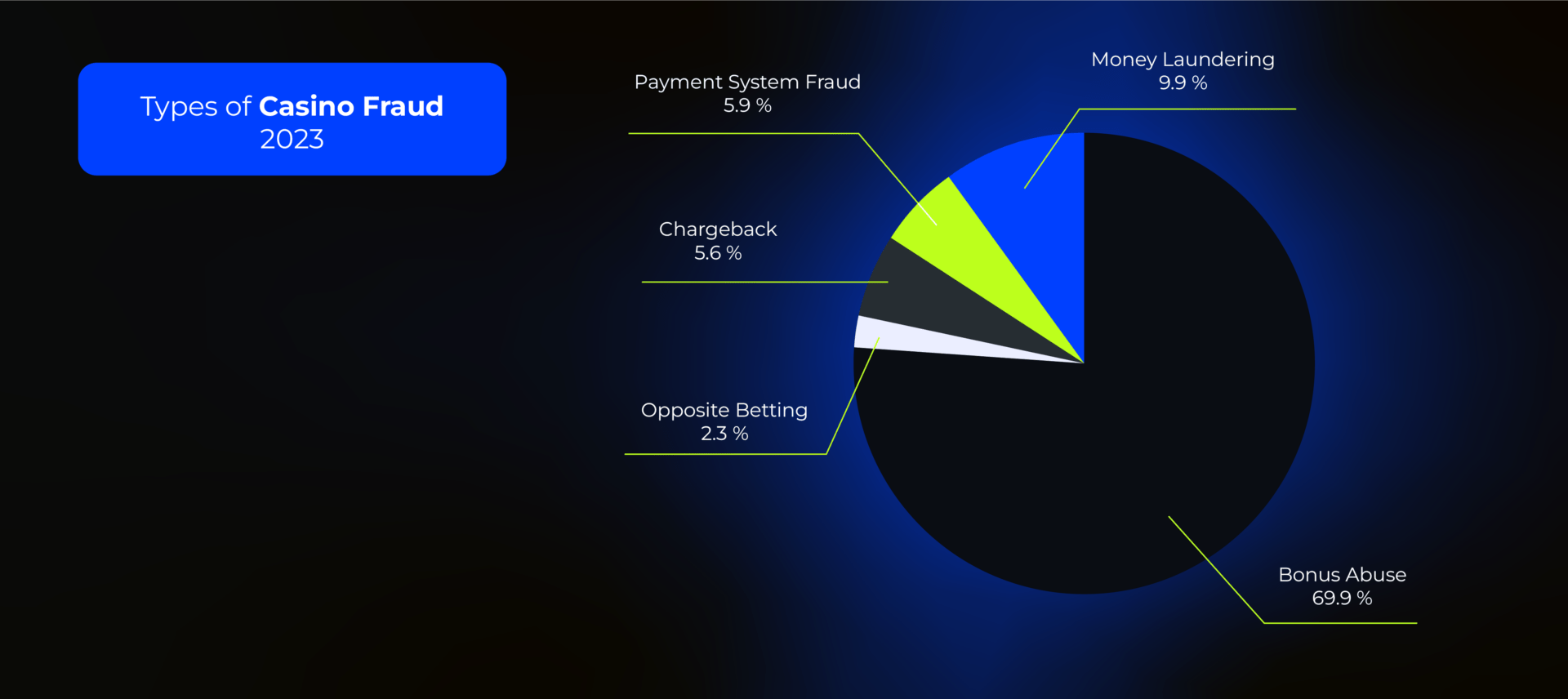

According to iGaming Report 2023 by trackier.com, bonus abuse is one of the most widespread types of casino fraud (see Fig. 2).

Implement fraud prevention measures to protect your platform and players. This can include using advanced verification processes and monitoring for suspicious activities.

Figure 2. Main casino fraud types by percentage

By carefully considering these steps and tips, you can select the right iGaming payment methods that align with your iGaming platform’s goals. This ensures they provide a positive experience for your players.

PayDo as the one among the top iGaming payment methods

At PayDo, we realise the importance of providing multiple payment options for your users. Our Checkout solution provides all iGaming payment methods your customers need in one place and with only one contract and integration.

We offer:

- All-in-one contract & integration

- 350+ payment methods for customers

- 170+ supported countries

- Unlimited websites within 1 account

PayDo simplifies payments for iGaming platforms with its One-Click Payment feature. It allows users to link their cards and pay with a single click. This improves customer retention and increases your conversion rates.

To address the challenge of commitment to monthly volumes, we provide flexible targets accommodating market conditions and player behaviour. Integrating deposits and mass payouts in one place simplifies the iGaming experience. And Fast Settlements solution ensures real-time payment processing for instant settlements. It reduces delays associated with different iGaming payment methods.

Overall, PayDo’s commitment to security and flexibility makes PayDo Business Account and Checkout Services reliable choices for iGaming platforms.

Conclusion

The payment landscape in the iGaming industry involves various methods

Among them are:

- debit and credit cards;

- digital wallets;

- direct debit for regular payments;

- secure bank transfers;

- BNPL options;

- mobile payments;

- crypto payments.

Choosing the right payment method for iGaming involves understanding the audience, its needs and preferences. At the same time, businesses should consider such factors as global accessibility, transaction costs, security, and regulation compliance.

Taking into account these factors, iGaming platforms can enhance the user experience and ensure smooth and secure transactions.

Open a PayDo Business Account to unlock the possibilities of cross-border payments for your business.