Visa and Mastercard are currently responsible for more than 90% of all financial transactions taking place outside of China, so a company in need of a business account is likely to select one of the two. Making that choice, however, is no easy task, since both Visa and Mastercard offer robust toolsets.

The ultimate decision will depend on your business’ priorities – let’s see which credit card giant is best suited for your goals.

The Difference Between Business Credit Card and Personal Credit Card

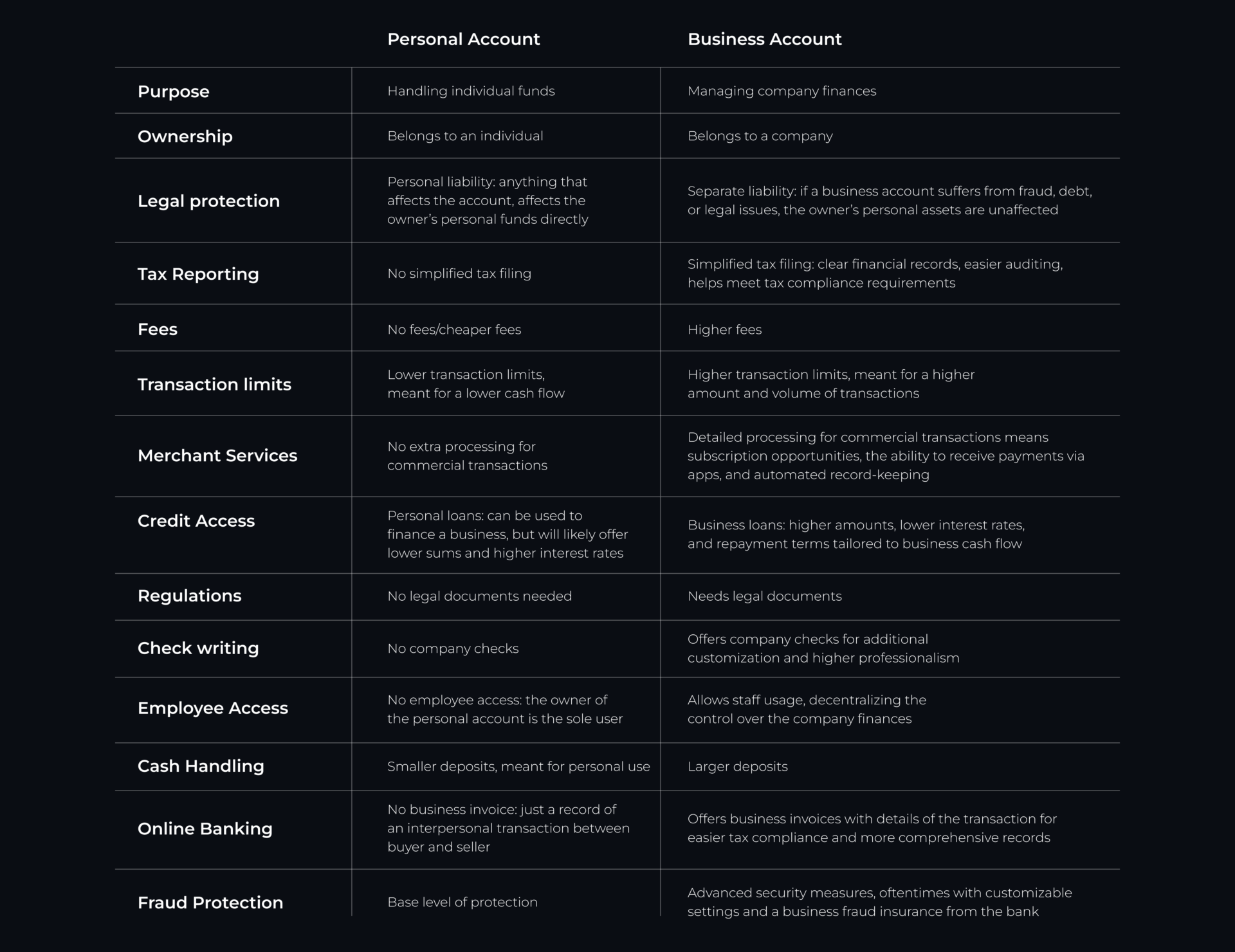

On the surface, it might seem like the main difference between a personal card and a business card lies in the fact that most banks will charge you for making a business account. Small business owners often use their personal cards for business transactions, finding the process of running a separate account too much of a bother.

The long-term reality of financially sustaining a business is a bit more complex.

Keeping your personal spending and business transactions separate is about more than work/life balance. A separate business account not only solidifies the legality of a business, but can also save more money than a personal card, despite the fees.

Here’s the breakdown:

Clearly, while very small privately-owned businesses can get by with a personal account, any strategies of growth need to include getting a business account. The real question is: which provider?

Visa and Mastercard for Business: What Do They Offer?

The card industry has been in a state of duopoly for decades. American Express came first, UnionPay came close, but it is Visa and Mastercard that share the throne, as well as more than 60% of the global market.

For corporations this huge, offering something your main competitor doesn’t means billions in revenue, so historically Visa and Mastercard went toe to toe updating their services. Here’s what that amounts to today.

