What Are Virtual IBANs (VIBANs) and How to Use Them

We have talked at length about the International Bank Account Number (IBAN) – the standard for international transfers. What makes it worth it, how to find it and understand what how it works – PayDo covered it all. Now, it is time to discover the next stage of IBAN evolution – a vIBAN.

What Is a Virtual IBAN Account (vIBAN)?

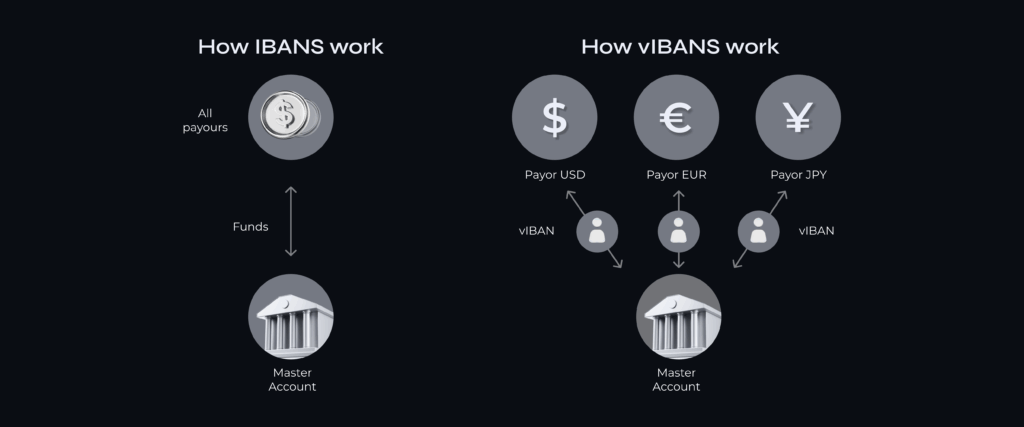

A vIBAN is a virtual sub-account for a physical master bank account. It might appear confusing, since it is also possible to see, access and use the regular IBAN via various fintech aps and e-banking services, but virtually-accessed IBAN and a virtual IBAN are not the same. Let’s talk about their differences in more detail.

| IBAN | vIBAN |

| The superior account; can exist without a vIBAN | The sub-account; cannot exist without an IBAN |

| One code that matches to one account and funnels all of the international payments into it | Can be multiple codes matching to one account and funneling international payments from different vIBANs into one main IBAN |

| Dedicated only to the owner | Can be dedicated to different clients and projects |

| Single-currency | Different vIBANs for separate currencies that are still tied to the main IBAN create a multi-currency option |

| Harder to sign up for | Easier to obtain; the full process can happen online |

While a virtual IBAN cannot exist on its own, tied to a regular IBAN it turns into a powerful upgrade that can expand the types of transactions for its owner. It is simple to open and operate, with benefits that can save time and money for certain kinds of businesses.

Who Needs a Virtual IBAN?

Companies that operate internationally – in terms of customers and employees alike – are the main target audience for virtual IBANs. A vIBAN simplifies the multi-currency exchanges like paying salary to workers in different countries ore receiving transactions from different markets, all with minimal conversion rates.

In addition to making multi-currency exchanges cheaper and faster, vIBANs can be great for users that suffer from IBAN discrimination. This problem occurs when someone can neither send nor receive a SEPA bank transfer, or set up a direct debit, because the company they are paying denies a bank account with a different country code. As a result, people and businesses might not be able to use important services like phone plans or electricity.

Additional benefits of using vIBANS for businesses are:

- Lower transaction fees due to the absence of intermediaries.

- Real-time visibility that boosts transparency.

- Ability to manage individual client balances separately from operational funds.

Two other ways in which vIBANs help businesses are by simplifying the reconciliation process and reducing the number of bank accounts to manage.

How Virtual Ibans Simplify Reconciliation

Account reconciliation consists of aligning two sets of records, usually from internal and external statements, to see that they match and there was no fraud or theft. Virtual accounts help companies simplify their reconciliation processes in the following way:

- The bank generates multiple vIBANs linked to a single real account.

- Each vIBAN is assigned to a specific client, entity, or project.

- When payments are made, they reference the appropriate vIBAN.

- The bank processes these payments into the real account, and the corresponding vIBAN appears on the bank statement.

- The company integrates these statements into their ERP system, using the vIBANs to match payments to the correct client or project.

The result is reduced manual effort and errors, which makes it easier to track and reconcile payments.

How Virtual Ibans Simplify Account Management

Virtual accounts also allow companies to reduce the number of real bank accounts they manage:

- The bank creates vIBANs linked to a single real account.

- Each vIBAN is assigned to different entities or locations within the company.

- Payments are made to these vIBANs, but all funds are collected into the single real account.

- The bank statement reflects the vIBANs used, and the company can allocate funds accordingly.

This structure simplifies account management and boosts the overall control companies have over their cash flows.

Conclusion

A vIBAN is the next stage in the progress of IBAN codes. These two concepts are very similar in their functionality, but a virtual IBAN grants its users an extra level of flexibility, transparency, and accessibility. Even so, vIBANs are a fairly recent term in financial technology, so we are likely to witness them evolve even further with new features that will widen the gap between the regular and the virtual.

Jump on the bandwagon early – talk to PayDo about our IBAN services and see how our product can push your business to new financial heights.