The International Bank Account Number (IBAN) was originally adopted by the European Committee for Banking Standards (ECBS) in 1997 as the international standard ISO 13616 under the International Organization for Standardization (ISO). Originally created to make payments easier within the European Union, IBAN number is now used by most European nations and many other countries globally to standardise banking transactions.

So, if you’re doing business with international suppliers, you have clients abroad, or maybe your contractors operate from multiple countries, you will most definitely need an IBAN for international payments. Here’s everything you should know about IBAN and its role in cross-border transactions.

What Is the IBAN Number?

IBAN number is a standard international numbering system developed to identify an overseas bank account.

Is IBAN same as account number? In reality, it can be both same and not same. It all depends on whether you send/receive funds to/from the IBAN countries.

What is IBAN in banking? Basically, each bank account has its own IBAN number, which helps people find where the account is, no matter where it is in the world. IBANs are mainly used for international transactions to ensure money goes to the right place.

IBANs can be as short as 15 characters (in Norway) or as long as 34 characters. Shorter IBANs are common in Europe, while longer ones are more typical outside of Europe (See Fig.1)

What do the numbers in IBAN mean?

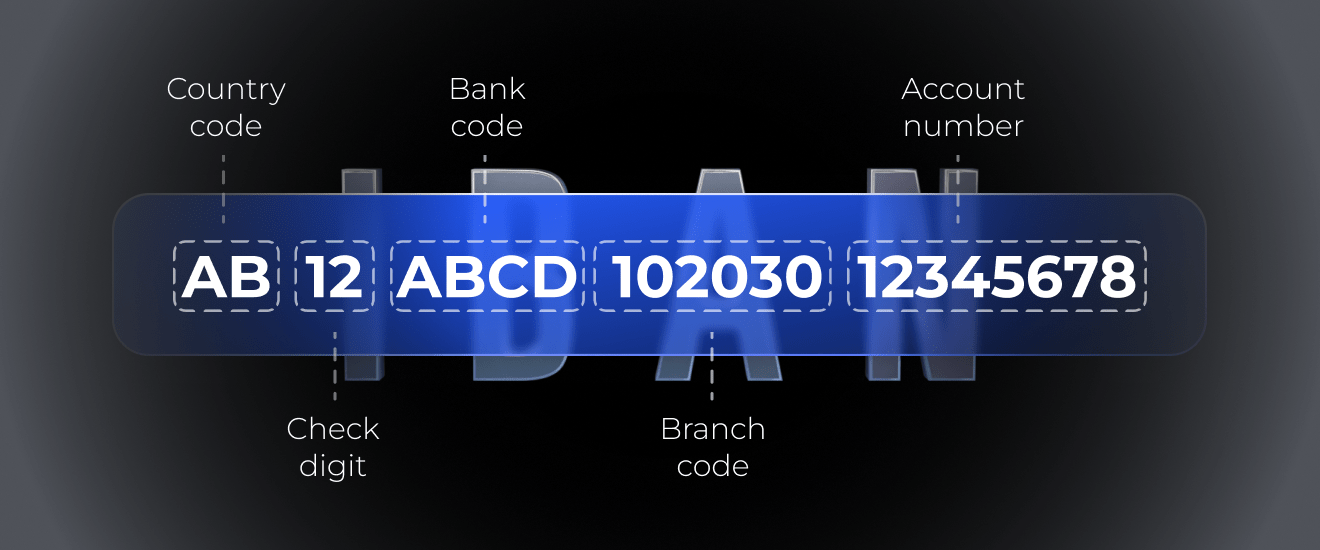

Here’s an IBAN number example to illustrate:

- The first two digits show which country the account is in.

- The next characters usually show the bank’s code.

- The rest usually show the branch code and account number.

Figure 1. IBAN example.

In certain countries, banks don’t use IBANs. For instance, in the United States and Canada, they use a mix of transit/routing numbers and account numbers. Australia relies on Bank State Branch (BSB) codes for local payments and Cross-border codes for international transfers.

Using IBANs makes it easier for banks to handle international payments. It reduces mistakes and the need for people to fix things by hand, which can cost time and money. There is a list of IBAN countries you need to know.

Difference Between Cross-border Code and IBAN Number

Cross-border code and IBAN number are globally accepted methods for identifying bank accounts in international transfers. Their main difference lies in the type of information they convey.

A Cross-border code pinpoints a particular bank in an international transaction, whereas an IBAN is utilised to identify the individual bank account engaged in the transfer.

Here are a few more differences between Cross-border and IBAN:

- Cross-border came before IBAN and is the big system for sending money worldwide. IBAN is newer and helps identify individual bank accounts.

- An IBAN has ~32 letters and numbers, with a two-digit country code and a two-digit checksum. It helps identify a specific bank account and where it’s from.

