When it comes to growing globally, businesses need to use localised checkout payment methods. This can help businesses build customer trust and position them for long-term success in the competitive online market. Businesses build a strong foundation for success by catering to the preferences of diverse consumers through localization.

This article examines the importance of gaining customer trust through localised payment methods. We’ll explore how offering payment options familiar to users makes transactions easier and strengthens the bond between businesses and customers.

The current landscape of checkout payment methods

The Baymard Institute asked online shoppers why they abandoned their online shopping carts. They found out that 8% of people leave because there aren’t enough ways to pay online. That’s a significant number of potential sales that are being missed.

However, that shouldn’t be a problem since many online payment service options are available on the market. And they evolve and grow every year. From traditional credit cards to newer methods like digital wallets and online transfers. The choices are diverse.

One notable trend is the continuous rise of mobile wallets and digital payments. More and more people are using their smartphones to make daily payments. Services like Apple Pay, Google Pay, and other digital wallets are gaining popularity.

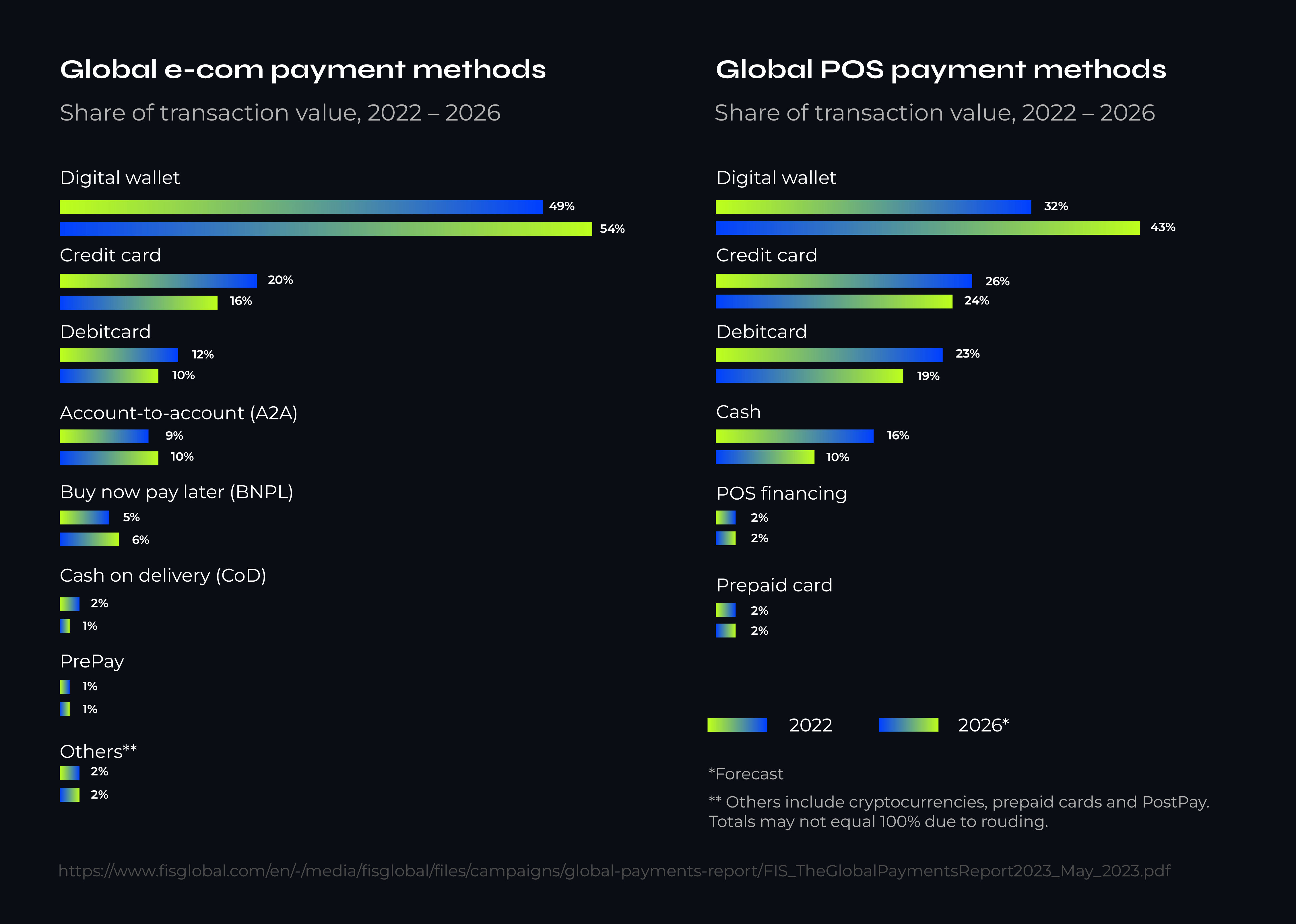

According to the Global Payments Report 2023, digital wallets remain the top & popular global payment method. They represent 49% of transaction value in e-commerce and 32% at point-of-sale (POS) in 2022.

Digital wallets are anticipated to continue to be the primary payment method in e-commerce (54%) and POS (43%) by 2026 (see Fig.1). This trend is fueled by competition among various players, including fintechs, banks, neobanks, super apps, EMIs, and device manufacturers – all competing to offer digital wallet services.

Figure 1. Global e-com payment methods

The trend above reflects a growing preference in the current payment landscape for convenient, contactless payment methods. What is important to know, incorporating multiple payment options can help businesses enhance consumer trust.

How does this work? Let’s find out.

Why is customer trust important, and how can localised checkout payment methods help?

Gaining the trust of your customers is crucial for several reasons. One significant aspect is its direct impact on conversion rates. When customers trust a business, they are more likely to make a purchase. Trust acts as a foundation for positive customer experiences, leading to increased confidence in a brand.

In today’s digital landscape, establishing trust is more crucial yet complex than ever. According to research from Salesforce, 73% of consumers emphasise that having confidence in companies is now more important than in the ecommerce past. However, the same study indicates that slightly over half of consumers find it increasingly challenging for companies to earn their trust.

Why is this the case?

Online shoppers are particularly concerned about receiving quality products or services at reasonable prices. Additionally, they prioritise the security of personal information shared during online transactions.

