What is a Company Registration Number and How to Find It

A Company Registration Number (CRN) is a code a business gets during incorporation. It acts as a distinct identifier for your company. It helps to differentiate your company from others and is vital for all official records.

What is a Company Registration Number?

What is a registered number? Often called a company ID or CRN number registration, this number serves as proof of incorporation and is used in all official documents. It’s different from a business registration number, as it identifies the company specifically rather than just its general business activities.

For example, if you register a company named “GreenTech Solutions Ltd” in the UK, you might receive a CRN like “12345678”. This number uniquely identifies GreenTech Solutions Ltd and ensures authorities officially recognize it. This CRN is specific to your company, unlike a general registration number that could apply to business activities or licenses.

Where Can I Find My Company Registration Number?

You can find your Company Registration Number in the following places:

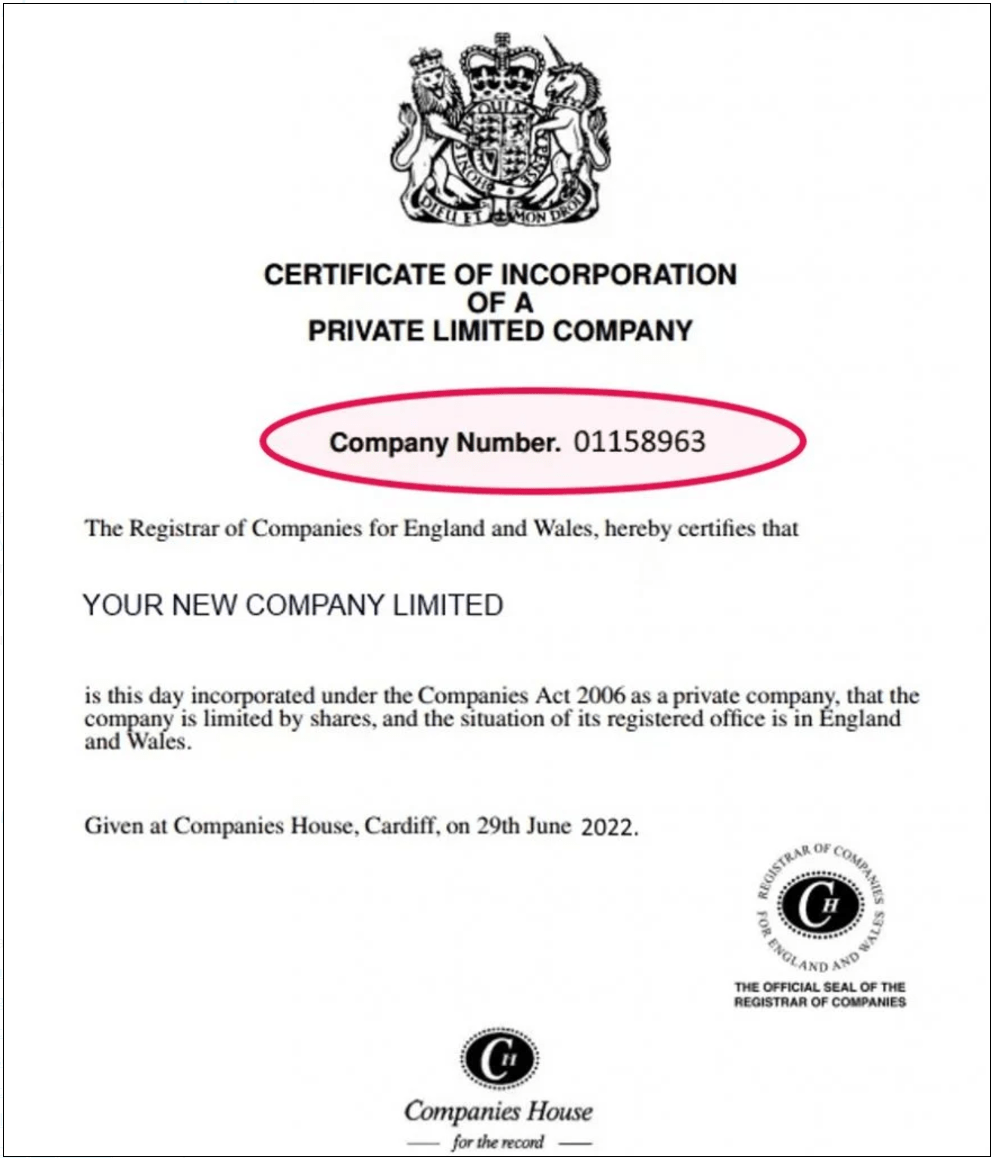

- On the certificate of incorporation issued by the registration authority upon the successful registration of your business.

- In various official documents, such as tax filings, annual reports, or company invoices.

- Online by searching for your business on the official business registry’s website using your company name or registration ID. There is a Company Registration Number check online available here (for UK only).

If you have the following question: What is my Company Registration Number in UK? Here’s an example of a Company Registration Number to give you an idea:

What is the Difference Between a VAT Number and a Company Number?

A Company Registration Number bundles information that government agencies and administrative bodies can use to verify and differentiate your company from others. As an entrepreneur, you must include the CRN on all official documents, such as invoices, contracts, and correspondence. It is also mandatory to display your CRN on your company’s website for transparency and legal compliance.

VAT Number

A VAT number is assigned to companies that are required to collect Value Added Tax (VAT) on their goods and services. While a VAT number may be similar to your Company Registration Number, key differences exist. A VAT number is activated separately and is used specifically for tax purposes related to VAT.