Visa Business Cards

Known for offering a broad range of benefits across its card tiers, Visa offers four credit card levels: Visa Business, Visa Platinum Business, Visa Signature Business, and Visa Infinite Business. Every next tier includes the perks of the previous one, but also adds something extra.

| Visa Business | Visa Platinum Business | Visa Signature Business | Visa Infinite Business |

| Essential business spending tools: expense tracking, spending controls, and basic fraud protection | Essential business spending tools + Enhanced purchase protections, extended warranties, and travel perks | Essential business spending tools + Enhanced purchase protections, extended warranties, and travel perks + 24/7 concierge services, higher credit limits, and exclusive travel deals | Essential business spending tools + Enhanced purchase protections, extended warranties, and travel perks + 24/7 concierge services, higher credit limits, and exclusive travel deals + Luxury perks and priority access, the strongest insurance, and the highest credit limits |

Other business cards that cater to narrower subsets of clients are:

- Business Debit Card: a base-level replacement for cash and checks, great for small-scale controlled spending.

- Corporate Card: a high-level benefits card, aimed at company-wide entertainment and transportation.

- Corporate Funded (Prepaid) Card: a centralized and convenient way to reimburse your employees.

- Commercial Prepaid Card: a card that employees can use for controlled company spending.

- Virtual Card: a convenient analogue of a physical card that your employees cannot lose or forget when they need it.

- Fleet Card: a card that simplifies and offers profitable deals for spending on fuel, gas, and other things transportation.

- Purchasing Card: meant mostly for procurement, this card simplifies large-scale shopping for company needs.

Mastercard for Business

Mastercard offers Mastercard Standard Business, Mastercard World Business, and the ultimate World Elite Mastercard for Business credit cards.

| Mastercard Standard Business | Mastercard World Business | Mastercard World Elite Business |

| A comprehensive toolset for a small business: basic fraud protection and liability coverage, expense tracking, reporting tools, minimal travel insurance. | Standard toolset for a small business + Productivity-boosting financial tools, extra security, and upgraded travel services | Standard toolset for a small business + Productivity-boosting financial tools, extra security, and upgraded travel services + Higher credit limits, year-end account summaries, VAT reclaim service and an airport concierge service for travel |

In addition to these regular credit cards for business, Mastercard, much like Visa, has more niche options:

- Business Debit Card that is meant to manage the general cash flow of small and medium-sized companies;

- Business Prepaid Card that controls your spending with preloaded fixed amounts;

- Professional Credit Card that helps small businesses to manage both personal and professional spending;

- Corporate Card that is meant for large businesses with high travel and entertainment expenses;

- Corporate Fleet Card that helps fleet managers get a better grip on various off-the-map expenses;

- Corporate Purchasing card thar simplifies procurement payments and reduces payment processing spending.

What’s the Difference Between Visa and Mastercard for Business?

If you’ve made it this far, you can already tell that Visa and Mastercard have business offers that either fully mirror each other or at least provide comparable perks. Fully unique tools are a rare find for either of the two card giants, but they both still have certain elements that carry each company’s signature spin.

For example, the perks of using Visa for business are:

- Small Business Hub. Visa offers an entire database of business advice for up-and-coming entrepreneurs. This ecosystem features checklists, tips and guides that have no analogues at Mastercard. Mastercard’s Small Business Resource Center serves a similar purpose, but it is not structured in the same centralized and intuitive way.

- SavingsEdge. This cashback system offers ample opportunities to turn business spendings on tech, travel, office supplies, and business services into statement credits that appear automatically. Mastercard has a similar system in EasySavings, but it has partnerships with different companies for corporate discounts, so your choice can also depend on the exact brands you want your business to buy from.

- Proportional Fees. Visa’s transaction fees are proportional towards the card volume, so smaller card owners will pay less.

Advantages of Mastercard:

- Extensive Identity Theft Protection. In addition to the general all-encompassing security measures, Mastercard offers ID Theft Protection, providing services to assist cardholders in the event of identity theft. Visa Protect offers diverse risk solutions, but identity theft does not get special attention the way it does at Mastercard.

- Priceless Experiences. As a frequent sponsor of major luxury events and venues, Mastercard offers a broad marketplace of discounts for various activities, from festivals to SPA centers and restaurants. While this feature mostly targets individual card holders, large companies may like to treat their employees to something off of the list for a special occasion.

- Dynamic Fees. Mastercard’s transaction fees percentage of global dollar volume

Visa and Mastercard: Which is Better?

It is time for the final showdown.

If your business could benefit from a wide selection of cards for various niche types of purchases, Visa will win by a hair. It will also be the better choice for small business owners who would appreciate having a vast library of learning resources on standby.

Mastercard will win the hearts of high-level enterprises, wanting to splurge on premium experiences when traveling. Business owners who see identity theft as a big concern may also feel safer going with Mastercard.

If these differences seem fairly small, it’s because they are. The duopoly of Visa and Mastercard is upheld by the fact that their offers are extremely similar. Study the list of their partners and see which exact brands your business is more likely to buy from, decide whether you want proportional or dynamic fees, and make your decisions from there.

PayDo accounts will support your Visa or Mastercard – regardless of your choice, we will be here to ensure maximum flexibility and convenience. Fill out a contact form and unlock all payment solutions in one place!