A Merchant ID, or MID, is a unique identifier assigned to a business by its payment processor or acquiring bank when it starts accepting card payments. This ID is key for ensuring payments go to the right merchant account. Essentially, it’s the digital fingerprint of a business in the payment processing ecosystem.

- A MID directs payment funds to the merchant’s account with precision.

- A MID plays a pivotal role in preventing errors and fraud.

Let’s see what else we can say about MID to help you get the best out of it.

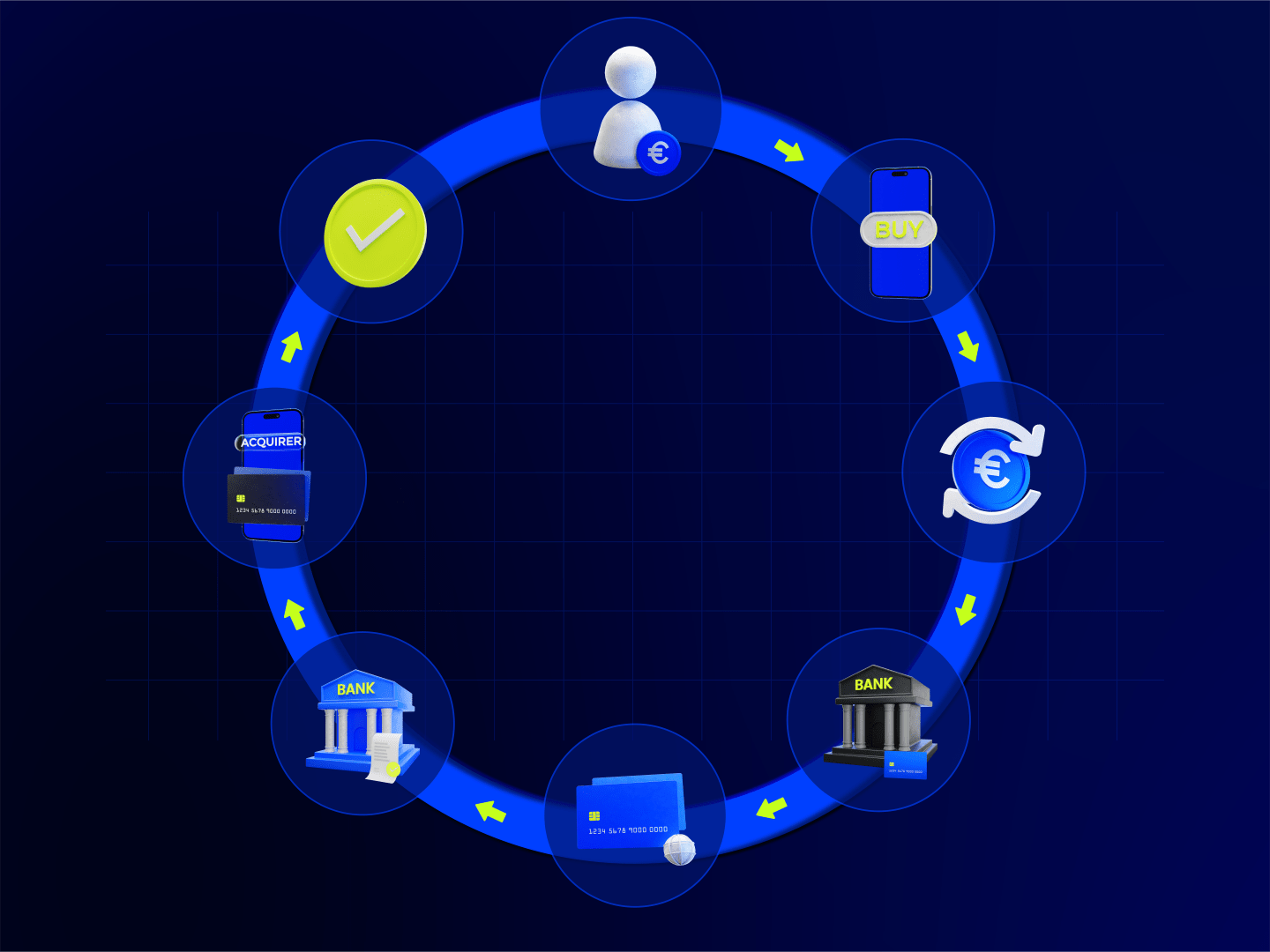

The Payment Processing Mechanism

Payment processing involves multiple parties working together.

