IBAN account number discrimination is a financial practice where companies or organisations refuse to accept IBANs from other countries within the Single Euro Payments Area (SEPA).

As more and more individuals and businesses rely on cross-border transactions, the issue of IBAN discrimination has come to the forefront. As the research by Estonian e-Residency banking shows, 29% of 1313 bank account holders have experienced IBAN discrimination. Among 240 respondents who live outside of the European Union, the proportion rose to 38%.

People and companies may face unfair treatment from denied services to higher fees simply because their bank account numbers originate from a specific country or region.

In this article, we will explore the issue of IBAN discrimination, its causes, and the toll it takes on businesses. We will also discuss actions that can be taken to counteract IBAN discrimination.

What is IBAN account number discrimination?

An IBAN (International Bank Account Number) is a unique identifier for bank accounts in a SEPA country. It consists of up to 34 characters, including the country code, bank code, branch code, and account number.

The IBAN was introduced in 1997 by the European Committee for Banking Standards (ECBS) to establish uniform bank account identification standards across Europe.

Despite efforts to standardise and improve payment processes, fintech companies still face significant operational challenges when expanding across Europe. IBAN discrimination is one of the key challenges they face.

IBAN discrimination is a form of financial inequality when companies or organisations refuse to accept IBANs from other countries within SEPA. This is illegal under the SEPA Regulation, which requires all payment service providers (PSPs) to accept IBANs from all SEPA countries.

Article 9 of the SEPA Regulation (EU 260/2012) specifically bans IBAN discrimination, stating that “a payer or payee cannot decide whether to perform a transaction based on the location of a transaction partner’s payment account.”

How does IBAN account number discrimination work?

IBAN discrimination can work in a number of ways. Let’s explore them:

- A company may refuse to accept an IBAN from a customer/business in another EU Member State.

- A company may charge higher fees for payments to and from non-domestic IBANs.

- In some cases, companies may even limit the services available to customers with non-domestic IBANs.

Like any other type of discrimination, IBAN injustice can hurt individuals and businesses. For individuals, it can make it difficult to receive their salary or pay their bills. For businesses, it can be challenging to trade and operate across borders.

According to a 2021 report by the European Commission, IBAN discrimination is still a problem in some EU Member States. The report found that the most common forms of IBAN discrimination are:

- Refusing to accept IBANs from other SEPA countries.

- Charging higher fees for payments to and from non-domestic IBANs.

- Limiting the services available to customers with non-domestic IBANs.

In the end, IBAN discrimination can take many forms, including refusing to accept IBANs from other EU Member States, charging higher fees, and limiting the services available to customers with non-domestic IBANs.

5 key reasons behind IBAN account number discrimination

Though the specific causes of IBAN discrimination vary between countries, incidents typically occur when individuals or businesses make cross-border payments.

Let’s explore some of the most widespread reasons for IBAN discrimination.

Reason 1. Lack of awareness

Companies that rarely serve foreign customers may be unaware of IBAN rules. For example, businesses that typically pay local employees may not realise they need to transact with international IBAN accounts.