- A Cross-border code contains 8 to 11 letters and numbers. It includes four letters for the bank, a two-letter country code, a two-digit location code, and sometimes three digits for the branch.

- Unlike IBANs, Cross-border codes don’t pinpoint a specific account.

- Usually, when you send money to a country that uses IBANs, you need both the Cross-border/BIC code and the IBAN to get the money to the right place.

Overall, a Cross-border code is used to identify a specific bank, while an IBAN code identifies a specific bank account.

Requirements

The requirements for an IBAN may vary depending on the country and the bank. However, the following are some general requirements for an IBAN:

- Is between 15 and 34 characters long.

- Start with a two-letter country code.

- Has two check digits.

- Contains domestic bank account numbers, branch identifiers, and routing information.

The IBAN format is consistent across all countries, although the number of characters may differ. For instance, Norway’s IBANs have 15 characters, while Liechtenstein’s have 21. The maximum length for any country’s IBAN is 34 characters.

It’s important to know that the IBAN system is mainly used in most European Union countries and other European nations. If you’re uncertain about making an international transfer, it’s always wise to verify with your bank first.

How is the IBAN used in cross-border transactions?

In cross-border transactions, the IBAN plays a key role in ensuring that money is sent to the correct bank account across different countries. Here’s how it works:

- The beneficiary’s bank provides the IBAN account number to the beneficiary.

- The beneficiary forwards the IBAN to the ordering customer.

- The ordering customer submits a cross–border credit transfer order, which includes the beneficiary’s IBAN.

- The ordering customer’s bank validates the IBAN and forwards the cross–border credit transfer to the beneficiary’s bank, which credits the beneficiary’s account on the basis of the IBAN.

Here, the IBAN acts as a unique identifier for bank accounts in different countries. It simplifies the international transfer process while ensuring your money reaches the intended recipient’s account securely and efficiently.

How to Find IBAN Number?

You can find your IBAN in a few ways. Check your bank statements or your online/mobile banking account. You can also look on your bank’s website or visit or call your branch.

So, how to find IBAN number? If you’re having trouble finding your IBAN, there is an online IBAN calculator to help. Just put in your country, bank account number, and sort code, and it will give you your IBAN. This is useful if you want to double-check before sending money internationally. It’s always smart to make sure your money is going to the right place.

The length of the IBAN varies from country to country and can reach 34 characters. As of right now, IBAN’s website lists:

- 86 countries participating in the IBAN system,

- 36 countries participating in SEPA (Single Euro Payments Area) using IBANs,

- 23 countries with partial or experimental use of the IBAN system.

The IBAN registry is a list of countries that follow the latest IBAN standards (ISO 13616). Published by Cross-border, it includes details about each country’s IBAN format.

Additionally, the registry updates the document’s history and explains key terms used in IBAN transactions.

The difference between an IBAN number and a virtual IBAN number

Virtual IBANs, also called vIBANs, are a modern way for organisations to manage international transactions and business expenses more easily. They might seem like regular IBANs, but there’s more to them.

First, virtual IBANs let you transfer money to an online account instead of a regular bank account. Getting a virtual IBAN is often easier because you apply online and avoid dealing with traditional bank paperwork.

Another big difference is that regular IBANs work with one currency, matching your bank account. However, virtual IBANs support multiple currencies. You can have different virtual IBANs for various currencies, and the money goes to one account in the end.

This makes vIBANs handy for businesses dealing with international clients or contractors worldwide. They can pay in the beneficiary’s currency, save on fees, and receive funds in different currencies, all directed to one place.

Get a dedicated virtual IBAN number at PayDo

Whether you are looking for an IBAN for personal reasons or require one for your company, PayDo has got you covered.

We offer Personal and Business IBAN accounts for your cross-border payments. Moreover, with PayDo, you can have IBAN accounts in currencies like EUR, DKK, and GBP.

If you need to receive payments from international customers – we also have you covered with our merchant solution. With a PayDo merchant account, you can accept payments from 170 countries in multiple currencies. Your customers can use cards or other 350+ payment methods to pay for your goods or services.

Creating a PayDo Business account is an easy way to get a dedicated virtual IBAN. You can do it from anywhere in the EU or even if you’re not in Europe.

Summing up

IBANs play a vital role in modern banking, facilitating transactions between countries and enabling individuals and businesses to send and receive funds internationally.

As the global financial landscape evolves, virtual IBANs have emerged as a modern solution for managing international transactions and business expenses. Offering greater flexibility and convenience, virtual IBANs enable businesses to operate seamlessly across borders, supporting multiple currencies and simplifying payment processes.

At PayDo, we offer virtual IBAN accounts for both personal and business use. Whether you’re sending or receiving payments from around the world, having an IBAN is a fundamental requirement for navigating the complexities of cross-border finance.

Contact us to learn more about a dedicated IBAN account for your business.