For instance, in some regions, a VAT number might begin with certain prefixes, like “BTW BE,” followed by the Company Registration Number (e.g., “BTW BE0123.231.324”). Remember that you can only use your VAT number after it is activated with the appropriate tax authorities, even if it resembles your CRN.

When Will I Use My Company Registration Number?

You will need your Company Registration Number in many situations, including:

- Making Changes to Your Company. When changing your company name, address, or registered office, add or remove a director or secretary or update their details.

- Filing Documents. When submitting annual confirmation statements, annual accounts, or filing copies of resolutions. Changing your accounting reference date or increasing share capital is also necessary.

- Dealing with Tax Authorities. When registering for business taxes, paying Corporation Tax, filing Company Tax Returns, and reporting PAYE.

- Dealing with Banks and Financial Institutions. When opening a business bank account or applying for loans and other forms of commercial credit.

- Issuing or Transferring Shares. When allotting, selling, or redistributing shares, issuing share certificates, or issuing dividend vouchers.

- Changing Company Status. When altering the company’s status, such as converting it from active to dormant.

- Dissolving the Company: When dissolving the company.

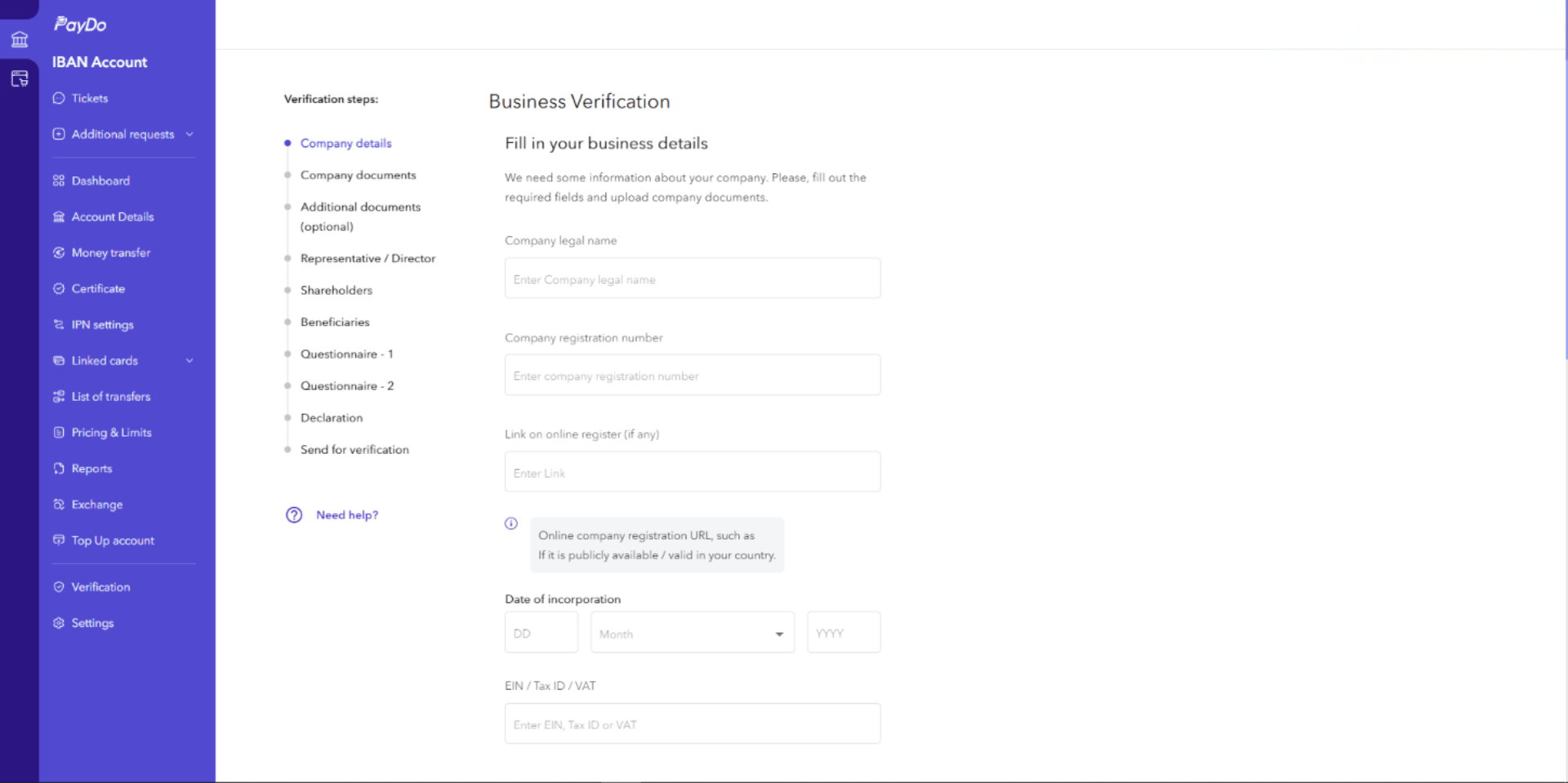

Besides, one of the key places you need a Company Registration Number is to pass verification when opening a business account at PayDo.

Additionally, you must include your Company Registration Number in all forms of business communication, including:

- Business Stationery: Such as official letters, emails, invoices, receipts, and order forms.

- Online Presence: Company websites must also display the CRN as per regulatory requirements.

The CRN serves as proof of legitimacy for your business and is essential for all official interactions.

Conclusion

A Company Registration Number is an important identifier that verifies your business’s legal status. It ensures that your company complies with all legal requirements and helps maintain accurate records. Always keep your CRN easily accessible, as it is needed for many official transactions and communications related to your business.