Reason 2. Certain countries are more prone to IBAN account number discrimination

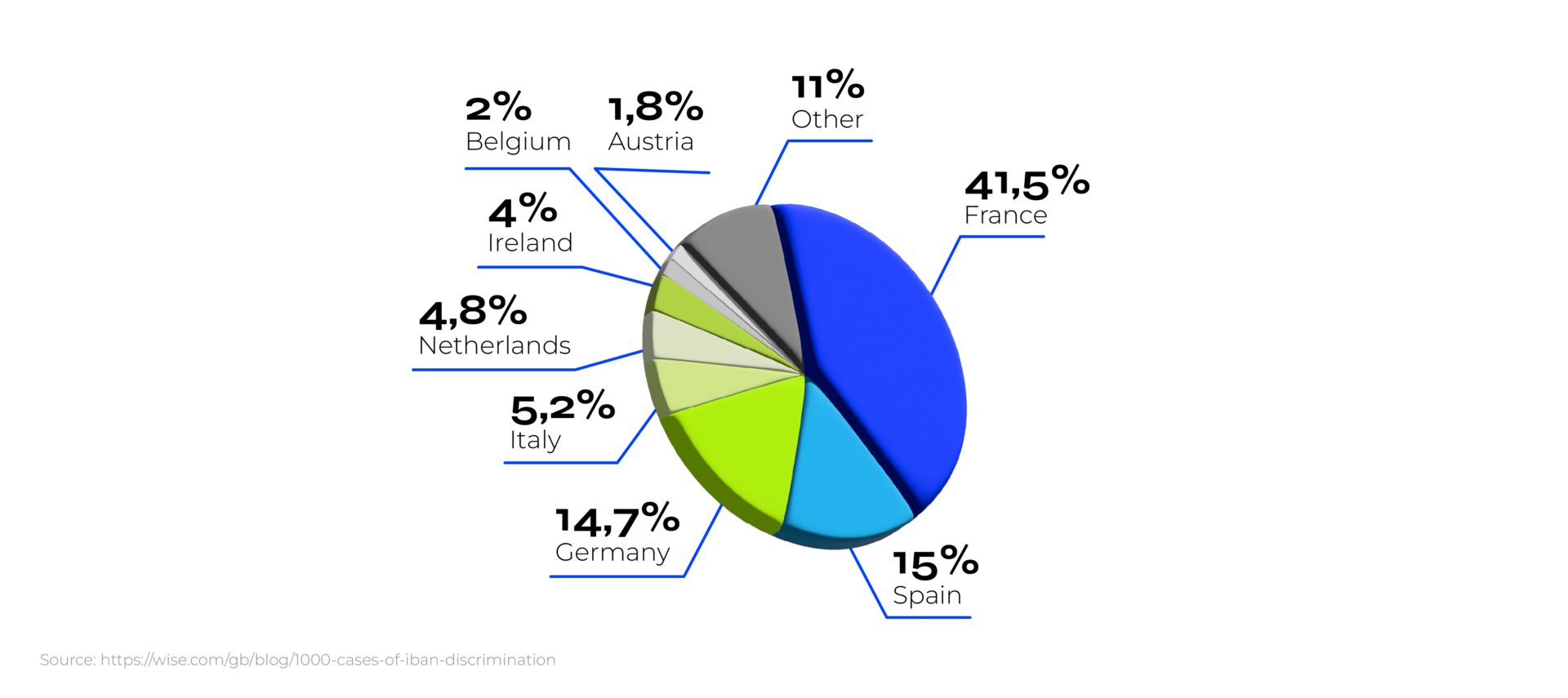

According to this research, France is responsible for 40% of surveyed IBAN discrimination cases, while Spain and Germany are each responsible for 15% of surveyed cases.

There is no clear reason why you might face IBAN discrimination, but the country in which you transact international euro payments might be one factor (see Fig.1).

Figure 1. Geographic split in IBAN discrimination across Europe

The prevalence of IBAN discrimination varies significantly across countries, with France, Spain, and Germany being notable examples. This suggests that the likelihood of encountering IBAN discrimination may depend heavily on the specific European country involved in the international euro payment transactions.

Reason 3. Financial regulations and compliance requirements vary across different countries and regions

These regulations are put in place to prevent money laundering, fraud, and other illicit activities. However, they can unintentionally contribute to IBAN discrimination.

Some financial institutions may have stricter regulations for certain countries or regions, leading to increased scrutiny and barriers for individuals and businesses operating in those areas.

Reason 4. The lack of standardisation in IBAN account number formats

Inconsistency in IBAN formats and varying requirements across different countries can contribute to discrimination. Some financial institutions may have difficulties verifying and processing IBANs from certain regions due to differences in formatting or missing information.

This can result in delays, higher fees, or even denial of services for individuals and businesses with IBANs from non-standardized regions.

Reason 5. Political events

Political events may also cause confusion around the law. For example, IBAN discrimination in the U.K. was reported to increase around 2021 as a result of Brexit.

In any case, this practice creates barriers to the smooth functioning of payment processing in the EU, which causes considerable detriment for both individuals and businesses.

The toll of IBAN account number discrimination on your business

IBAN discrimination can have a number of negative consequences for businesses:

- It can make it difficult to trade and operate across borders.

- It leads to higher costs, revenue losses, increased friction in the market, limiting options and causing difficulties for consumers.

- If your transaction partner does not cooperate with IBAN laws, you could have a hard time making or receiving important payments.

Exactly how this will impact your business depends on the type of transactions that you make.

For example:

- IBAN discrimination may restrict you from ordering products or services from a supplier when a business partner or supplier rejects your IBAN.

- You may be unable to pay employees or contractors in another country if a foreign payment network refuses to accept payments from your IBAN address.

Overall, IBAN discrimination can affect any sort of activity that involves financial transactions. Though fighting discrimination is sometimes necessary, choosing to work with known and trusted payment services can help you avoid discrimination before it occurs.

Actions to take when facing and counteracting IBAN account number discrimination

If you face IBAN discrimination, there are a number of things you can do. First, you should try to resolve the issue directly with the company or organisation concerned. If you are unable to fix the problem, you can report the incident to your national financial regulator.

You can also report IBAN discrimination to the European Commission. The Commission has a dedicated online platform where you can report incidents of IBAN discrimination.

How to report IBAN account number Discrimination?

To report IBAN discrimination to the European Commission, you can visit the following website.

Then, you will need to provide the following information:

- Your name and contact details

- The name and contact details of the company or organisation that discriminated against you

- The date and time of the incident

- A description of the incident

Once you have submitted your report, the Commission will investigate the matter and take appropriate action.

Avoiding IBAN discrimination with PayDo

At PayDo, we operate under SEPA regulations which mitigates IBAN discrimination risks for businesses and individuals.

After successful registration, you will get your own virtual IBAN to receive and send SEPA payments.

A virtual IBAN is a unique identifier that is assigned to your PayDo account. It is just as valid as a traditional IBAN (consists of up to 34 characters – the country code, bank code, branch code, and account number), and it can be used to transfer SEPA payments from anywhere in the world.

Virtual IBANs can be used by businesses of all sizes and industries. They are a versatile and cost-effective way to manage international payments. For example, a software company that has remote employees all over the world can create a virtual IBAN for each country where it has employees. This will allow employees to receive their salaries in their local currency.

The company can also use virtual IBANs to pay for local expenses, such as office rent and utilities. Additionally, the company can use virtual IBANs to make payments to contractors and suppliers in other countries.

How to get an IBAN with PayDo

- Go to Sign Up. Choose between Personal and Business Account and click [Create an account]

- Proceed with a short verification.

- Set up 2FA.

- After successful activation, you can find available IBAN here.

Conclusion

IBAN discrimination can cause difficulties for both individuals and businesses, limiting their options and forcing them to find alternative payment methods.

PayDo is a great option for businesses and individuals who want to avoid the phenomenon while receiving and sending SEPA payments from anywhere in the world.

With PayDo, you get a virtual IBAN that is just as valid as a traditional IBAN. This means that you can receive and send SEPA payments from anywhere in the world without having to worry about being discriminated against.

Want to learn more about the benefits you can get from your PayDo account? Get in touch with us today, and let us show you how PayDo can benefit your business.