Why B2B and B2C Payments Demand Different Strategies

Digital payments in commerce are growing and evolving rapidly. The fintech-for-commerce market is booming, driven by the demand for faster, more efficient payment processing. Digital and automated B2B payments are projected to reach a global market value of $18 trillion by 2028, while B2C payment revenues are expected to hit $159.8 billion by 2032.

But what exactly are B2B and B2C payments? What sets them apart—and how do they differ from each other? In this guide, we break it down to help fintech providers develop tailored software solutions for each payment model.

What are B2B and B2C Models?

B2B and B2C represent two common business models based on the target audience: Business-to-Business (B2B) and Business-to-Consumer (B2C). B2B companies provide products or services to other businesses, while B2C companies cater to individual consumers.

It’s also common for companies to engage in both models—offering bulk deals for businesses and smaller-scale products for consumers. Some go a step further by adopting hybrid approaches such as B2B2C (Business-to-Business-to-Consumer) or B2C2B (Business-to-Consumer-to-Business).

What Is the Difference Between B2B and B2C Payments?

At first glance, it might seem like payment types don’t differ much between B2B and B2C. But in reality, payment infrastructure requirements can vary significantly. For banks and EMIs, supporting one model doesn’t automatically mean readiness for the other.

Here’s how they differ:

- Number of stakeholders involved. B2B purchases typically involve multiple stakeholders and are made on behalf of an organization. In contrast, B2C payments are made by a single individual for personal use.

- Average payment size. B2B payments are generally much larger due to bulk purchases or high-value services. For example, the average B2B transaction is around $491, compared to $147 for B2C.

- Payment frequency. B2B clients often place recurring orders—especially for operational needs—while B2C purchases are more occasional and need-based.

- Payment terms. B2C payments are usually instant or prepaid. In B2B, payments are often made after the service or product is delivered, with longer invoicing cycles and approval processes.

- Subscription billing cycles. Consumers usually prefer monthly billing for flexibility. Businesses, however, often opt for annual plans due to budget stability and longer-term planning.

In summary, B2B transactions favor long-term contracts and recurring payments, while B2C transactions are immediate and transactional.

From a payment processing perspective, this means that B2B payments require:

- Higher transaction limits

- Stronger security due to greater financial risk

- Support for delayed or invoiced payments

B2C payments require:

- Speed and simplicity

- Strong fraud protection

- High-frequency, low-value payment handling

B2B2C and B2C2B

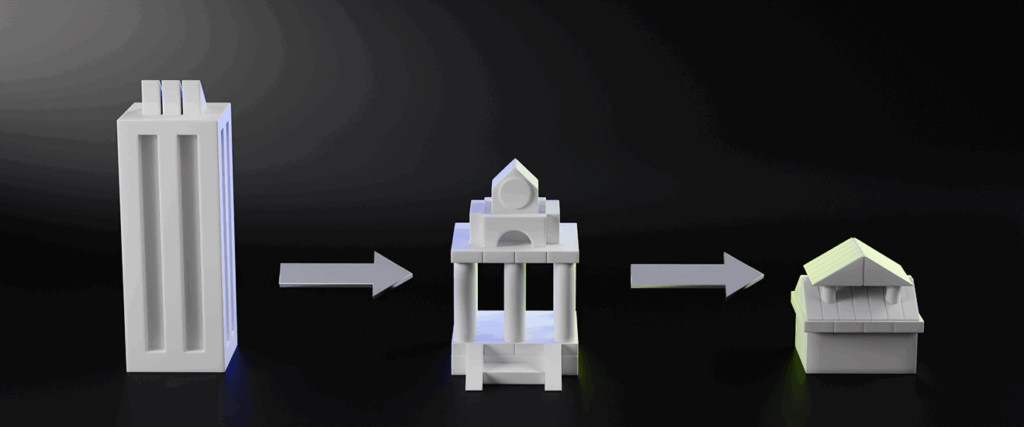

B2B2C (Business-to-Business-to-Consumer) extends the B2B model into consumer e-commerce. Here, businesses sell to other companies that then offer the service to end-users. A great example is a company providing restaurant booking software: the diners use the product, but the restaurant pays to integrate it.

This model adds financial complexity—requiring high levels of data sync and transaction visibility between all parties involved.

B2C2B (Business-to-Consumer-to-Business) starts with individual users and evolves into enterprise adoption. Tools like Slack, Notion, Figma, and Adobe often begin with free or low-cost plans for individuals and teams, later upselling full business licenses once adoption scales across a company.Payment systems for B2C2B must support both personal and enterprise-level transactions, prioritizing scalability and flexibility.

Conclusion

B2B is about scale, long-term relationships, and managing high-value, high-risk payments.

B2C is about speed, ease of use, and protecting individual users from fraud.

Fintech providers must understand these distinctions to build platforms tailored to each model’s needs. With hybrid models like B2B2C and B2C2B on the rise, the lines are blurring—but mastering the nuances remains essential.

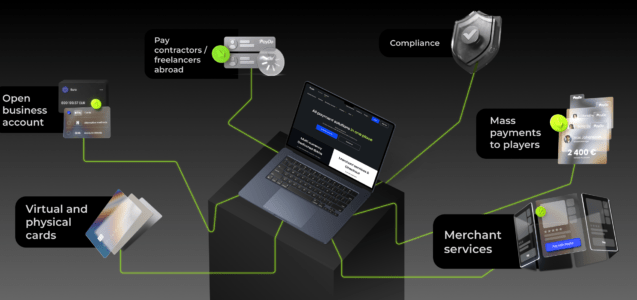

At PayDo, we’re built for both. Whether you operate in B2B, B2C, or anywhere in between, we’re here to power your payment processes. Drop us a line—let’s find the perfect fit for your business model.