Financial data, in particular, is highly valued. RSA reports that 78% of consumers are the most protective of their financial information. Securing the checkout process with checkout payment methods, where sensitive information is exchanged, is paramount. It serves as a primary focus for merchants aiming to build customer loyalty.

Merchants can employ various strategies to protect their customers and establish trust. For example:

- Ensure PCI DSS compliance or collaborate with a payment service provider that facilitates compliance.

- Incorporate trust indicators throughout the checkout. For instance, independent ratings (e.g., Trustpilot), regulatory badges, and clearly stated return or exchange policies.

- Implement tokenisation in payment flows to securely store customer card details. This is particularly beneficial for businesses with a high volume of returning customers and essential for features like ‘one-click payments.’

- Thoughtfully incorporate regulations to add extra layers of security when using checkout payment methods.

- Implement anti-fraud protection, like 3D Secure. 3DS helps to reduce the likelihood of fraud with stolen card details, as a fraudster would need to pass through additional layers of verification to make a purchase.

As a result, higher trust levels often result in a higher conversion rate. When customers believe in the reliability, credibility, and integrity of a business, they are more inclined to complete transactions.

How localised checkout payment methods drive consumer trust

The global ecommerce market is expected to grow to $100.63 billion between 2020 and 2024, presenting a substantial potential for business expansion. By embracing localised payment methods, merchants unlock the door to global expansion, directly catering to customers’ payment preferences outside their home territories.

Local payment methods include various options. For example, digital wallets, bank transfers, local debit networks, and other global purchasing methods.

Localisation allows consumers to navigate the often complex landscape of payment methods. When individuals see payment choices that are widely accepted or align with their preferred methods, it instils confidence. This familiarity reduces the perceived risk associated with online transactions, contributing to higher levels of trust.

Payment localisation simplifies the payment processing for users, enabling them to choose familiar methods. It results in a smoother and more trustworthy online shopping experience.

The role of personalisation in checkout payment methods

Personalising payment options is essential for tailoring the experience to the customer’s needs. Businesses can enhance overall satisfaction by offering various payment methods and letting customers choose what suits them best.

Different people prefer different payment methods. Personalisation ensures a customer-friendly approach, such as offering traditional credit cards, digital wallets, or online transfers. Providing options and recommendations based on past preferences streamlines the checkout payment methods process. Additionally, it creates a more user-friendly environment.

However, it is important to find the balance between personalisation, which is great for your customers, and overcomplicating the payment process, which can lead to losing sales. Let’s explore this issue in more detail.