Here’s a simplified breakdown of the key players and their roles:

- Customer. Initiates the transaction by purchasing using a credit or debit card.

- Merchant. The business sells goods or services. They collect the customer’s payment information and forward it to their payment processor.

- Payment Processor. Acts as the intermediary between the merchant and the financial institutions. It processes the payment on behalf of the merchant by sending the transaction details to the acquiring bank.

- Acquiring Bank. The merchant’s bank receives the transaction details from the payment processor. It then communicates with the card network.

- Card Network. This includes Visa, MasterCard, and others. The card network routes the transaction details to the issuing bank for approval.

- Issuing Bank. The bank issues the customer’s card. It verifies the transaction, checks for sufficient funds or credit, and approves or declines it.

- Acquirer. Receives the transaction approval or decline from the issuing bank via the card network and relays this information to the payment processor, who then informs the merchant.

- Settlement. After approve, the transaction is settled, and the funds are transferred from the issuing bank to the acquiring bank and finally to the merchant’s account.

Importance of a Merchant ID in Making Transactions Accurate

MID is crucial in this multi-step process to ensure each transaction attributes to the correct merchant. Every business receives a unique MID when they set up their merchant account. Companies use this ID at every transaction stage to track and manage payments accurately.

Imagine a customer purchasing a book from “ABC Books” online. A MID ensures that the payment for this purchase goes to “ABC Books” and not mistakenly to another merchant.

Introduction to the Seller’s Identifier (Merchant ID) and Its Role in Payment Processing

A MID is a unique numerical identifier the payment processor assigns to the merchant. It plays a vital role in the payment ecosystem by ensuring the correct routing of funds and minimizing errors.

Here’s how it works:

- Transaction Initiation. When a customer purchases, the transaction details, including the merchant’s MID, go to the payment processor.

- Routing and Approval. The payment processor uses a MID to route the transaction through the appropriate channels (acquiring bank, card network, issuing bank).

- Settlement. A MID makes certain the funds reach the correct merchant account.

This identification system significantly reduces the risk of misdirected payments and allows merchants to receive their payments promptly and accurately. It also aids in managing chargebacks effectively, as a company can track and verify transactions using a MID.

Understanding Merchant ID

MID is a unique identifier assigned to a business by its payment processor or acquiring bank when it sets up a merchant account to accept card payments. This identifier acts as a digital fingerprint, allowing the payment processing system to recognize and route transactions to the correct merchant.

Detailed Description of How Merchant ID Prevents Errors in Transactions

A MID is integral to the payment processing system, ensuring accuracy and reliability. Here’s how it helps prevent errors:

- Accurate Routing. A MID ensures that transaction details are routed through the correct channels, from the payment processor to the acquiring and issuing banks. This minimizes the risk of funds being directed to the wrong account. A customer purchases a book from “Book Haven.” A MID associated with Book Haven ensures the payment is correctly routed to another merchant selling similar products.

- Verification and Settlement. During the verification process, a MID helps confirm that the transaction is legitimate and that the merchant is authorized to receive the payment. This reduces the chance of fraudulent transactions and errors in settlement. When “ABC Electronics” processes a transaction, a MID verifies that ABC Electronics is the payment recipient, ensuring no mix-up with another electronics store.