The risk of overcomplicating checkout payment methods

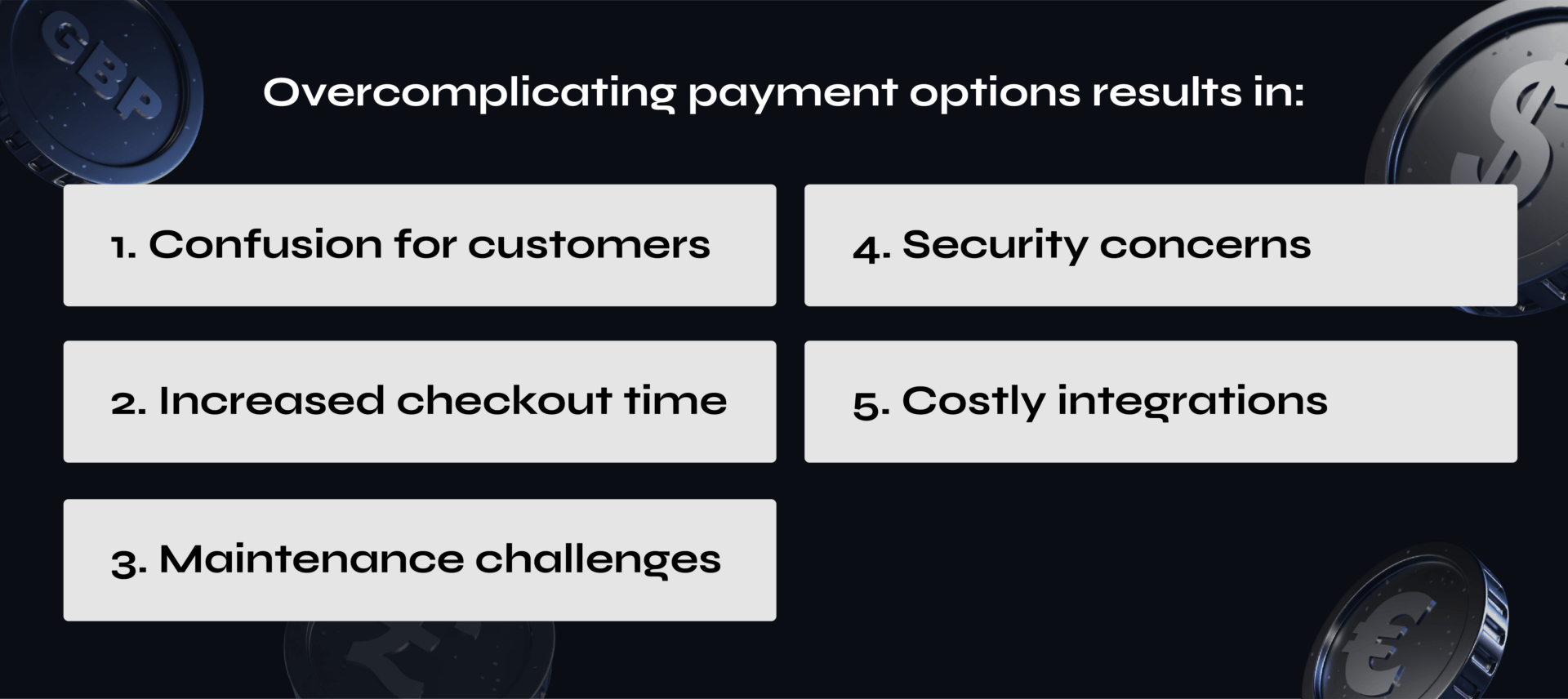

Introducing too many payment options can pose several risks and drawbacks. Here are the four key reasons why having too many payment methods can be problematic:

1. Confusion for customers

A plethora of payment options can overwhelm customers and lead to confusion. Too many choices may result in decision paralysis, causing potential buyers to abandon their purchase altogether.

2. Increased checkout time

A wide array of local payment methods may extend the checkout process, leading to longer transaction times. Lengthy checkouts can frustrate customers, potentially deterring them from completing one of their purchases.

3. Maintenance challenges

Managing numerous local payment methods requires ongoing maintenance and updates. This can be time-consuming and resource-intensive for businesses. Especially if there are frequent changes in the payment landscape.

4. Security concerns

Each additional local payment option introduces its own set of security considerations. Managing the security of multiple payment methods increases the complexity of safeguarding customer information, potentially raising the risk of data breaches.

5. Costs of integration

Integrating and maintaining various local payment methods comes with associated costs. Businesses may incur expenses related to integration, software updates, and ongoing support. It can impact the overall profitability of the operation.

While offering diverse payment options is important, businesses must strike a balance. This helps avoid overcomplicating the payment process and prevents potential negative consequences for both customers and the business itself.

Future trends in payment methods

The payments industry is always changing due to technical advancements, shifts in customer preferences, more stringent regulation, and worldwide economic influences. In 2024 and beyond, we can expect further changes in the payment landscape. These changes will be driven by the increasing popularity of digital wallets and ongoing conversations surrounding AI and ML.

Let’s explore these trends further:

Growth of digital wallets and mobile payments

The use of digital wallets and mobile payments is projected to grow significantly. GlobalData forecasts a compound annual growth rate of 19.9% for mobile wallet payments. Businesses are advised to offer various wallet solutions and ensure their payment infrastructure accommodates the rising number of mobile and digital wallet users.

Open banking and API integration

Open banking and API integration are transforming the financial services industry. They foster collaboration and innovation among banks, fintech companies, and other stakeholders.

Open banking enhances customer data portability, giving consumers more control over their financial information. API integration is crucial for driving innovation in the payment ecosystem, allowing businesses to seamlessly integrate digital payment capabilities and provide a wide range of payment options and services.

Machine learning and AI in fraud prevention

Fraud prevention is a critical aspect of the digital payments landscape. Machine learning (ML) and artificial intelligence (AI) are increasingly essential in detecting and preventing payment fraud in real time.

These technologies analyse vast amounts of data to identify patterns and anomalies indicative of fraudulent activity, enhancing transaction security and fostering trust and confidence with customers.

Emergence of alternative payment methods

Alternative payment methods, including cryptocurrencies and peer-to-peer payments, are gaining popularity due to their flexibility and transactional choices. Central bank digital currencies (CBDCs) are being explored as potential solutions to address issues such as financial inclusion and regulatory oversight.

Financial inclusion through digital payments

Digital payments are crucial for making financial services accessible to people who don’t have bank accounts or have limited access to banking. Businesses can help close the gap between traditional banking and the needs of underserved communities by offering various digital payment options. This is especially important in emerging markets where many people don’t have easy access to regular banking services.

As the industry grows, both traditional banks and new financial technology players will be crucial in deciding how we buy and sell things. Success in the changing world of payments and – will depend on adapting to these shifts and developing new and creative solutions.

PayDo offers checkout payment methods tailored to consumer needs

When shopping online, people want to make fast and easy purchases. They search, click a few times, and expect quick delivery. The tricky part is often at the checkout, where things can get slow and cause problems.

With PayDo Checkout integration, you can give your customers 350+ checkout payment methods from around the world for easier payments. We automatically show available payment methods based on their country, determined by their browser and IP location. The checkout displays your customers’ local payment options and uses the correct language.

PayDo Checkout improves this process for businesses by providing adaptable services to create a checkout experience that customers love. and then talk about our IP geo location. Our system cuts down on the things that make checkout slow, helping businesses avoid losing customers along the way. For example, we provide coverage in 170 countries to better reach your audience.

With our one-click payments, your customers can pay with a single click. There’s no need to enter credit card & data every time, leading to higher conversion rates. Your payers can save an unlimited number of cards instantly.

PayDo routing and cascading features help you to prevent declined transactions. We assist in directing transactions to channels most likely to approve them, thus reducing declines.

You can access all major payment methods with one contract and single API integration. No need for different contracts for each payment method. Integrate all methods through 1 payment scheme.

By catering to your customers’ needs and preferences, wherever they are in the world, you can build trust and vastly increase the chances of a successful purchase.

Conclusion

A successful checkout process involves offering customers with the right payment methods tailored to their needs.

The ideal setup varies based on your business’s unique requirements. Of course, there’s no one-size-fits-all solution. However, a personalised approach is essential.

At PayDo, we can assist you in pinpointing and activating the payment methods that align perfectly with your brand and audience. This will decrease abandoned carts, increase conversions, and fortify your business by cultivating a loyal, involved, and content customer base.

Create a PayDo Merchant Account and integrate our merchant services solution to sell your goods and services worldwide via 350+ checkout payment methods.