- Chargeback Management. In disputes or chargebacks, a MID helps track and manage the transaction history accurately. This ensures that chargebacks are processed correctly and attributed to the correct merchant, assisting in efficient dispute resolution. If a customer disputes a transaction at “Gadget World,” a MID helps trace the transaction, ensuring that any chargeback is correctly handled without affecting unrelated transactions.

Importance of Keeping a Merchant ID Secure and Only Sharing It When Necessary

A MID is a critical component of a business’s payment infrastructure, and its security is paramount. Here’s why keeping a MID secure is crucial:

- Preventing Fraud. Sharing a MID indiscriminately can expose the business to fraudulent activities. Unauthorized individuals could use a MID to process fake transactions, leading to financial losses and reputational damage.

- Maintaining Transaction Integrity. By keeping a MID secure, businesses ensure that all transactions processed under their merchant account are legitimate and authorized. This helps maintain the integrity of their financial operations.

- Minimizing Disputes and Chargebacks. Secure handling of a MID reduces the risk of disputes and chargebacks, as it prevents unauthorized transactions from occurring in the first place.

A MID is a vital identifier that ensures the accurate processing of transactions, protects against errors and fraud, and helps manage chargebacks efficiently. Businesses must treat their MID with the same level of security as other sensitive financial information, sharing it only when necessary to maintain the integrity of their payment processing systems.

Acquiring a Merchant ID

You need to know several vital things when acquiring a MID.

Steps Involved in Obtaining a Merchant ID

Obtaining a MID involves several vital steps to ensure the business is legitimate and capable of processing card payments. Here’s a detailed overview of the process:

- Research and Choose a Merchant Service Provider. The first step is to find a reputable merchant service provider or acquiring bank that offers the necessary payment processing services.

- Application Process. Apply to the chosen provider detailing your business’s operations, expected transaction volumes, and other relevant information.

- Review and Approval. The provider reviews the application, assessing the business’s risk level and suitability for a merchant account.

Partnership with a Merchant Service Provider or Acquiring Bank

Forming a partnership with a merchant service provider or acquiring a bank is essential for obtaining a MID. This relationship is crucial for several reasons:

- Transaction Processing. The provider facilitates the processing of card payments, ensuring funds are correctly routed and settled into the merchant’s account.

- Support and Services. Providers offer various support services, including fraud detection, chargeback management, and customer service, which are vital for seamless operations.

- Compliance and Security. Acquiring banks and service providers ensures merchants comply with industry standards and regulations, such as PCI DSS, to protect sensitive card information.

Required Documentation and Verification Process

To obtain a MID, businesses must provide several documents and undergo a thorough verification process. This helps the provider verify the legitimacy and financial stability of the company:

- Business Information. Details about the business structure, ownership, and operational model.

- Financial Statements. Recent bank statements and financial records to assess the business’s economic health.

- Tax Information. Tax identification numbers and related documentation to ensure compliance with tax regulations.

- Personal Identification. Identification documents of the business owners or principals to verify their identities.

Duration and Permanence of a MID Once Obtained

Once a business gets MID, it typically remains with the business for the duration of its relationship with the merchant service provider or acquiring bank. Here are some key points to consider:

- Long-Term Use. a MID is designed for long-term use, remaining valid as long as the business continues its partnership with the provider and complies with the terms of service.

- Stability and Consistency. Maintaining the same MID ensures stability and consistency in transaction processing and record-keeping.

- Reapplication for New ID. The business must reapply for a new one if a MID is revoked due to excessive chargebacks or non-compliance.

By following these steps and maintaining a solid partnership with a merchant service provider, businesses can obtain and retain an MID that facilitates smooth and secure payment processing.

Conclusion

A MID is critical for any business accepting card payments. It ensures accurate routing and transaction settlement. And prevents errors as well as helps in managing disputes along with chargebacks.A MID gives each business a unique ID. It is key to the payment system’s integrity and efficiency. Similarly, PayDo, as a payment ecosystem, is the key to business growth. Open a Business Account today, transact in 35+ currencies, and reach more than 140 destinations.